As we find ourselves at the outset of 2024, the crypto community is abuzz with the impending Bitcoin halving event, poised to potentially redesign the crypto market landscape. This event holds colossal historical relevance, with transformative effects rippling through the entire crypto sector. Armed with the insights from previous halvings, we now set our sights on the upcoming halving to decipher whether it will chart a similar or disparate path. It’s time to delve deeper into the heart of the matter.

Bitcoin’s Journey to Scarcity and Value

The design of Bitcoin is inherently geared towards perpetuating a trajectory of increasing scarcity, thus effectively taming inflation. With a predetermined ceiling of 21 million Bitcoins, the current tally stands at 19.62 million. The concept of scarcity, amplified by the controlled infusion of Bitcoin into the market, positions BTC as the digital equivalent of gold, both boasting an aura of exclusivity and scarcity.

Visualizing the Bitcoin blockchain as a relentless timepiece, one can observe that the halving unfolds every 210,000 blocks, approximately every four years, resulting in a halving of the reward for mining new blocks. This rhythm has persisted since Bitcoin’s inception in 2009, commencing at 50 BTC per block and whittling down to 3.125 BTC in 2024.

The Stock-to-Flow ratio, heralding a comparison between existing supply and incoming coins, foreshadows Bitcoin’s impending rarity, surging to a level even surpassing that of platinum by 2032, post the 2024 and 2030 halvings.

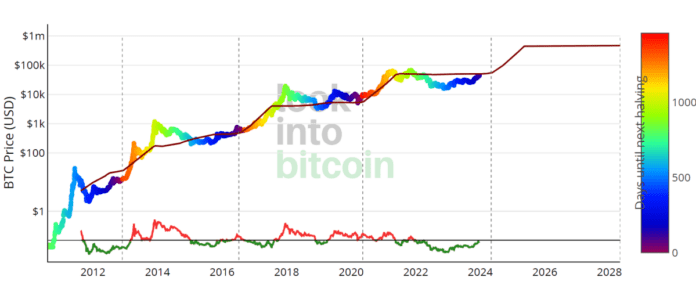

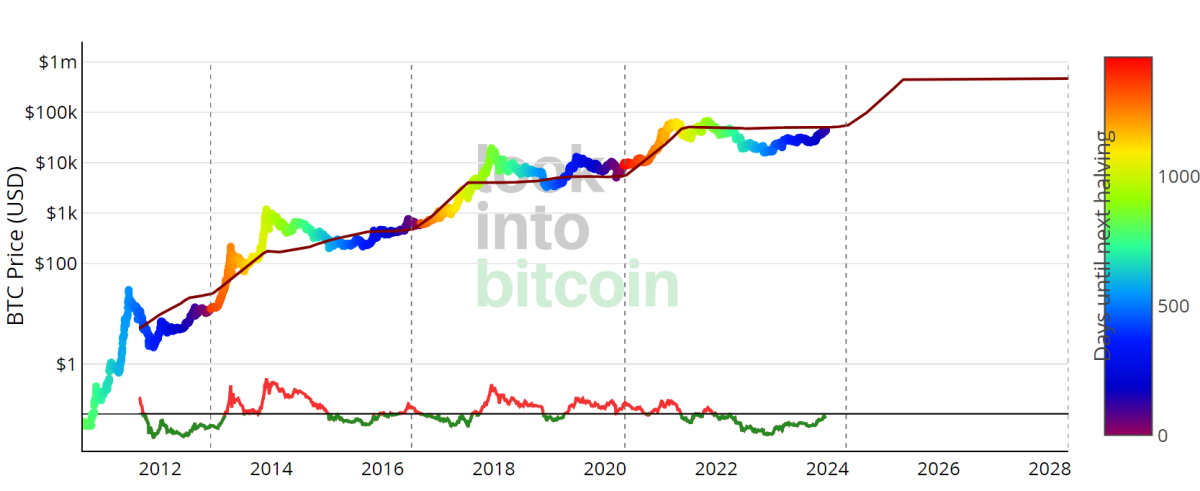

Bitcoin’s Post-Halving Growth Trajectory

Laying a historical breadcrumb trail, each halving event has unfailingly propelled Bitcoin’s value to astronomical heights. Following the 2012 halving, within a mere 100 days, the market capitalization surged by a monumental 342%. The subsequent year witnessed a meteoric rise to an astounding peak price of $1,152, representing an explosive leap of 8,761%. Fast forward to 2016: halving the rewards from 25 to 12.5 BTC occasioned a surge to $17,760 the succeeding year, culminating in a formidable 2,572% escalation. The latest halving in 2020, marking the reward reduction to 6.25 BTC, saw Bitcoin soaring to $67,549 the succeeding year, marking a substantial growth of 594%.

Engaging in a bit of armchair mathematics, the observed reduction in Bitcoin’s growth rate after each halving – a decrease of 70.64% from the first to second halving and 76.91% from the second to third – yields an estimated average decrease of 73.78%. Extrapolating this figure onto the 594.03% growth post the third halving, speculatively lands us with a growth rate estimate of 155.79% post the 2024 halving. This translates to a potential value of around $111,807 within one to one and a half years post the impending halving. However, it’s imperative to underscore that these projections dwell firmly in the realm of speculation and should not form the bedrock of any investment decisions.

Miners’ Survival Amidst the Turmoil

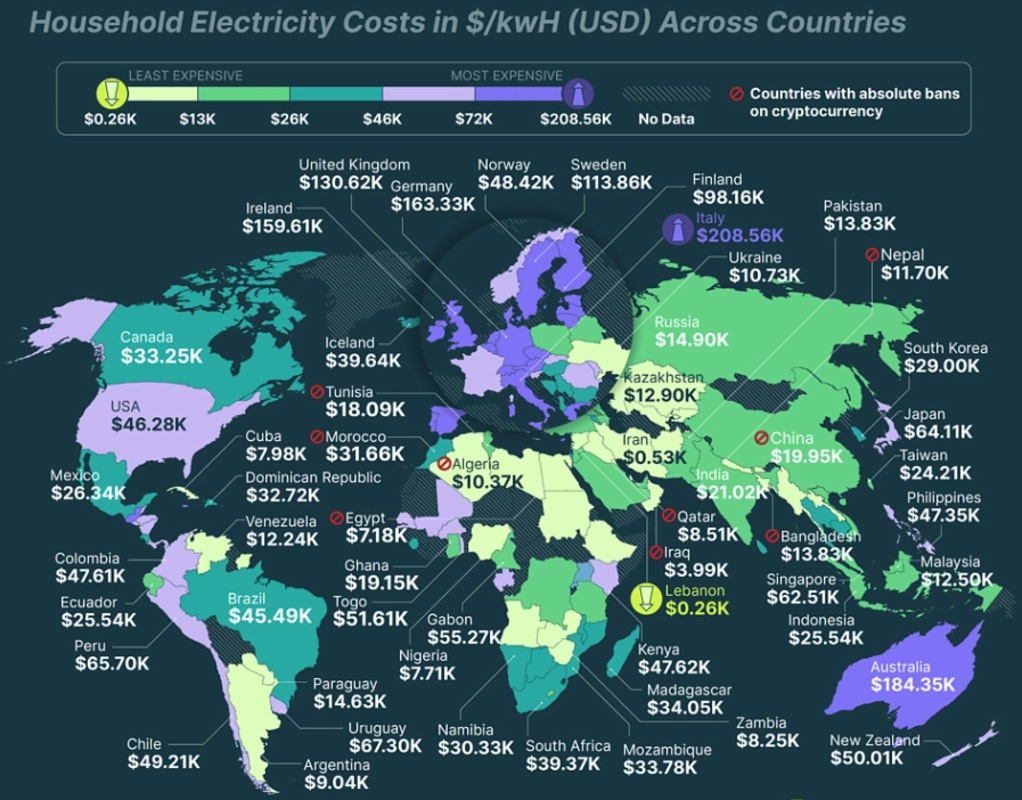

For Bitcoin miners, the 2024 halving looms as an arduous trial. With rewards plummeting by 50%, miners entrenched in outdated equipment and grappling with soaring electricity costs face a dire reckoning. In certain regions, such as Italy, the expenses tied to mining a single Bitcoin can soar to the heights of a luxury Lamborghini Huracán or a Porsche 911 Turbo S, eclipsing the $208,560 mark.

The 2024 halving is set to engender an environment in the mining sphere reminiscent of ‘The Hunger Games,’ where only the most robust miners, armed with cutting-edge technology and access to cost-effective energy sources, will endure. This impending halving appears as the ultimate arena, an assay of tenacity and strategic acumen, wherein only those equipped with prudent, economical tactics will emerge triumphant in this fiercely competitive battleground.

Parting Reflections

The 2024 Bitcoin halving stands poised to induce seismic reverberations, punctuated by radical shifts in mining operations and the potential for a momentous surge in Bitcoin’s valuation. This impending event amalgamates resolute economic precepts with trailblazing technological strides, all enveloped within the inimitable allure of crypto. Whether one is entrenched in mining, embracing the “hodl” principle, or simply watching from the periphery, it’s time to grab your popcorn – for this is one for the annals!

This is a guest post by Maria Carola. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.