AI’s Sputnik Moment and What it Means for Investors

“Control of space means control of the world.”

That was how then-Senator Lyndon Johnson reacted to the Soviet Union’s launch of Sputnik, a moment that jolted America into action.

Now, the debut of China’s DeepSeek AI has drawn parallels to that Cold War shock. Tech pioneer Mark Andreessen went as far as calling it “AI’s Sputnik moment.”

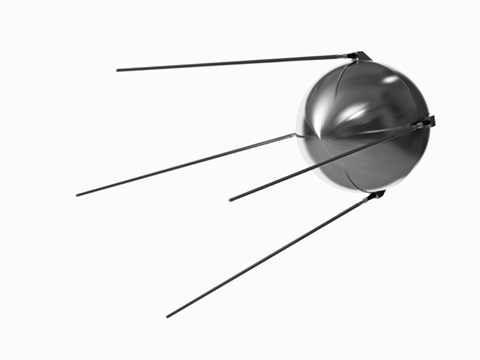

The Soviet Sputnik satellite that kick started the space race. (Source: iStock)

Americans were suddenly reminded that technological dominance is not guaranteed.

In hindsight, Johnson’s words may have seemed exaggerated—but today, they ring truer than ever. Simply replace “space” with “artificial intelligence.”

A wake-up call is a good thing, but people can react without thinking.

That’s what the market did Monday.

And smart investors were ready to take advantage.

Stay Calm During Market Volatility

In case you missed it, the market reacted with shock to the debut of DeepSeek. The tech-heavy Nasdaq lost 3% of its value in a single day!

Legendary quant investor Louis Navellier has witnessed every type of market reaction over his 40-plus-year career, and he knows a knee-jerk response when he sees one. Here is what he told his Growth Investor subscribers on Monday.

This is a good time to remind all investors that the stock market is really just a “manic crowd.” The truth of the matter is crowds “react” and do not “think.”

In fact, the bigger the crowd, the lower the IQ.

So, during Monday’s sell off, the stock market’s violent reaction was especially stupid, since investors were just reacting and not thinking.

Louis’ superior stock returns come from data-driven analysis and rational thinking, which is why he has the market-beating track record that many envy – and why he recommended Nvidia (NVDA) long before anyone heard of ChatGPT or OpenAI – when the AI trend really took off.

As I write, Louis is sitting on open gains of 2,700% in NVDA.

But now Louis is focused on second wave of AI … and how Trump 2.0 is going to spark bigger and faster gains than before.

The Energy Demands of AI and the Trump Factor

It’s no secret that AI uses a ton of energy. Researchers at Goldman Sachs believe one ChatGPT search uses 10 times as much energy as a Google search.

As AI adoption grows, energy needs will only increase.

And that’s an opportunity for smart investors. Here is Louis with the key information needed to convince you.

Elon Musk believes we could run out of power for AI data centers as soon as 2025. And without enough electricity, data center building will screech to a halt and the growth of the AI industry could be severely stunted.

However, there is one person who can fix this problem. I’m talking about none other than Donald Trump.

Louis has a set of recommended AI-related investments in his Growth Investor service that were chosen to take advantage of the massive changes taking place during the first 100 days of the new Trump administration.

And, yes, he does still recommend buying Nvidia.

You can check out a special presentation about these recommendations by clicking here.

How to Profit Beyond Buy-and-Hold

The Federal Reserve has signaled at least two potential interest rate cuts in 2025 that could ignite the market, but this week, they held rates steady.

A more accommodative Fed, however, combined with Trump’s pro-business policies and the AI Megatrend are likely to make this a great year for stocks – but also a volatile one.

As we saw with the market’s reaction to DeepSeek, investing stories – especially when it involves AI stocks – can pivot on a dime. But our tech investing expert Luke Lango believes the DeepSeek news is net positive for AI companies and investors.

The truth, in our view, is that the DeepSeek breakthrough will meaningfully accelerate AI model advancement and meaningfully boost the odds that Big Tech companies achieve AGI much sooner than previously thought.

Does that mean you should be buying the dip in AI stocks after this week’s gut-wrenching selloff?

Absolutely.

But we should be clear … the market will remain volatile.

Investors who rely solely on a buy-and-hold strategy can get whipsawed by rapid market shifts.

While long-term investing can be highly profitable (as Louis’ gains above show) there are other ways to invest that aren’t quite so stomach-churning.

To try to manage the emotional wear-and-tear of heightened volatility,, Luke developed the Auspex Trader service – a portfolio strategy where stocks are held for only one month.

At the beginning of every month, all the stocks are sold, and a new set is purchased. This approach reduces the whiplash associated with long-term buy-and-hold strategies while still delivering consistent gains.

Luke launched the system to his Inner Circle subscribers on July 1, and since then it has beaten the S&P every month but one. (Note: Luke ran the system twice in December, when it debuted more widely.)

The system uses three factors to identify the best stocks at the beginning of every month.

- Fundamentals: Auspex looks for companies demonstrating positive and accelerating revenue and earnings growth, as well as expanding profit margins.

- Technicals: Auspex employs a range of indicators to identify stocks with strong upward momentum.

- Sentiment: Auspex tracks analyst revisions and changes in trading volume to identify stocks that are garnering increased positive attention from both professional analysts and the broader market. This can often precede significant price movements.

As I write Friday morning, Auspex is beating the market again in January … by a wide margin!

Luke provides all the details about the system in a special presentation you can access here. And a new slate of picks will debut Monday morning.

Doubtless the market is going to continue to experience new shocks as the AI megatrend unfolds.

Maintaining a rational, thoughtful approach to the markets is going to be crucial.

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace