Transforming America’s Financial Future: A Call to Eliminate Capital Gains Tax on Bitcoin

As digital assets rise in importance for global finance, the U.S. faces a pivotal moment. The Trump administration repeatedly aims to enhance the economic well-being of its citizens. From promises of economic rejuvenation during the campaign to selecting progressive advisors, the White House appears ready to leap into a new phase of financial opportunity. However, to truly empower average Americans and position the U.S. as the global “Bitcoin Superpower,” bold policy reforms are essential—specifically, the removal of capital gains taxes on Bitcoin.

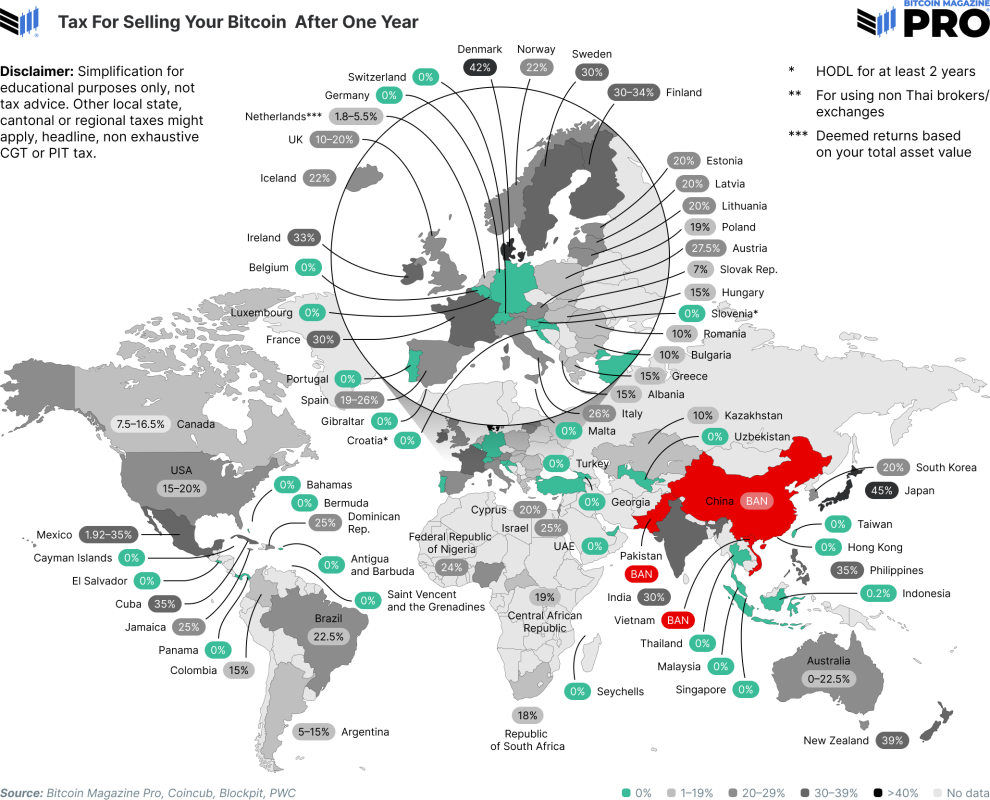

Insights from Global Leaders

Recently, the Czech Republic made news by voting to exempt capital gains taxes on Bitcoin if held for over three years and meeting specific income levels. This action reflects a broader trend, as numerous countries—Switzerland, Singapore, the United Arab Emirates, and others—recognize the advantages of having low or no capital gains taxes on Bitcoin, which can foster financial innovation and consumer confidence.

As John F. Kennedy once said, “A rising tide lifts all boats.” Applied to Bitcoin, this principle suggests that global economic growth is happening fast. In a world filled with liquidity and debt, the U.S. must leverage Bitcoin to enhance its economic landscape. The successes of other nations offer a compelling reminder: America should embrace Bitcoin as an asset for prosperity instead of stifling it with outdated tax policies.

Trump Advocates for Change

President Trump has shown openness to reconsidering Bitcoin’s tax implications. In a recent discussion, he stated, “They have them paying tax on crypto, and I don’t think that’s right.” Many Americans share his view, arguing it is unreasonable to pay capital gains taxes on everyday purchases made with Bitcoin. Highlighting the absurdity of the current system, he asked, “Maybe we get rid of taxes on crypto and replace it with tariffs.”

This viewpoint goes beyond mere rhetoric. At the Bitcoin 2024 Conference in Nashville, Trump outlined his ambition for the U.S. to emerge as a “Bitcoin Superpower.” Additionally, his appointment of former PayPal COO David Sacks as ‘White House A.I. & Crypto Czar’ demonstrates a commitment to modern crypto policies.

Introducing the BITCOIN Act of 2024

Significant progress has been made with the BITCOIN Act of 2024, which requires federal agencies to transfer holdings of Bitcoin to the Treasury for a strategic reserve. Over five years, the Treasury is tasked with acquiring one million Bitcoins as part of a long-term financial strategy. However, eliminating capital gains taxes on Bitcoin could further support this initiative, encouraging individuals to invest without facing heavy taxation.

Empowering Every American

For average U.S. citizens, the struggles of living costs and inflation loomed large in Trump’s reelection campaign. Traditional economic measures often miss the mark against far-reaching challenges. Bitcoin can serve as a protective asset for Americans seeking to preserve and grow their wealth. Without capital gains taxes, citizens could utilize Bitcoin freely without penalty on incremental gains.

This change could lead to more frequent Bitcoin transactions, enhancing demand and potentially strengthening the U.S. Treasury’s reserves. As Bitcoin’s value escalates, so too could the nation’s financial stability—contributing to debt reduction and reinforcing the dollar’s global status.

The Case for Bitcoin in America

Bitcoin is beyond a niche interest; it has become essential for many Americans, especially younger generations. According to the Stand With Crypto Alliance, over 52 million Americans now own some form of cryptocurrency. A significant majority believes the financial system needs renewal. Notably, 45% of voters would oppose candidates resistant to crypto progress, emphasizing that crypto has transitioned into mainstream discourse.

Desire for American leadership in this space is evident—53% of citizens prefer crypto companies to remain U.S.-based. Among Fortune 500 leaders, a striking 73% favor U.S. partners for their crypto ventures, highlighting the need to maintain a competitive edge in financial innovation.

Failure to address these issues may replicate past mistakes, similar to America’s previous decline in advanced manufacturing dominance. We cannot surrender the future financial landscape to other countries. Bitcoin represents more than just an investment; it is foundational to the evolving monetary system. The U.S. must fully embrace Bitcoin to secure its economic future and ensure that every citizen can benefit from this emerging financial revolution.

Setting a New Path for America

By adopting innovative policies like eliminating capital gains tax on Bitcoin, the U.S. could solidify its position as a leader in financial freedom and technology. This move would illustrate to entrepreneurs and the public that America is taking the digital economy seriously.

Taxing every digital transaction presents unnecessary challenges for innovation and everyday life. Americans deserve the autonomy to participate in a digital economy unrestricted by tax burdens.

Ultimately, this is an opportunity for the U.S. to lead through innovation and adaptability. Removing capital gains taxes on Bitcoin not only fulfills a campaign commitment; it paves the way for enduring economic growth and empowers citizens to build secure financial futures. A rising tide lifts all boats—what could be a more fitting vessel than a Bitcoin Ark, guided by a forward-thinking administration?

This article is a Take. The opinions shared are solely those of the author and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.