Editor’s Note: Join my InvestorPlace colleague Louis Navellier as he breaks down the latest U.S. retail sales report, its implications for the economy, and a selection of stocks positioned to benefit from declining interest rates.

Over to you, Louis…

Throughout my 47 years in the market, one lesson has always stood out: the resilience of the U.S. consumer should never be underestimated. Recent news from the latest U.S. retail sales report reinforces that belief.

In today’s Market 360, I’ll highlight key insights from this report and discuss how it impacts the broader economy and the potential for interest rate cuts. Additionally, I’ll introduce a group of stocks set to gain from falling rates—a scenario that could lead to impressive gains of 100% or more in the next 12 to 24 months.

Strong Signals from U.S. Consumers

The recent U.S. retail sales report has revealed broad growth for September, surpassing economists’ expectations.

Retail sales increased by 0.4%, outpacing the anticipated 0.3% rise and significantly improving from August’s 0.1% rise.

Earlier this week, I mentioned to my premium readers my curiosity about whether consumers would utilize savings from lower gasoline prices on other expenditures—and it appears they did.

When excluding autos and gas stations, sales were up 0.7% for the month, rising 3.7% on a yearly basis. Economists had predicted only a 0.1% increase, highlighting an unexpected surge.

Drilling down further, ten out of the thirteen categories tracked showed gains. Here are some notable figures:

- Miscellaneous store sales (including florists and pet shops) increased by 7.9% annually.

- Non-store retail sales climbed 7.1% from last year.

- Food service and drinking places experienced a 3.7% annual increase.

Consumer spending constitutes about two-thirds of our gross domestic product (GDP), which is why analysts monitor the “retail sales control group.” This measurement excludes car sales, gas stations, and building materials.

Control group sales rose at an annualized rate of 6.4% for the three months ending in September, prompting the Atlanta Federal Reserve to project a 3.6% annualized increase in personal consumption for the third quarter—the strongest pace this year.

Recent inflation data suggests a moderation in inflation rates. Though the job market is showing some softness, current indicators do not signal a crisis. The combination of resilient consumer spending and expected solid GDP growth suggests a 0.25% rate cut at the upcoming November Federal Open Market Committee (FOMC) meeting is likely.

Opportunity for Small-Cap Stocks

Lower interest rates present a favorable climate for stocks, but small-cap stocks may benefit the most.

As previously mentioned in Market 360, smaller companies often carry larger debt burdens compared to their larger counterparts. Thus, they stand to gain significantly from falling interest rates.

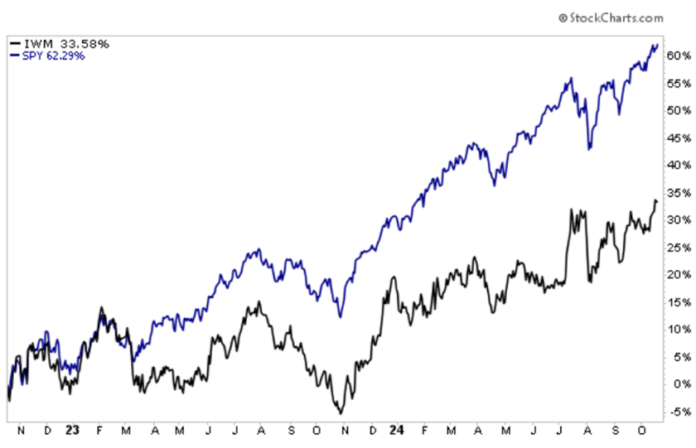

The current market has been characterized by a pronounced divide where larger-cap stocks have outperformed small-cap stocks dramatically since spring 2023. This disparity is illustrated by the performance of the SPDR S&P 500 ETF (SPY) compared to the iShares Russell 2000 ETF (IWM).

As interest rates decline, I expect this gap to close. Notably, the small-cap Russell 2000 has outperformed the S&P 500 over the past two weeks, rising by around 4.5% compared to 2.8% for the S&P 500. The Dow has seen a 2.2% increase, while the NASDAQ gained about 3%.

This could just be the start. Historically, we often observe an “early January effect” at this time of the year, typically leading to an even larger rally in January.

Additionally, several factors are fostering optimism for small-cap stocks. With the presidential election just weeks away, both candidates are actively campaigning, which tends to boost sentiment on both Main Street and Wall Street. Anticipation of a rally leading up to the November 5 election is strong.

Furthermore, earnings announcements for the third quarter have begun, and early indications suggest higher results than expected. FactSet forecasts that the S&P 500 will achieve earnings growth considerably exceeding the estimated 3.4%, aiming for nearly 10% growth.

A Valuable Opportunity for Profits

My focus has always been on the numbers, and the data demonstrates that companies with robust sales and earnings growth consistently outperform the market.

We stand to gain significantly in this market by identifying strong-performing small-cap companies that are poised for growth.

My colleague Jason Bodner echoes this sentiment and has been advising readers about a potential strong market run.

He attributes this optimism to the same factors I highlighted—falling interest rates, controlled inflation, and favorable seasonal and electoral patterns. Jason anticipates a “Big Lift” for the market into the new year, particularly for small-cap stocks.

Notably, Jason has described the current environment as a “Retirement Accelerator Window,” providing investors a rare chance to fast-track their retirement goals.

This window has emerged only three times in the past 35 years, yielding returns of 117%, 250%, and even 514% in extensive retrospections.

Upon reviewing Jason’s research, I discovered that many of my best stock picks occurred during these Retirement Accelerator Windows.

We identified over 40 tripling and quadrupling recommendations during these periods.

I see this as a significant wealth-building opportunity.

Having collaborated with Jason for years, I assure you this is a critical moment not to be overlooked. He has prepared a new presentation detailing the Retirement Accelerator Window and how you can capitalize on it. He also shares his top investment recommendation aimed at a potential triple-digit gain.

Click here to watch the broadcast now.

Sincerely,

Louis Navellier

Editor, Market 360