Darling Ingredients – From Boom to Bust

Darling Ingredients Inc. (DAR) repurposes materials from animal agriculture and food industries. Despite strong revenue growth in recent years, DAR’s outlook is now bleak.

Why Investors Should Be Cautious

DAR’s diversified offerings include gelatin, animal proteins, organic fertilizers, and more. However, projected revenue and earnings declines in 2024 signal trouble ahead.

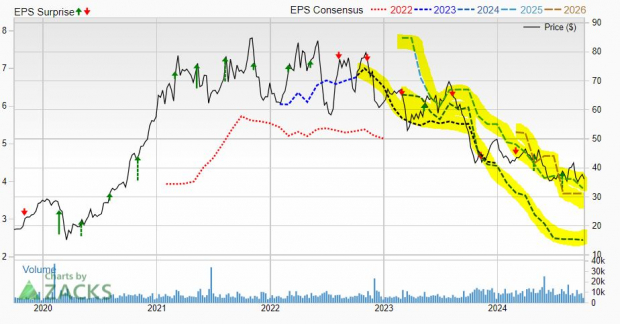

Recent metrics show a 12% revenue drop and a 41% decrease in adjusted earnings per share for FY24. These figures have plummeted significantly over the past year.

Current State of DAR Stock

DAR stock has fallen 48% in the last three years, but historical gains of 100% over five years and 433% over the past 15 highlight its volatile nature. With a Zacks Rank #5 (Strong Sell), caution is advised for potential investors in DAR.

Final Thoughts on DAR

DAR’s CEO aims to improve margins through cost-cutting measures, but downward revisions for FY25 remain a concern. Investors should carefully evaluate DAR’s future prospects before making any decisions.

Investing in Infrastructure Stocks

The U.S. is poised for a massive infrastructure overhaul, presenting lucrative opportunities for investors. Learn which companies stand to benefit the most from this boom. Download the free Zacks Special Report today.

—

The bearish outlook for Darling Ingredients Inc. (DAR) stems from a recent decline in revenue and projected earnings. Investors should exercise caution when considering DAR stock due to its current ranking as a Strong Sell by Zacks.