“`html

Analyzing the Impact of Trump’s Return: Are Oil Stocks Set to Rise or Fall?

The Trump Effect on Oil Stocks: A Complex Scenario

Are oil stocks a “buy” with Trump possibly returning to the White House?

Some people think that Trump’s favorable stance toward oil means it’s time to buy top-tier oil stocks, as he’s likely to deregulate the industry.

However, if Trump really adopts a “drill, baby, drill” approach, the increase in U.S. oil production could saturate the global market. Economists know that an increase in supply typically drives prices down.

This raises a question: while drivers may enjoy lower gas prices, will oil executives be as happy?

The Situation Is More Complicated Than It Seems

While U.S. producers could increase supply because of deregulation, Trump has also expressed intentions to impose sanctions on oil from Iran and Venezuela.

If these sanctions are enacted, global oil supply may decrease by around 2.5 to 3 million barrels per day, which is roughly 3% of the world’s total supply. Even slight supply reductions historically can cause significant price increases.

For instance, during the 2011 Libyan Civil War, a production drop of about 1.5 million barrels per day saw prices soar from $90 to over $120. Similarly, in 2018, Trump’s sanctions on Iran cut about 1 million barrels per day from supply, pushing prices from $67 to $86.

This illustrates how sensitive oil prices are to minor disruptions.

Balancing Increased Supply and Sanctions

If Trump follows through with deregulations, U.S. oil production could rise by 0.5 to 1.5 million barrels per day over the next four years. This increase might offset some of the expected declines from sanctions, but not completely.

Moreover, China may choose to disregard U.S. sanctions on Iran and Venezuela. The impact of this will greatly depend on China’s economic state: is it going to stimulate growth or slip into a recession?

Yet, there’s another layer to consider. Trump has indicated a desire to resolve the conflict between Russia and Ukraine. If he succeeds, could this lead to increased oil flows from Russia, potentially adding another 500,000 to 1 million barrels per day to the market?

At this point, the effect on supply and prices becomes uncertain, leaving many questions that require answers.

Attractive Valuations and Dividend Yields in the Energy Sector

Let’s use the S&P 500 as a benchmark.

Currently, the S&P’s price-to-earnings (PE) ratio stands at 30.52. This number is significantly higher than the average PE ratio of 16.10, which suggests the market is relatively expensive.

The S&P 500’s dividend yield is currently 1.23%, which is just above its all-time low of 1.11% in August 2000.

In contrast, consider the PE ratios and dividend yields of select oil companies:

- Equinor: PE 6.9, dividend yield 5.91%

- Diamondback Energy: PE 10.4; dividend yield 4.57%

- Valero: PE 12.0; dividend yield 3.14%

- Shell: PE 13.6; dividend yield 4.01%

- Exxon: PE 15.0; dividend yield 3.27%

These offer notably better valuations and dividend yields compared to the broader market.

Is Oil an Obvious Buy Right Now?

The answer isn’t clear-cut.

With numerous uncertainties in play, this isn’t a straightforward investment. It’s possible oil prices could fall into the $50s in the next year. Considering that U.S. oil companies generally need prices at around $64 to profitably drill, today’s upper $60s price leaves little room for comfort.

However, if you’re looking to hold for over 24 months, top-tier oil stocks might be enticing with their appealing pricing and dividend yields while waiting for a price recovery.

Investing in oil today is a gamble, but it could be rewarding for patient investors.

Reflect on this thought from billionaire Rob Arnott, founder and chairman of Research Affiliates:

In investing, what is comfortable is rarely profitable.

Switching Focus: The Crypto Market and Trump’s Potential Deregulation

As I write this, Gary Gensler may be refreshing his resume. If he isn’t, he should be.

Gensler, the SEC Chairman, is notorious among crypto enthusiasts for his strict regulatory stance.

During his tenure, he has sued major crypto exchanges like Coinbase, Binance, and Kraken and pursued various tokens such as Ripple (XRP), challenging their legality as unregistered securities. His actions have drawn criticism from various political figures.

In sharp contrast, Trump has indicated his intention to replace Gensler if re-elected. After a keynote speech at the Bitcoin Conference this summer, Trump declared he would fire Gensler on his first day back in office, a statement that received enthusiastic applause.

While Gensler’s appointment does not expire until 2026, his resignation seems likely. Possible successors include:

Dan Gallagher, who is currently Robinhood’s chief legal officer and previously served as a SEC commissioner.

Hester Peirce, another Republican SEC commissioner, has opposed many of Gensler’s recent initiatives.

Mark Uyeda, who has been with the SEC for an extended period, could also be considered for the chair position.

The next appointed chair is likely to be more favorable toward cryptocurrencies, potentially spurring growth in crypto values for the future.

And we won’t have to wait until 2025 for potential gains in the crypto market.

Bitcoin Surges Following Trump’s Election, Setting New Records

Following Trump’s likely election, Bitcoin has reached new all-time highs, and investment inflows have increased dramatically.

Last Tuesday, Bitcoin was priced at just over $68,000. As Trump’s re-election prospect became more palpable, Bitcoin’s price surged.

By 11:00 PM that night, the price had climbed to around $74,600, continuing to rise since. As I write this on Monday afternoon, Bitcoin is trading at $84,720—a 25% increase since last Tuesday.

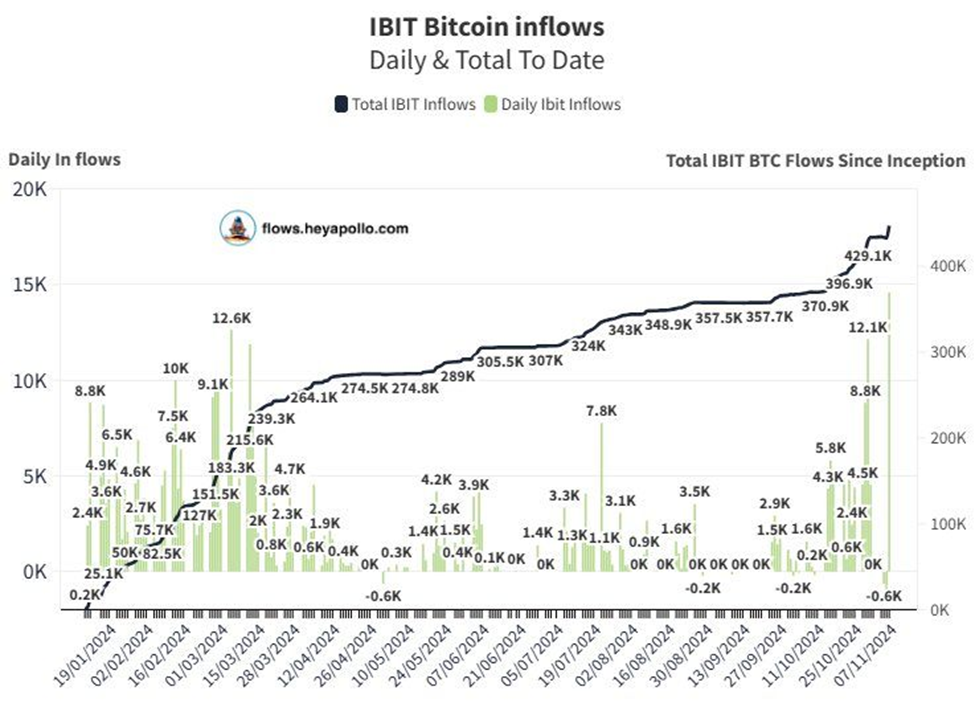

The trading volume has been remarkable as well. Notably, BlackRock’s Bitcoin ETF, IBIT, experienced its largest inflow ever.

BlackRock’s Bitcoin ETF Sees Record Inflows: What’s Next for Crypto?

Predictions for Bitcoin’s Future Rise

Recent developments point to an optimistic trajectory for Bitcoin (BTC) in the coming months. According to crypto expert Luke Lango, BTC is likely to reach $100,000 as early as this winter. He noted this in his latest edition of Crypto Trader:

We think that BTC is headed for $100,000 within the next few months and that altcoins are ready to soar.

The technical analysis supports this view, suggesting promising trends for Bitcoin.

Industry Insights Reflect Growing Optimism

Lango’s outlook is echoed by Ned Davis Research, which has set a price target of $121,000 for Bitcoin. Market analysts believe Bitcoin’s recent rally could propel the cryptocurrency closer to the $100,000 mark by year’s end, particularly after the Republican presidential victory of Donald Trump, who is viewed as favorable to the crypto industry:

Bitcoin’s rally to an all-time high last Wednesday could open the door for the crypto to reach the $100,000 mark by the end of the year…

Strategists Patrick Tschosik and Matt Bauer from Ned Davis Research have rated Bitcoin as a strong buy based on technical analyses following these developments.

Currently, Bitcoin is only 18% away from the $100,000 target. If past trends hold true, aggressive buying could see this happen before Thanksgiving.

Shift in Focus: Altcoins Ready to Emerge

In periods of uncertainty, crypto investors typically gravitate towards established cryptocurrencies like Bitcoin, Ethereum, Tether, and Solana. However, when confidence returns, interest often shifts toward smaller altcoins. This trend indicates that leadership can change from prominent coins to emerging ones. Historical data from 2020 and 2021 illustrates how smaller altcoins have been able to experience dramatic price increases.

Thus far in 2024, Bitcoin has dominated attention. Yet, Lango suggests we may be witnessing a pivotal moment where altcoins reclaim some of the spotlight:

Now… for the first time in over nine months… the fundamental and technical data is highly supportive of both Bitcoin and altcoins.

He proposes that we could see an “Everything Rally” for cryptocurrencies as we approach the year’s end, driven in part by the introduction of more crypto investment vehicles, such as ETFs for altcoins, along with expanded options from financial institutions offering access to cryptocurrencies.

What Could This Mean for Investors?

If these predictions materialize, investors might want to consider adding leading altcoins to their portfolios. Previous trends indicate that altcoins can yield significant returns when market enthusiasm surges. The 2020 and 2021 crypto rally demonstrated how these smaller tokens can generate impressive gains.

As the year unfolds, all eyes will be on how the dynamics shift within the crypto market. The potential for an exciting end to 2024 is palpable.

We’ll keep you informed on all developments.

Have a great evening,

Jeff Remsburg