NVIDIA’s Stellar Growth: A Look at Investment Returns Since IPO

As it welcomes 2025, NVIDIA Corporation NVDA boasts record financial achievements and solidifies its status as a leading tech player after being added to the Dow Jones Industrial Average.

Reflecting on NVIDIA’s Impressive IPO Journey

On January 22, NVIDIA marks the anniversary of its initial public offering (IPO). For those who invested in NVIDIA from the start, the returns have been nothing short of remarkable.

Investing $1,000 at IPO: A Lucrative Choice

NVIDIA reached a significant milestone in May 2023 by surpassing a $1 trillion market capitalization. Since then, the company achieved even greater heights, now valued at $3.589 trillion, outpacing Apple, which has a market cap of $3.339 trillion.

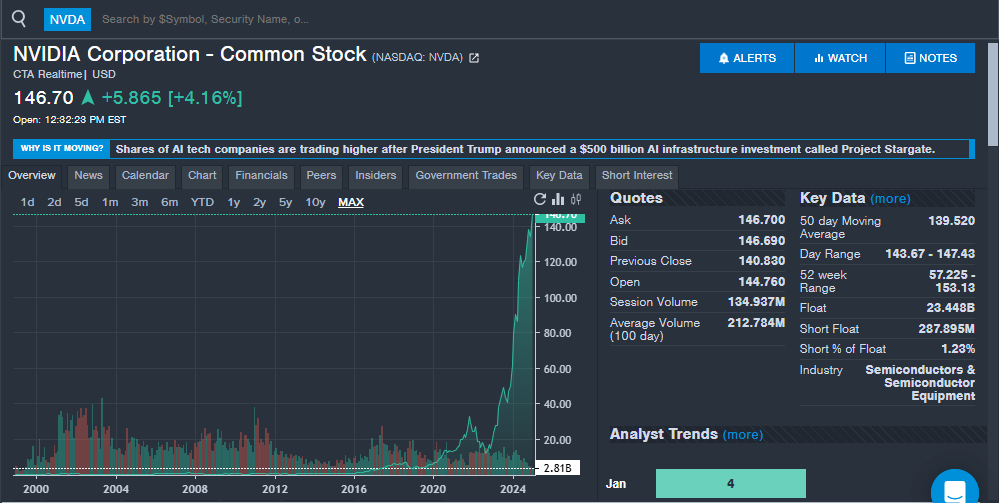

NVIDIA’s IPO in 1999 saw shares priced at just $12 each. An investment of $1,000 would have allowed investors to acquire 83.33 shares at that time.

The Power of Stock Splits

Over the years, NVIDIA experienced several stock splits, which increased the total number of shares for investors. The company executed 2:1 splits in 2000, 2001, and 2006, a 3:2 split in 2007, a 4:1 split in July 2021, and a 10:1 split in June 2024.

This means that the initial 83.33 shares purchased would have grown to a staggering 39,998.4 shares today.

The Value of Long-Term Investment

That original $1,000 investment is now worth an impressive $5,862,965.47 at a share price of $146.58. Such a return highlights the potential for significant gains for those who invested in NVIDIA from the beginning.

A Comparison with the S&P 500 ETF

In comparison, a similar investment of $1,000 in the SPDR S&P 500 ETF Trust VSPY at the time would have yielded lesser returns. At an adjusted price of $78.03, investors could have purchased 12.82 shares.

Today, an investment in the SPDR S&P 500 ETF Trust would be worth $7,789.94.

NVIDIA’s Role in AI Advancements

Currently, NVIDIA stands out in the AI landscape, bolstering its stock price over recent years. Founded in 1993, the company has consistently pushed boundaries in technology innovation.

NVIDIA revolutionized the computer sector in 1999 by introducing the Graphics Processing Unit (GPU). A decade later, the company modernized AI through its AlexNet neural network, showcasing its early belief in AI’s potential.

The launch of the Blackwell GPU in March 2024 further positioned NVIDIA to lead the AI evolution.

Future Prospects for Investors

Looking ahead, analysts regard NVIDIA as a strong contender for continued growth in AI. The key challenge remains whether the company can maintain its market-leading performance.

NVIDIA exceeded analyst expectations in its third-quarter revenue and earnings per share. CEO Jensen Huang emphasized the surge in AI demand and the company’s capacity to meet it.

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” Huang stated. He noted how nations have come to prioritize AI advancements.

NVIDIA’s Political Context

Moreover, political emphasis on AI could impact NVIDIA’s stock in the long run. During President Donald Trump‘s first year in office, NVIDIA ranked as the ninth best-performing stock in the S&P 500. Many investors hope for a similar trend with a potential return of Trump to office.

Further Reading

This article was previously published by Benzinga and has been updated.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.