This article dissects the potential impact of the upcoming FOMC January meeting and the potential rise in the Federal Funds Rate to 5.75% from the current 5.5%

The Trend in Federal Funds Rate

The Federal Reserve initiated a continuous series of rate hikes in March 2022, eventually reaching a 5.5% target range by August 2023. However, the pace of these hikes has decelerated, and the intervals between increases have lengthened. While a pause in rate hikes is likely, the prevailing bias leans towards a rate increase. Various factors contribute to this sentiment, such as disciplining federal government spending, promoting efficiency in the private sector, providing a buffer for the central bank to counter recessions, and fostering a culture of responsible saving.

Most likely, the new upper limit target range will be 5.75%, heralding adjustments to other rates, including the prime rate and Interest on Reserves Balances, while the process of Quantitative Tightening (QT) in bond selling will persist.

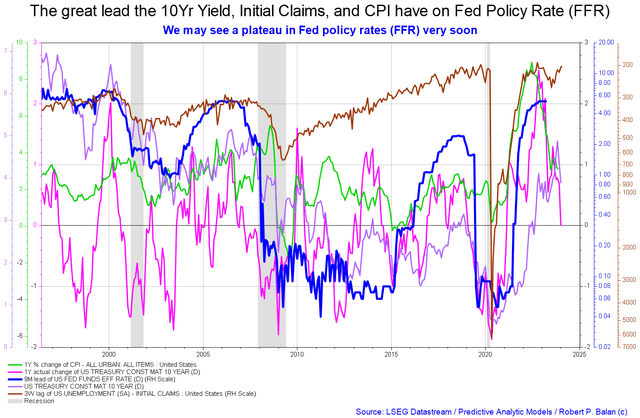

The chart below shows the relationship between various influencing factors and the Federal Funds Rate (FFR). It reflects how changes in these factors could lead the FFR to a downward trajectory.

Historically, the Fed tends to persist with rate hikes until a crisis, at which point the rate is lowered in response. This recurring pattern underscores the perennial inclination towards upward rate adjustments.

Balance Sheet Dynamics and Yield Curve Control

The Fed’s balance sheet (SOMA) has been steadily diminishing due to its bond selling program. This reduction effectively transfers liquidity from the private sector to the government sector, consequently impacting the overall financial liquidity in the private sector. This reduction in private sector liquidity results from the abundance of Treasuries in the macroeconomy, which amplifies the longer end of the yield curve – effectively yielding a subtle form of yield curve control.

The impending movement of the Federal Funds Rate is poised to have significant ramifications, as it directly impacts the interest burdens on private debt, the interest on newly issued Treasury deposits, and the interest paid on reserve balances and repurchase (REPO) and reverse repurchase agreements (RREPO) balances.

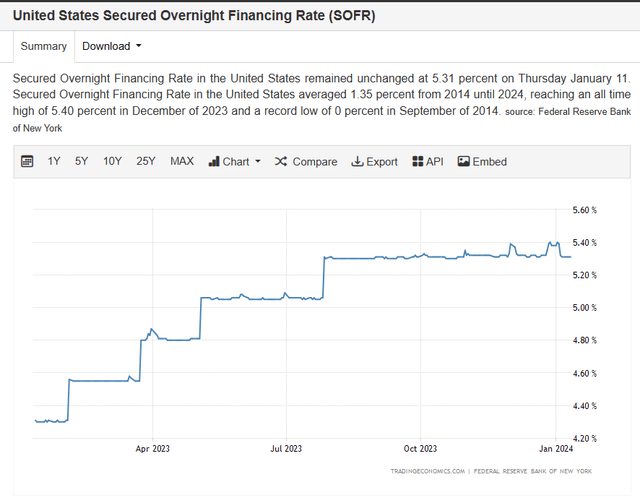

The interbank rate chart offers a visual representation of the effectiveness of the Fed’s FFR maintenance endeavors, demonstrating that the rate is positioned at the upper threshold of its target range.

Conclusion

As investors eagerly anticipate the January Fed meeting, the potential trajectory of the Federal Funds Rate has widespread implications across various sectors of the economy. Understanding the dynamics of this imminent policy decision is paramount for devising informed trading strategies and assessing potential portfolio adjustments. Despite historical trends and prevailing sentiments, the FOMC’s verdict is poised to steer the investment landscape in uncharted territories, warranting vigilance and strategic foresight.