I can’t escape the constant buzz about the Magnificent Seven—the seven companies with eight stocks that have been hogging the spotlight for the past few months. These corporate giants include Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META), Tesla (TSLA), and Alphabet (GOOG/GOOGL). Although these names aren’t newcomers to the scene and have all been key players in the S&P 500 for at least five years, their current prominence is unprecedented.

Investors have intensified their focus on the Magnificent Seven, and it’s not merely due to the catchy moniker. It is a well-founded adoration: big tech offers exposure to innovation and technological progress while also providing a secure investment haven due to the companies’ sheer size.

With the added fervor surrounding artificial intelligence, the Magnificent Seven present one of the most straightforward avenues for capitalizing on this trend, bypassing the need to invest in obscure small-cap stocks. However, many investors might be inadvertently over-allocating these stocks in their ETFs. I’ll delve into how investors can either sidestep or embrace the Magnificent Seven in their ETFs.

The Perils of Over-Concentration in the Magnificent Seven

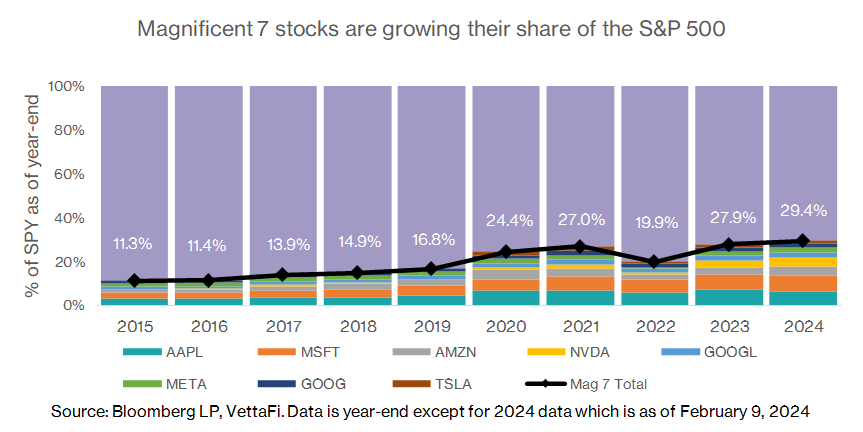

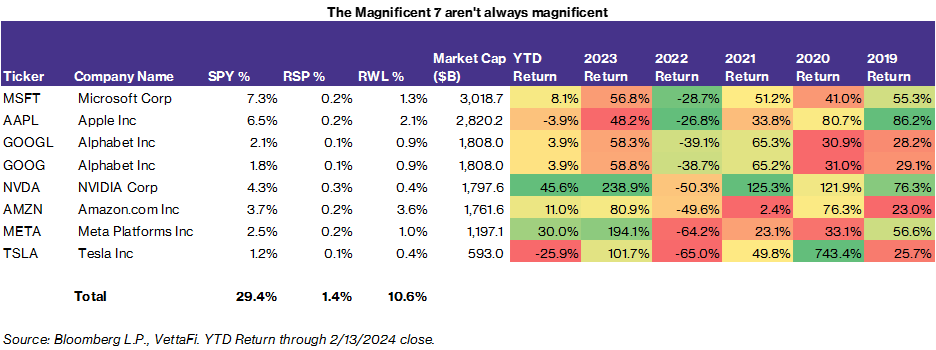

Since 2020, these seven companies (and eight stocks) have accounted for nearly a quarter of the S&P 500 index. At present, they constitute almost one-third of the SPDR S&P 500 ETF Trust (SPY). While their significant market weightings and high returns have propelled the S&P 500 (manifested, for instance, in Nvidia’s 46% year-to-date surge), these stocks can also drag the market down when they experience downturns, typified by Tesla’s 26% year-to-date dip. Given that investors typically hold multiple ETFs, their exposure within their portfolio usually extends beyond the S&P 500.

Another popular ETF, the Invesco QQQ Trust (QQQ), which tracks the tech-heavy Nasdaq-100 Index, allocates approximately 40% of its weight to the Magnificent Seven stocks. Similarly, many other industry and thematic ETFs, focused on disruptive technology and innovation, exhibit hefty exposure to these same stocks.

For example, a future mobility ETF such as the iShares Self-Driving EV and Tech ETF (IDRV) holds about 15% exposure to these stocks. Furthermore, an artificial intelligence ETF like the Roundhill Generative AI & Technology ETF (CHAT) has roughly 30% exposure to the Magnificent Seven. This phenomenon arises from the relative scarcity of public companies in newer industries. The few that do exist may possess a low market capitalization or minimal trading volume and thus fail to meet index inclusion criteria.

Despite the indispensable role these companies play in the infrastructure and advancement of emerging technologies, their repeated inclusion across indexes and ETFs could lead to investors unwittingly amassing exposure to the Magnificent Seven multiple times over, negating the foundational purpose of an ETF: diversification.

Alternative Weighting Strategies to Navigate Over-Concentration

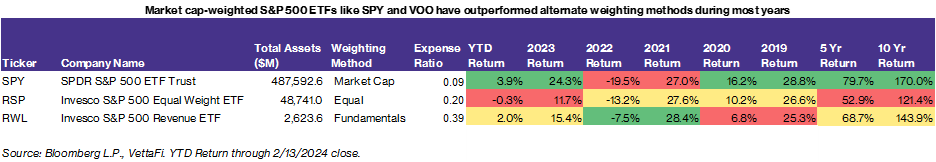

In a market-cap-weighted ETF like the SPY, it might seem incongruous to invest in a set of 500 stocks when only eight stocks (from seven companies) constitute one-third of the holdings. Ponder, for instance, stocks like Ralph Lauren (RL), which has seen a 23% year-to-date surge but commands a mere 0.02% weight. Why harbour holdings that virtually amount to zilch?

Enter equal-weight ETFs such as the Invesco S&P 500 Equal Weight ETF (RSP), which resolve this issue by leveling the playing field among stocks. These ETFs ensure that stocks like Ralph Lauren meaningfully contribute to performance. Additionally, certain ETFs employ alternative weighting methods, like the Invesco S&P 500 Revenue ETF (RWL), which weighs S&P 500 constituents by their earned revenue and caps each company’s weight at 5%. These weights, being rooted in fundamental analysis akin to how an analyst would evaluate stocks, might appear more “rational” compared to equal weighting.

Although these alternative weighting methodologies have outperformed in volatile years, such as 2021 and 2022, the market-cap-weighted SPY has outshone them in other periods and over more extended timeframes. Given the difficulty of timing the market, many investors may opt to maintain the status quo and invest in a market-cap-weighted ETF such as SPY or VOO. Ultimately, the over-concentration in the S&P 500 may not be a significant concern if one’s portfolio encompasses diversified assets beyond large-cap equities—encompassing fixed income, alternatives, international equities, and small-cap domestic equities.

Embracing the Magnificent Seven Through ETFs

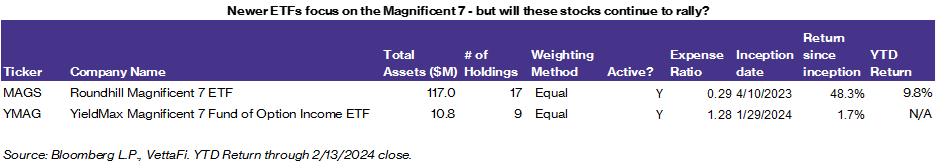

For investors who feel they aren’t getting enough of the Magnificent Seven, fear not! There’s an ETF for every inclination. Consider the Roundhill Magnificent 7 ETF (MAGS) and the YieldMax Magnificent 7 Fund of Option Income ETF (YMAG), both of which afford greater exposure to the Magnificent Seven. Although MAGS had previously been titled the Roundhill Big Tech ETF, a rebrand in November 2023 saw the fund rechristened and augmented with exposure to Tesla and Nvidia. MAGS proffers equal exposure to the seven companies. Notably, Roundhill is gearing up to launch three additional Magnificent Seven funds in early 2024, including leveraged and inverse versions. YMAG, conversely, apportions an equal weight to the seven companies but leverages exposure to option income ETFs instead of stocks, prioritizing income generation as its objective.

Thus far, MAGS has outperformed the S&P 500. However, like many trends and themes, ETFs often unfurl subsequent to the apex of the trend. With inquiries already arising over Tesla’s current “magnificence,” opting to invest in the Magnificent Seven via individual stocks, where one can adjust holdings in specific stocks, might be more feasible than purchasing an ETF with a fixed allocation.

For more news, insights, and analysis, visit VettaFi | ETF Trends.

The perspectives expressed herein are those of the author and do not necessarily align with those of Nasdaq, Inc.