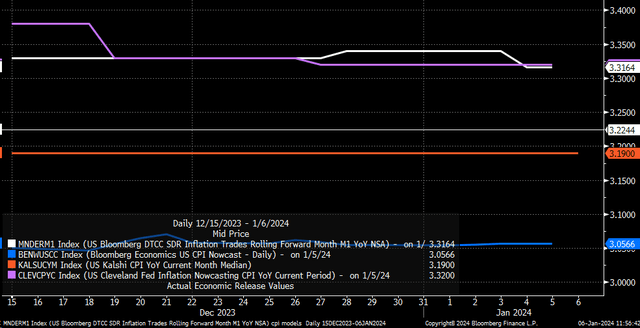

This week’s inflation data is expected to reveal that the Fed still has a long journey ahead. The market’s expectation for 5.5 rate cuts in 2024 could be a mirage, more fantasy than reality. Core CPI is forecasted to rise in December at a rate inconsistent with 2% inflation, while headline CPI is anticipated to accelerate from last month’s reading.

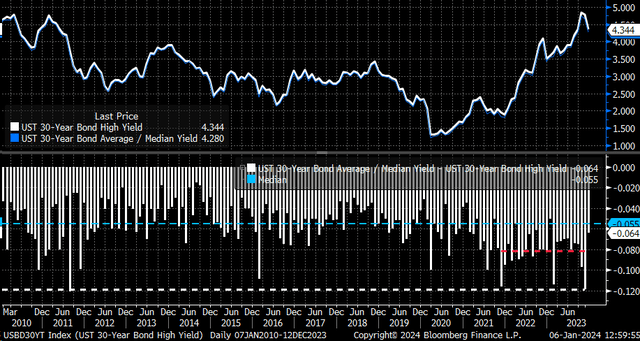

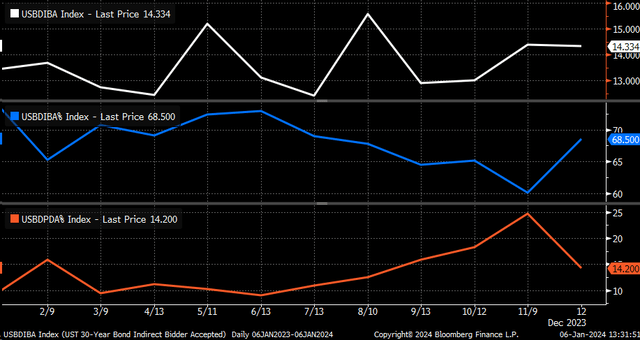

It won’t just be inflation in focus this week. Treasury issuance will be at the forefront, with the return of the 3-Year, 10-Year, and 30-Year Treasury auctions. The CPI report won’t be out until the morning of January 11.

Shifting Market Sentiment

Despite the previous anticipation of 6.5 rate cuts in 2024, the market has made progress this past week, effectively removing rate cuts from the equation. This shift follows the hotter-than-expected non-farm payroll report and robust wage growth, signaling a potential change in market sentiment and a need for revised strategies.

Market Analysis

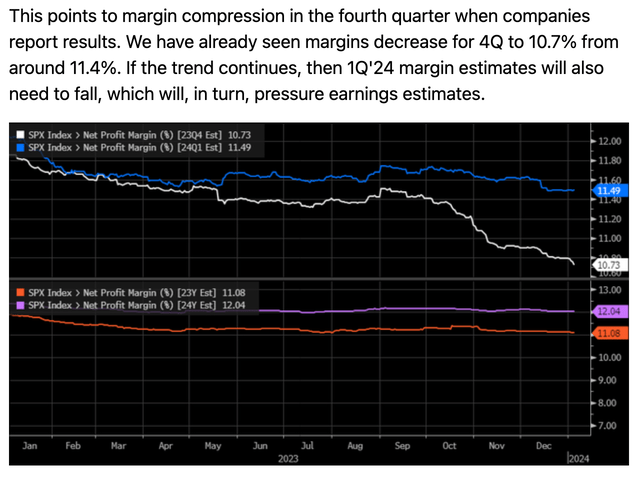

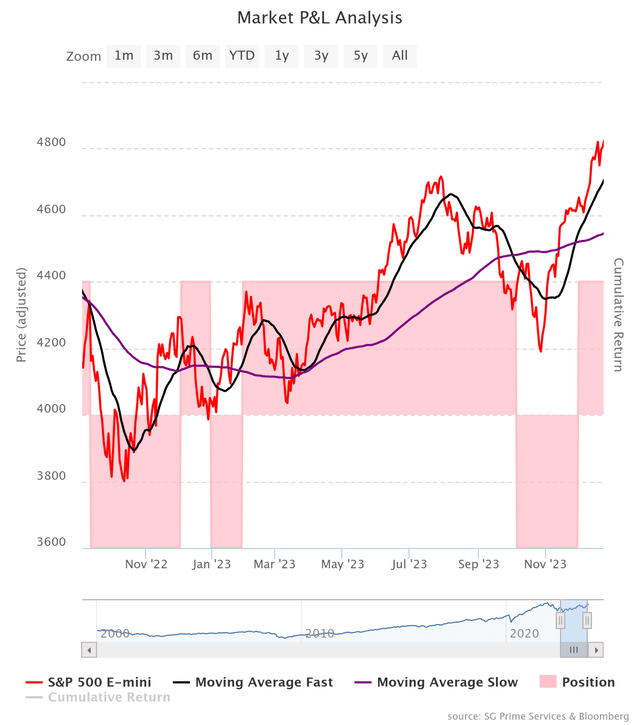

Bearish sentiments on the stock market have stemmed from expectations of stickier inflation and a stronger-than-expected economy, leading to a higher for longer policy path. This environment may cause multiple contractions and restrain stock prices. Amidst unexpected changes, a chance for redemption has surfaced, with the possibility of the index returning to 4,100 over the next several weeks.

The sudden shift in November, following the Treasury Refunding Announcement and the Fed’s actions, added further complexity to the market, leading to an unpredictable end-of-year rally. However, signs of a potential downturn and an impending return to previous levels have emerged, offering a glimmer of hope to investors.

Evaluating Inflation

The upcoming inflation data may chart a path to redemption, especially if it indicates a more conservative approach to future rate cuts. The forecasts for December’s CPI indicate a potential increase from November, raising questions about the overall inflationary trend. Divergent predictions from different sources add to the uncertainty surrounding future inflation rates.

The divergence in inflation forecasts and the market’s expectations suggest that a significant recalibration of future rate cuts may be imminent, contingent on the forthcoming inflation data.

Implications of Treasury Auctions

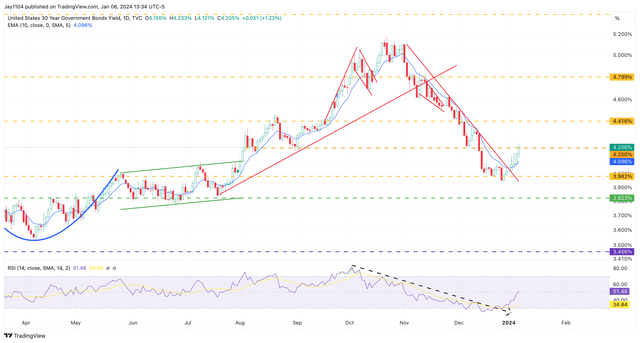

Apart from inflation, the results of the upcoming Treasury auctions will significantly impact the rate market. Recent auctions have experienced challenges, with indicators pointing to potential complications. The outcome of these auctions, particularly the 30-year auction following the CPI report, may have substantial repercussions on the financial landscape.

The technical signals and market movements indicate a likelihood of rates on the back of the curve trending higher, affecting the trajectory of the 30-year Treasury. The interplay between these factors holds the potential to shape the direction of future rates.

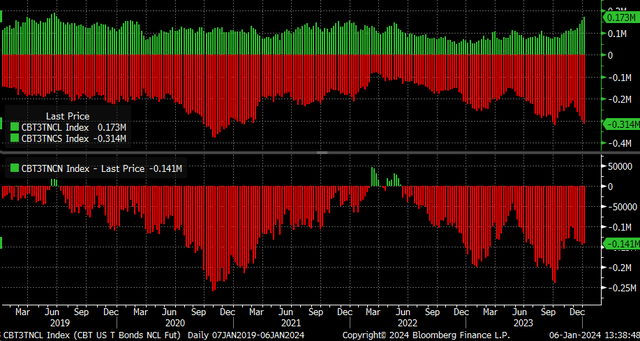

Ongoing market dynamics further underscore the potential impact of the auctions on the financial landscape. The unabated movement in short positions and long positions in futures signifies the heightened uncertainty surrounding future market movements.

Influencing Stock Market

The potential reevaluation of rate cuts and the projected rise in back-curve rates will undoubtedly reverberate throughout the stock market. Investors are poised to reassess their strategies and positions based on the evolving market dynamics, heralding a period of potential recalibration and adjustment.

The confluence of inflation data, Treasury auctions, and market sentiments presents a challenging yet opportune moment for investors to navigate the ever-changing financial landscape. As the week unfolds, market participants will keenly consider the unfolding events, seeking clues to steer their investment strategies amidst the shifting tides of the financial world.

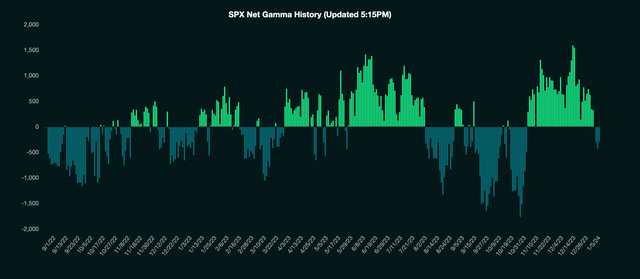

Assessing the Stock Market: Rising Implied Volatility and Stock Fluctuations

As of Friday, the S&P 500 has flipped back into negative gamma. This negative gamma regime leads to an increase in implied volatility, a factor that’s likely to unsettle the stock market. Notably, rising implied volatility would result in the market maker hedging flows moving in accordance with the market’s direction. Therefore, any decline in the markets will be accompanied by downward dealer flows.

According to Gamma Labs, the zero gamma level is estimated to be around 4,720 for the S&P 500. This implies that the index needs to surge past this level in order to transition back into a positive gamma regime. Upon achieving this, the market maker flows will be favorable for a lower implied volatility environment, thereby creating conditions conducive for stock price appreciation.

However, a decline below 4,640, a level identified by Nomura in a trading note, is likely to prompt systematic funds to become sellers. This adds an additional layer of volatility and selling pressure on the market. Moreover, the S&P 500 has already dipped below the 20-day moving average. Historically, when the 20-day moving average falls below the 120 moving average, these systematic funds are predisposed to either long or short the S&P 500 futures.

It is becoming increasingly evident that the market has once again placed significant bets on Federal Reserve policy. Specifically, the market is anticipating an aggressive number of rate cuts from the Fed in 2024. Any data point that doesn’t align with the anticipated rate cuts is being viewed as a hawkish event, even if the data falls in line with expectations. Subsequently, weaker data will be necessary to persuade the Fed to implement the rate cuts that the market is anticipating. Conversely, in response to hotter data, rate cuts will be priced out, leading to an increase in rates across the treasury curve. Consequently, this would prompt a readjustment of the equity market valuation to a lower level to account for the revised rate-cut expectations.