The Rise of AI: Why Amazon Leads the Magnificent Seven

In recent years, artificial intelligence (AI) has captured the attention of the financial world, fueling interest in the group dubbed the “Magnificent Seven.” This term refers to the largest technology companies that are finding their unique roles in the expansive AI market.

Here are the returns of each Magnificent Seven stock in 2024:

Where to invest $1,000 right now? Our analysts just revealed the 10 best stocks to consider. See the 10 stocks »

- Nvidia: 171%

- Meta Platforms: 65%

- Tesla: 62%

- Amazon (NASDAQ: AMZN): 44%

- Alphabet: 35%

- Apple: 30%

- Microsoft: 12%

All the mentioned tech giants, apart from Microsoft, surpassed the performance of the S&P 500 and Nasdaq Composite indices last year. Despite their strong returns, one stock stands out in my analysis as having the greatest potential.

In the following sections, I will discuss why I believe Amazon holds the key to being one of the most rewarding investments in the AI sector.

Amazon Positioned for Success

While companies like Nvidia and Tesla are often highlighted for their cutting-edge technologies, Amazon’s role in the AI landscape is gaining traction.

Amazon has been quietly developing its AI framework, starting with a $4 billion investment in Anthropic, an AI start-up whose large language model (LLM), Claude, competes with ChatGPT. In November, Amazon further increased its backing of Anthropic, bringing its total investment to $8 billion.

This partnership has not only benefited Anthropic by utilizing Amazon’s Trainium and Inferentia chips for training AI models, but it has also strengthened Amazon’s cloud computing arm, Amazon Web Services (AWS).

As a result, Amazon has experienced a noticeable growth in its AWS revenue and operating profits, generating significant free cash flow. This financial success has empowered Amazon to expand its AI initiatives, including building new data centers and enhancing its chip infrastructure.

Image source: Getty Images.

Transformative Potential of AI at Amazon

AI stands as a transformative force for many businesses, but its true potential varies by sector. It is likely to enhance software sales or increase user engagement on social media. However, for Amazon, AI’s capacity to drive growth is expansive.

Amazon can harness AI across multiple segments—from its e-commerce platform to AWS, grocery delivery, streaming, and beyond. Given the company’s vast ecosystem, it is unlikely that AI will reach its limits within Amazon’s operations.

This is particularly true as most of Amazon’s offerings are designed to keep customers engaged and returning, suggesting ongoing opportunities for growth.

Valuing Amazon’s Opportunities

Despite its strengths, investing in Amazon can be challenging due to its valuation. As its primary sectors—cloud computing and e-commerce—are sensitive to economic fluctuations, Amazon’s net income often experiences considerable volatility.

Instead of fixating on net income, focusing on free cash flow provides a clearer picture of Amazon’s profitability. For the trailing twelve months ending on September 30, Amazon reported a 123% increase in free cash flow, amounting to $47.7 billion. Surprisingly, this robust growth isn’t reflected in its share price.

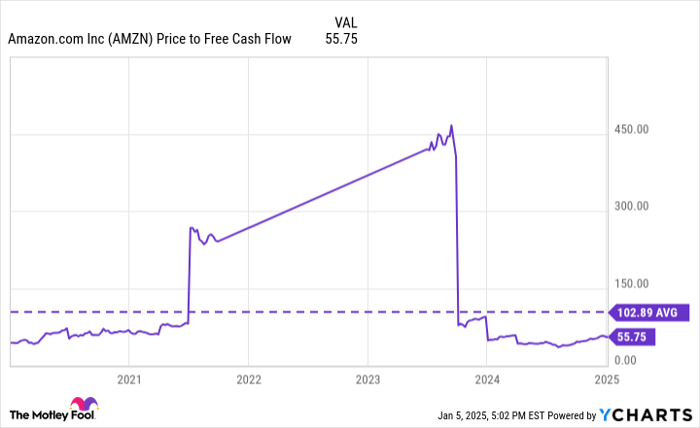

AMZN price-to-free-cash-flow data by YCharts.

Currently, Amazon’s price-to-free-cash-flow (P/FCF) ratio stands at 55.7, substantially lower than its five-year average. Market concerns regarding Amazon’s rising capital expenditures on AI projects have instigated skepticism about the returns on such investments.

However, these apprehensions appear to be unwarranted. The collaboration with Anthropic is already leading to increased sales and profitability in AWS, equipping Amazon to continue investing in AI.

Additionally, considering the transformative potential AI presents, it’s surprising to observe Amazon trading at such a discount from historical values. I believe Amazon stands out as the most compelling choice among the Magnificent Seven, and at its current valuation, it’s an ideal time to acquire shares.

A Second Chance at a Promising Investment

Do you feel you’ve missed out on previous investment successes? Here’s your opportunity.

Our team of analysts occasionally identifies a “Double Down” stock, indicating companies poised for significant growth. If you’re concerned you’ve already missed your chance, now might be the best moment to invest.

- Nvidia: A $1,000 investment from 2009 would be worth $387,474!*

- Apple: A $1,000 investment from 2008 would be worth $46,399!*

- Netflix: A $1,000 investment from 2004 would be worth $475,542!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and this may be your last chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, former CEO of Whole Foods Market, which is an Amazon subsidiary, serves on the board of directors for The Motley Fool. Randi Zuckerberg, a previous director at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, also sits on the board. Additionally, Suzanne Frey, an executive at Alphabet, is on the board. Adam Spatacco holds positions in several companies including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool endorses Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla and has a specific disclosure policy.

The views expressed here are those of the author alone and do not necessarily reflect those of Nasdaq, Inc.