This morning, the latest payrolls report from the Labor Department showed our economy added just 12,000 jobs in October.

Hurricanes and the ongoing Boeing strike were behind much of the anemic figure. To put this into perspective, the number of jobs added in September was 223,000.

With irregular, nonrecurring disruptions playing a major role in today’s data, it’s hard to draw any meaningful conclusions about the overall health of our economy. This complicates the Fed’s job, as getting a bead on the true condition of the labor market is critical for setting interest rates.

Unfortunately, we’re likely in for another month of readings influenced by outside factors. Here’s The Wall Street Journal explaining:

With the data likely to show continued volatility from storms and strikes, the central bank’s challenge in the months ahead will be to tease out how well the labor market is doing.

Some job losses from Milton might not show up until the November jobs report comes out next month, for example, while people who go back to work after temporarily losing their jobs could push the numbers the other way.

Now, even though we need to take this report with a grain of salt, I want to point out one troubling aspect of it. All the job growth – every bit of it – came from the government. The private sector shrank.

Here’s MarketWatch:

The government created 40,000 new jobs in October, accounting for all of the increase. The private sector actually shed 28,000 jobs due to the Boeing strike and a pair of hurricanes.

In this morning’s Growth Investor Flash Alert, legendary investor Louis Navellier highlighted another underwhelming detail – revisions:

The news gets even worse when you look at the details: August and September were revised down by a cumulative 112,000 jobs.

We’ve also now lost 46,000 manufacturing jobs – a lot of that from is from The Boeing Company’s (BA) ongoing struggles.

Additionally, the number of unemployed people has risen by 150,000 people. The unemployment rate remains unchanged at 4.1%, however, because the workforce is shrinking.

All in all, this payroll report is a statistical mess. It will probably need to be revised when we have more information.

We’ll keep you updated if/when those revisions come.

Switching gears to next Tuesday, Louis is urging investors to prepare for a contested election

Let’s go straight to his recent update:

The real story I’m preparing for is not what happens on Election Day. It’s what could be coming the day after– next Wednesday, November 6.

It doesn’t matter who you’re voting for. That’s when unprecedented social strife could be unleashed as both sides contest the election.

It could also set off a chain reaction on Wall Street – including a bout of massive stock market volatility.

Louis writes that he wouldn’t be surprised if we didn’t have a clear winner even weeks after the election.

On Tuesday, The New York Times reported that more than 187 election-related lawsuits have already been filed. The Times writes, “Any open or pending litigation could prove grist for post-election rhetoric,” and “cases dismissed simply because the people who brought a case did not have standing to do so — rather than on the merits of their arguments — could still be used by those seeking to cast doubt on the process.”

And this is from Reuters on Wednesday:

With the U.S. election just days away, officials in the most competitive battleground states are bracing for misinformation, conspiracy theories, threats and possible violence…

Election officials say one of their biggest fears is a razor-close result where the outcome will hinge on court fights over small numbers of disputed ballots.

A contested election that drags on for weeks would be the worst thing for the market

If Trump or Harris wins decisively we’ll see some immediate, exaggerated reaction as Wall Street adjusts to the new president’s agenda. But with the election uncertainty behind us, we’re likely to get back to some semblance of normalcy soon after.

However, a contested election would keep Wall Street guessing. And an uncertain Wall Street often becomes a volatile Wall Street.

But for traders, volatility presents an opportunity…

Earlier this week, Louis sat down with our geopolitical expert, Charles Sizemore from The Freeport Society to discuss the risk of election-based volatility in the market, and how they plan to trade it. During this “Day After Summit,” Louis laid out his gameplan for profiting from the post-election chaos:

It has nothing to do with following your instincts… or with human emotions.

Instead, it’s a quantitative system I consider to be the No. 1 tool for anyone looking to turn uncertain macroeconomic, financial, or political events into outsized stock market gains.

The greater the volatility, the greater the potential gains.

You can get the full details, as well as Louis’ and Charles’ thoughts on the election, by watching a free replay of the event right here.

Now, if you’re worried about the outcome of the election, resist the urge to allow that anxiety to drive your market decisions. If you own the stocks of great companies, Louis believes that staying calm in the next few weeks is the right call:

If targeting short-term gains using a quantitative system is not your thing, that’s fine. Just remember that the worst thing you can do when volatility kicks up is to panic sell out of your long-term stock holdings.

We could be in for a trying couple of months. But eventually, we’ll have a new president. And markets will return to a more stable footing.

While “stable footing” sounds great, be aware of different behavior between mom-and-pop investors and corporate insiders that doesn’t suggest “stable”

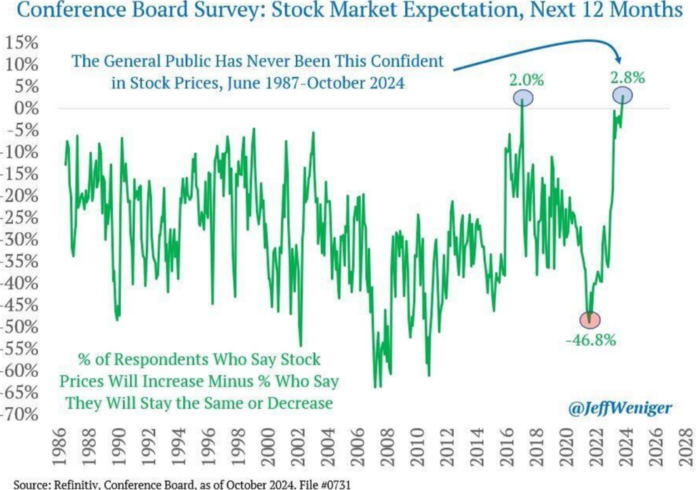

I’m about to show you a chart that should make you uneasy.

What you’re going to see is the net percentage of mom-and-pop investors who believe stocks will be higher one year from now.

If you can’t read it, the subhead within the chart reads, “The general public has never been this confident in stock prices, June 1987 – October 2024.”

Source: @JeffWeniger

This should concern you because history shows that “the general public” tends to be excessively bullish or bearish at precisely the wrong time. This is one of the best contrarian indicators we have, screaming “watch out!”

We received another confirmation of this bullish sentiment yesterday when CNBC reported on research from Bank of America. The takeaway is that mutual fund cash levels are now the lowest ever. Or as the headline put it, “Investors all in on stocks.”

Meanwhile, what are corporate insiders doing with the stocks of the companies where they work?

Selling…a lot.

From Barron’s:

Corporate insiders are selling… shares of their companies at near-record rates…

Among all companies with any insider transactions so far in October, just 13% have experienced more insider buying than insider selling. That’s the lowest insider buy ratio in at least a decade, according to [InsiderSentiment.com] …

Insiders historically have been more right than wrong in the timing of their personal purchases of their companies’ shares.

[Professor Jon Seyhun from InsiderSentiment.com] has found from his research that the insider buy ratio has one of the best track records when forecasting the market’s 12-month return—superior to many better-known valuation indicators.

To be clear, the takeaway is not “bail out of stocks”

But it is “get your investment plan ready.”

To that end, here are a handful of questions to consider over the weekend:

- Which stocks do you plan on holding, regardless of volatility?

- Are you truly emotionally prepared to hold them if their prices plummet much further than you expect?

- Which stocks do you hold with less conviction that you’ll sell if they fall to a pre-established stop loss?

- What’s the specific stop-loss for each of those stocks?

- Do those stop-loss values reflect the intrinsic volatility of that stock so that you’re not selling prematurely, or holding too long? (By the way, if you want help with your stop-losses, click here to learn more about one of the best stop-loss tools in the industry)

- Which stocks are on your “buy list”?

- At which prices will you pull the trigger and add those stocks to your portfolio?

Remember, market volatility isn’t necessarily “bad.” Rather, it’s just a wealth-transfer mechanism.

It shifts wealth from emotional investors without a plan…to rational investors who have prepared for turbulence.

What you don’t want to do is follow the herd based on fear or greed. Back to Louis:

As humans, we tend to crowd-source our decision-making, especially when we’re facing fear and uncertainty.

But the urge to join a stampeding crowd can kill your stock portfolio.

The human brain is a marvelous tool for creating art, music, language, and feats of engineering. It’s a terrible tool for investing.

This is why Louis’ plan – for both election volatility and longer-term investing – is based on cold, impartial data, not emotions.

Bottom line: Don’t make the mistake of thinking you’ll be able to make wise decisions if/when stocks turn. The time to prepare is today, when your portfolio is likely setting new all-time highs.

Hopefully, you’ll never have to put that plan to work. But you’ll sleep better tonight knowing that it’s there if you need it.

Have a good evening,

Jeff Remsburg