“`html

Unlock Your Financial Dreams: The Power of Vision Boards

Let’s get straight to the point…

When I first came across the term “financial vision boards,” I honestly thought it belonged in a category of Things People on Pinterest Do.

Alongside creative meal plans and perfectly arranged spice racks, of course.

However, I noticed that these boards are not just a Pinterest phenomenon; they’re also favored by renowned business leaders. Prominent figures like Michelle Obama, Oprah Winfrey, and even Conrad Hilton use them.

In 2019, Inc.com revealed that 1 in 5 successful entrepreneurs use vision boards, and their claims have scientific support.

During that same year, neuroscientist and executive coach Tara Swart commented in a CNBC interview that many high-level executives have vision boards, either physically or digitally.

How does she know? They are her clients.

Swart works regularly with big-name companies such as KPMG, LinkedIn, MIT Sloan School of Management, Samsung, Sony, SAB Miller, and Stanford Business School, teaching them how to reach their goals through applied neuroscience, which includes the use of vision boards as a tool.

Was I skeptical? Absolutely. Initially, I just saw it as a collection of pictures stuck to a board. How could it possibly help with serious financial goals like retirement savings or overcoming procrastination?

Yet, the concept lingered in my mind. I found myself wondering, what if there’s something to this?

What if, through this exercise, envisioning a paid-off mortgage or dreaming about a vacation could actually speed up those objectives? Or even make them happen at all?

So here I am, compelled to explore this idea, not only to persuade you but also to convince myself. If a simple exercise could clarify my financial goals, I’m eager to try it.

Are you ready to see if we can turn our financial aspirations into reality?

Welcome to the January 2025 vision board experiment. Let’s get started.

Understanding Financial Vision Boards

Let’s dive into the essentials.

A financial vision board merges your financial ambitions with your dreams. It acts as a visual representation—a collage of images, words, and concepts that showcase your goals in life and finance.

Think of it as your personal motivator. Why are you saving? Why are you budgeting? Why skip dinner out this week to fund something bigger?

Create your board by collecting images that resonate with your goals. You might include a picture of your dream house, stacks of books symbolizing lifelong learning, or an airplane soaring toward your next dream destination. Place them on either a physical or digital board and keep it visible.

Why should these images occupy such prominence? Because seeing your ambitions regularly makes them feel tangible and achievable.

This process goes beyond merely admiring pretty visuals. A financial vision board connects your aspirations to the money required to achieve them. It becomes a personal roadmap, guiding your financial decisions based on your values.

Simply put, without purpose, money can feel pointless.

You can save diligently, but without goals, it’s easy to forget why you’re doing it. That’s where a financial vision board becomes essential.

By creating one, you not only pinpoint what you desire but actively visualize it. It brings clarity to your financial goals. Studies indicate that visualization can significantly enhance goal achievement by keeping individuals motivated. Our brains appreciate strong visual stimuli!

I know this may sound unconventional at first—trust me, I was once a skeptic. However, witnessing the success of others convinced me to think, Why not?

At worst, I spend an hour creating something inspiring; at best, I gain the focus to pursue my financial aspirations.

Steps to Crafting a Financial Vision Board

Now that you’re intrigued, let’s look at how to create a financial vision board. Rest assured, crafting one doesn’t require artistic skills or a mountain of magazines.

Step 1: Gather Your Materials

First, decide whether you want to create a physical or digital board:

Physical: A board with printed images, magazines, scissors, and glue.

Digital: Use platforms like Pinterest, Canva, or even a simple Word document to compile and arrange your images.

Both options work; choose whichever feels easiest and most enjoyable for you.

Now, start collecting images. Ellen Rogin, a former wealth advisor who co-authored a guide on crafting financial vision boards, recommends starting with 20 to 30 images. These can feature anything that sparks joy or inspiration, including:

– Dream travel destinations.

– Symbols of debt freedom (a paid-off credit card, for example).

– Anything representing the life you desire, such as a cozy home, a successful career, or quality time with loved ones.

Pro tip: Don’t stress over the selection. Just choose what resonates; you can make changes later.

Step 2: Reflect on Your Images

This step is where the real insight occurs.

Examine each image carefully and ask yourself:

– Why does this image catch my attention?

– What does this image signify?

– Visualize yourself in the scene. What do you see, hear, or smell?

– How would I feel if I accomplished this?

– Who would I celebrate this achievement with?

This reflection helps clarify what truly matters to you. You might uncover aspirations you weren’t aware of. After identifying these goals, jot them down so they’re not forgotten. In the next step, you can connect them to specific financial actions.

Step 3: Arrange Your Vision Board

It’s time to make your vision board practical.

There are two common approaches for layout. The first is a freeform arrangement where you organize your images in a way that feels right. Consider adding words or phrases that resonate with you and support your goals.

This approach is not just contemporary; it has historical roots. For instance, a young Conrad Hilton famously clipped an image of the Waldorf Astoria…

“`

Visualize Your Financial Future: The Power of a Vision Board

Crafting Clear Goals with a Structured Approach

Creating a financial vision board can transform your dreams into achievable goals. If a freeform approach seems overwhelming, try a structured method to clarify your objectives.

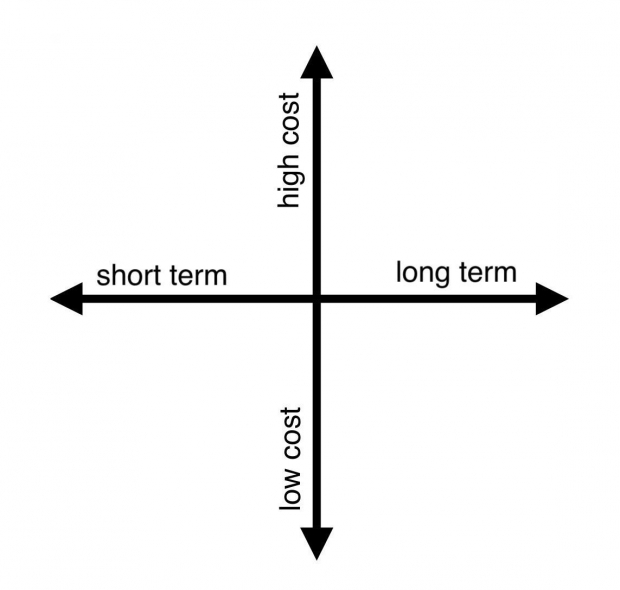

Begin by organizing your board around two key variables: time and cost. You can do this on a physical board or digitally. Draw a simple grid divided into four quadrants. The horizontal axis indicates time—ranging from short term to long term—while the vertical axis reflects cost—spanning from low cost to high cost.

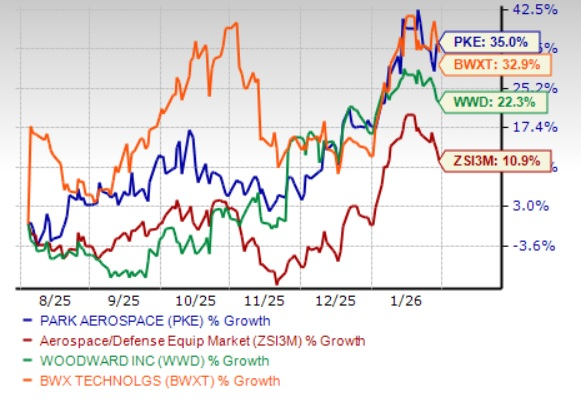

Image Source: Zacks Investment Research

Consider placing specific visions and goals into these quadrants:

- Top Left: High-cost, short-term goals (e.g., a car or vacation).

- Top Right: High-cost, long-term objectives (e.g., retirement or homeownership).

- Bottom Left: Low-cost, short-term ambitions (e.g., a new hobby).

- Bottom Right: Low-cost, long-term goals (e.g., building relationships, learning a skill).

By plotting your goals this way, you can visualize not only what you aspire to achieve but also the time and effort involved. For instance, your dream vacation might fit into the top left quadrant, while a significant investment like paying off your mortgage would be categorized in the top right.

Make Your Goals Visible

To ensure your financial vision board serves its purpose, it’s essential to keep it in sight. Display it prominently—above your desk, on your fridge, or even as a phone wallpaper—to remind yourself of your goals daily.

While simply looking at your board won’t bring money or success automatically, it does cultivate focus. Regularly viewing your vision board helps train your brain to recognize opportunities that align with your goals.

This process relies on a concept called neuroplasticity, which refers to the brain’s ability to reorganize itself based on focus and experiences. While visualizing your goals, your brain interprets this as a practice run, preparing you for real-life achievement.

Two significant components in this process include:

- Mirror Neurons: These aid in learning and planning by allowing you to mimic actions seen or imagined, making goal visualization effective.

- Neural Resonance: This supports your ability to focus and problem-solve, enhancing your capacity to notice opportunities related to your goals.

As you build your vision board, carefully select images that resonate with your most important aspirations. Doing so helps clarify what truly matters to you. Once complete, your board will serve as a visual tool that filters out distractions, guiding your mind toward relevant information.

Staying on Track with Your Goals

Now that you’ve crafted your financial vision board, it’s time to turn those images into reality. Start by linking your goals to actionable plans. Your vision board acts like a map, but it’s effective only when you know how to navigate it.

Examine each image closely and ask yourself:

- What is the first step to achieve this?

- What will it cost, and how long until I can reach it?

- What changes should I make to my spending, saving, or earning patterns?

For example, if you have an image of a renovated kitchen, begin by estimating costs and setting up a savings plan. If your objective is debt freedom, calculate how much extra you can allocate toward repayments each month.

Having a clear plan increases your chances of success. Whenever you feel your motivation dipping, revisit your board to remind yourself of your purpose. Visualize how it will feel to accomplish your goals consistently.

Remember, your financial vision board is not a static document. As you achieve milestones, update it to reflect new accomplishments. Cross off completed goals or add pictures representing your successes, like moving into a new home or enjoying your dream trip. Tracking progress visually can be rewarding and energizing.

Join Me in the Vision Board Experiment

You now have the tools and knowledge to start your vision board journey. This January, I will embark on my own experiment. I plan to reflect on my financial goals and build a board that connects my money habits to my aspirations. Keeping it visible, I will use it daily and revisit it throughout the year to assess its impact on my focus.

Consider taking part. Whether you’re an experienced budgeter or just curious, creating a vision board could be a great way to achieve your “somedays” faster than expected.

Free Insights for Your Financial Growth

Zacks’ Money Sense newsletter delivers trusted personal finance strategies right to your inbox. Weekly, you’ll receive practical ideas to enhance your savings, make better investment decisions, and build a stronger financial future.

Whether you’re a novice or have already amassed a solid nest egg, our expert insights can propel you toward greater financial freedom. Sign up today for free.

Get Money Sense absolutely free >>

To check out this article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.