The cryptocurrency market is experiencing a pulsating revival.

From a period of sluggish trading activity and depressed crypto values, the market has surged to a total valuation of $2.8 trillion — teetering on the brink of a monumental $3.0 trillion milestone.

The once-slumbering crypto market has awoken with heightened volatility. In the span of a single week, total market values catapulted from $2.5 trillion to the aforementioned $2.8 trillion peak — only to retreat back to $2.5 trillion six days later. And even after this sharp retreat, the fear and greed indexes for the crypto sector are poised at the edge between “greed” and “extreme greed.”

Conventional wisdom may dictate that this is an inopportune time to delve into cryptocurrencies. The soaring crypto prices, coupled with escalating fear and greed metrics, may portend an impending correction. Logically speaking, it would seem wise to steer clear, right?

But I beg to differ.

You should seriously contemplate allocating $1,000 (or any sum within your means) into your preferred cryptocurrencies at this juncture. In particular, venerable Bitcoin (CRYPTO: BTC) is primed for one of those exhilarating price upsurges that have the potential to overshadow unfavorable indicators and lofty coin prices. The pioneering and largest figure in the digital assets realm is knee-deep in several pivotal catalysts driving its price.

The Impact of Halving Bitcoin’s Rewards

First and foremost, Bitcoin mining is approaching another epochal moment with the impending halving of mining rewards.

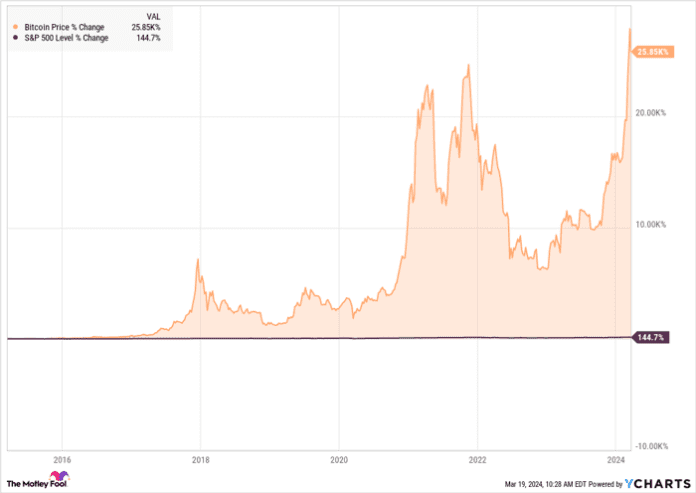

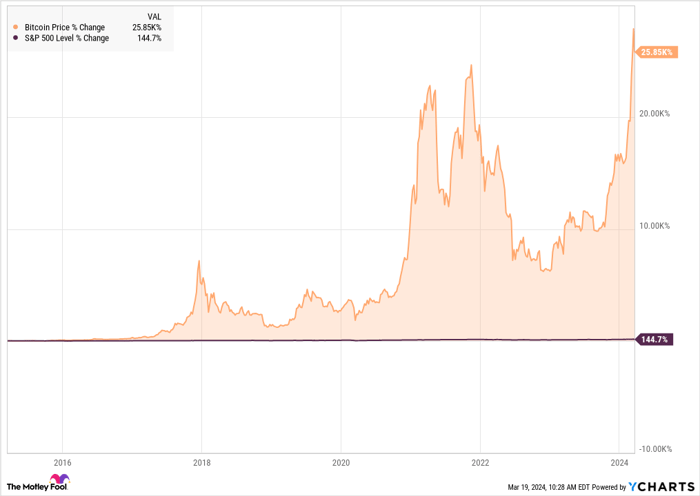

The fourth “halving” occurrence in Bitcoin’s storied history is slated for around April 23, 2024. Each previous halving event has indelibly etched its mark on Bitcoin’s price trajectory, culminating in exponential peaks materializing over the ensuing 12 to 18 months:

Bitcoin Price data by YCharts

Interestingly, the price appreciation has commenced slightly ahead of schedule in this cycle. Numerous crypto investors have astutely recognized these predictable four-year patterns and acted swiftly to leverage the imminent opportunity.

However, there’s more to this narrative. Bitcoin has a unique advantage this time around, propelling it to surpass the gains witnessed in earlier halving cycles.

The Emergence of New Bitcoin Investment Avenues

The narrative shifts as heavyweight investors are now taking Bitcoin seriously.

In a momentous move, the Securities and Exchange Commission (SEC) greenlit 11 applications for Bitcoin-centric exchange-traded funds (ETFs) in January. While this long-awaited approval didn’t trigger an instantaneous price surge, it set a compelling chain of events in motion.

Previously sidelined investors who lacked viable avenues to directly invest in Bitcoin now have accessible (and lightly regulated) instruments mirroring Bitcoin’s market movements with remarkable precision. ETFs mirror the characteristics of stocks, although they track the performance of an underlying asset rather than embodying ownership of a specific entity. They command or oversee tangible Bitcoin portfolios, akin to gold-price ETFs that hold physical gold or a stock index ETF that acquires shares across various companies.

In essence, these newest spot-market Bitcoin ETFs offer the closest proxy to owning Bitcoin within a conventional stock brokerage account. They are seamlessly integrated into retirement accounts, pension plans, and other investment vehicles that would traditionally steer clear of cryptocurrencies. And their burgeoning popularity has already begun to exert an impact on Bitcoin’s intrinsic value.

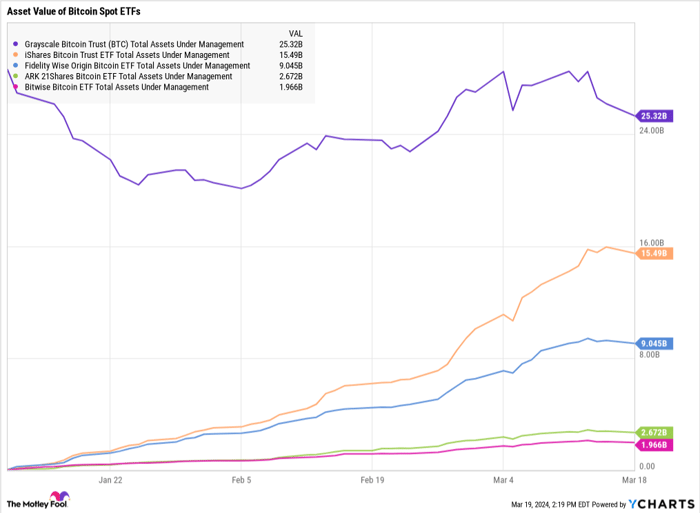

Approximately two months post ETF introduction, the five largest Bitcoin ETFs harbor a cumulative net asset value of $54.5 billion. It’s crucial to note that these sums correspond to actual Bitcoin holdings managed by each fund, a significant uptick from the $28.7 billion recorded during mid-January initiation.

GBTC Total Assets Under Management data by YCharts

Initially, the lion’s share of ETF-based Bitcoin assets resided within the Grayscale Bitcoin Trust (NYSEMKT: GBTC), a former mutual fund that swiftly transitioned into the ETF format post the SEC’s approval. Subsequently, Grayscale’s valuation has receded to $25.3 billion, while the iShares Bitcoin Trust ETF (NASDAQ: IBIT) escalated to $15.5 billion and the Fidelity Wise Origin Bitcoin ETF (NYSEMKT: FBTC) settled at $9.0 billion.

Hence, financial interest in Bitcoin via these funds has nearly doubled within a span of two months, facilitating diversification across multiple financial instruments. This paradigm shift has opened the door for novel investor classes to engage with the digital currency in a familiar format.

The ETF debuts curated the stage for Bitcoin’s imminent surge, albeit ahead of schedule. This powerful combination has kickstarted an exciting chapter for Bitcoin. However, this isn’t the endgame. Rather, it signifies that the fourth halving is commencing from a loftier pricing pedestal than anticipated. Anticipate significant untapped value gains over the next 18 months, whether you’re contemplating your debut Bitcoin investment (via ETFs or direct Bitcoin ownership).

If you’re mulling over joining the ranks, ponder on this: a savvy voyager always packs a safety net and a map. In investment parlance, this translates to avoiding an all-in bet. Diversify your investment portfolio to hedge risks. Bitcoin (or its indirect stand-ins) should constitute the cornerstone of a diversified crypto portfolio, owing to its robust security frameworks and dominant market position. Begin with a $1,000 stake in Bitcoin, followed by a diverse array of altcoins or crypto-adjacent equities.

Furthermore, Bitcoin’s exhilarating ascent is often punctuated by unforeseen price plunges. Exercise patience and allow the digital investment realm to stabilize before making impulsive decisions, like offloading your recently acquired Bitcoin holdings amidst panic. Remember, while the summit vista may be awe-inspiring, the journey there is rarely smooth sailing.

Gear up for the adventure, but arm yourself for any turbulence along the way.

Is now the right time to invest $1,000 in Bitcoin?

Prior to delving into Bitcoin, contemplate this:

The Motley Fool Stock Advisor analyst crew recently unveiled their curation of the 10 best stocks for investors to purchase now… and Bitcoin wasn’t on the roster. These 10 selections hold the potential to yield substantial returns in the years ahead.

Stock Advisor offers investors a roadmap to success, complete with portfolio-building insights, analyst updates, and bi-monthly stock picks. Since 2002*, the Stock Advisor service has outperformed the S&P 500 thrice over.

Explore the 10 stocks

*Stock Advisor returns as of March 18, 2024

Anders Bylund holds positions in Bitcoin and Grayscale Bitcoin Trust (BTC). The Motley Fool has positions in and recommends Bitcoin. The Motley Fool upholds a disclosure policy.

The opinions articulated herein reflect the author’s viewpoints and don’t necessarily align with those of Nasdaq, Inc.