To imagine the potential of a $1,000 investment in a stock, consider the eyes of an 8-year-old watching it mature over 50 years. By adding $1,000 annually for half a century, the investment could grow to a staggering $2.6 million, assuming market-matching returns of 12%. Should we dream of exceeding the market by just 2%, this sum could double.

One such investment showing promise of outperformance and sustained growth is Uber Technologies (NYSE: UBER). Since the beginning of 2023, Uber’s stock has tripled in value, signifying a remarkable ascent.

While some may feel they missed the boat on Uber’s stock surge, the company’s trajectory indicates that the best may still be on the horizon. Uber’s strengthening network effects and expanding growth avenues make it an enticing buy-and-hold forever kind of growth stock.

Uber’s Ever-Expanding Cash-Generating Network

Spanning operations across over 70 countries and facilitating 9.4 billion trips in 2023, Uber raked in $37 billion in revenue – marking a 24% and 17% increase from 2022 in trips and revenue, respectively. With a massive two-sided network connecting 7 million drivers to 150 million active monthly platform users, Uber operates through three core segments:

- Mobility (56% of sales in Q4 2023): Uber’s flagship segment encompasses ridesharing, carsharing, micromobility, rentals, public transit, and taxis. This mature business line acts as a profit hub with a 26% adjusted EBITDA margin in Q4.

- Delivery (31% of sales): Comprising grocery, retail, alcohol delivery, and Uber Eats, this unit recorded a 15% adjusted EBITDA margin in Q4 and witnessed an eightfold surge in gross bookings since 2018.

- Freight (13% of sales): Uber’s on-demand freight platform, nearly breaking even on adjusted EBITDA, aims at revolutionizing the logistics domain by matching shippers with carriers. Per Bloomberg, this segment was considered for a spin-off in 2023, accentuating the growth potential residing in Uber’s platform.

Tripling its sales post its 2019 IPO, Uber’s vast network continues to propel its dominance as an industry juggernaut, boasting increasing cash flows as it achieves heightened efficiencies.

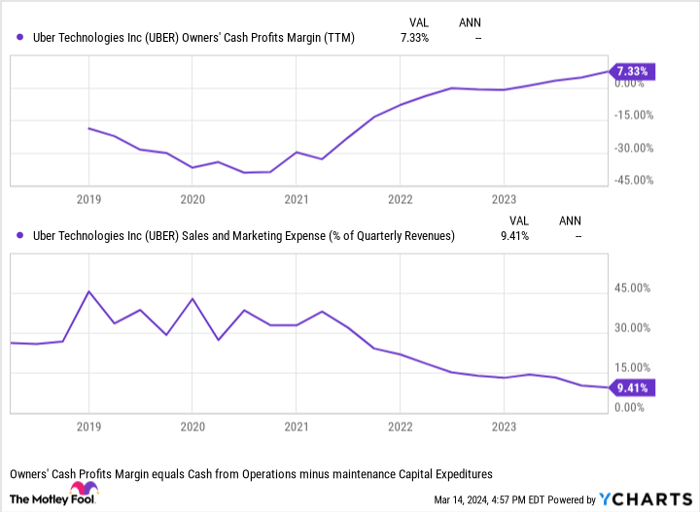

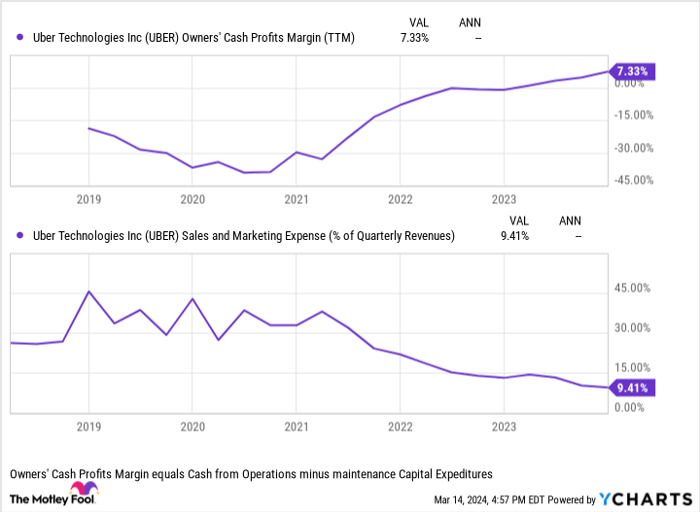

UBER Owners’ Cash Profits Margin (TTM) data by YCharts

Reducing its sales and marketing expenses as a percentage of revenue from over 30% in 2021 to 9% presently, Uber’s owners’ cash profit margin – akin to free cash flow – has surged to 7%. This turnaround underscores the company’s shift from cash-burning tactics towards cultivating positive cash flows while sustaining growth momentum.

A significant cash-generating shift like Uber’s usually aligns with a slowdown in growth as companies mature. Yet, Uber’s growth narrative, along with its array of future prospects, appears more compelling than ever.

Image source: Getty Images.

Uber’s Wealth of Growth Potential

Despite Uber holding an estimated 75% share in the U.S. rideshare market, it still harbors two primary growth streams:

1. Tailored Product Offerings

Uber One, the company’s membership program, has swiftly amassed 19 million members since its late 2021 inception. Contributing 30% of Uber’s gross bookings, members spend 3.4 times more than non-members. Additionally, Uber Reserve’s trip count skyrocketed tenfold since 2021, showcasing how innovative products can fuel revenue growth. With features like Record My Ride, intercity travel, multi-merchant pickups, and package returns via Uber Connect, Uber continues expanding its repertoire for diverse use cases.

2. Diverse Industry Expansion

Pursuing an “All Taxis on Uber” initiative, the company has begun integrating taxi drivers from select locations onto its platform – a previously inconceivable move. These hailable rides have quadrupled their trip numbers since 2021, augmenting the driver base in its network. Furthermore, Uber’s emerging advertising unit now contributes 5% to gross bookings, yielding high-margin revenue. With endeavors such as white-label deliveries, B2B shipping, car rentals, and ongoing trials in last-mile delivery, Uber has an array of adjacent industries to explore.

A Pensively Rational Valuation

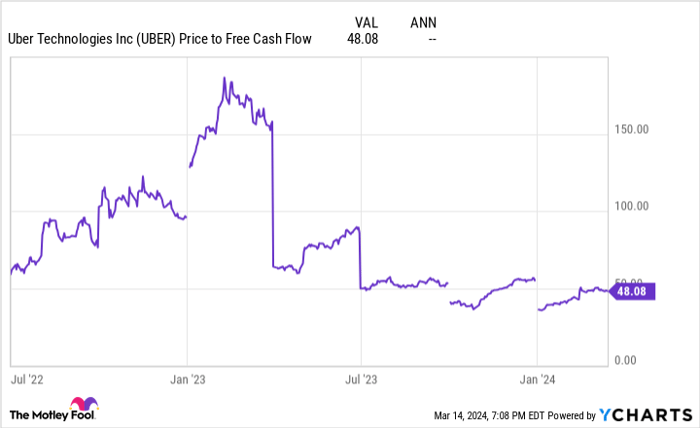

Despite a recent stock price surge, Uber’s price-to-FCF ratio at 48 remains sensible, notably as management anticipates 30% to 40% annual growth in adjusted EBITDA and FCF over the next three years.

UBER Price to Free Cash Flow data by YCharts

With FCF totaling $3.4 billion over the last year, this figure could soar to around $8 billion by 2026 should management’s projections materialize. This valuation – inclusive of stock-based compensation – presents an intriguing proposition considering the plethora of growth pathways awaiting Uber, solidifying its position as the prime growth stock for a $1,000 investment today.

Is Uber Technologies the right $1,000 investment choice for you?

Before diving into Uber Technologies stock, contemplate this:

The Motley Fool Stock Advisor analysts have pinpointed what they consider the 10 most promising stocks for investors to seize now… and Uber Technologies didn’t make the cut. The selected 10 stocks hold the potential for substantial returns in the foreseeable future.

Stock Advisor furnishes investors with a practical blueprint for succeeding in the market, offering portfolio building guidance, analyst insights, and bi-monthly stock recommendations. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500 index*

Explore the 10 stocks

*Stock Advisor returns as of March 11, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool holds positions in and endorses Uber Technologies. The Motley Fool abides by a disclosure policy.

The expressed views and opinions herein belong solely to the author and may not mirror those of Nasdaq, Inc.