Tracking Dividends Made Simple: Introducing Income Calendar

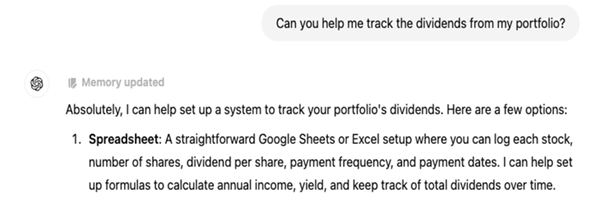

Keeping tabs on dividends can be challenging, especially if you manage multiple investments. Traditional methods, like spreadsheets, fall short when faced with this task.

While some brokerage accounts have basic tools for tracking dividends, these options usually only cater to assets controlled by the specific broker. This limitation can create complications for investors who spread their portfolios across various accounts.

Moreover, relying on external applications often entails entering your investment details manually, which can be a cumbersome process. Many investors wish to minimize the effort involved in managing their finances, especially if they are retired or aiming to retire soon.

Streamline Your Dividend Tracking with Income Calendar

At Contrarian Outlook, we explored various dividend tracking tools but found none that met our expectations. Consequently, we decided to develop one ourselves: Income Calendar.

This tool has recently been enhanced with new features that simplify its use, including compatibility with any brokerage account, even Fidelity! Users can now automate the input of tickers and share counts directly from their brokerage accounts.

I connected my Schwab account with Income Calendar in just a few clicks. This streamlined process is only the beginning of what IC offers.

Let’s delve into this upgraded tool with the example of Ares Capital (ARCC), a business development company that specializes in loans to small enterprises and is well-suited for today’s economic environment.

BDCs, like Ares Capital, enjoy specific tax advantages. In return, they are mandated to distribute at least 90% of their taxable income to shareholders as dividends. This results in higher yields since the savings on taxes benefit dividend payouts. Currently, ARCC boasts an attractive 9% dividend yield.

In the past 12 months, Ares Capital reported earnings of $2.39 per share, comfortably surpassing its quarterly dividend payment of 48 cents per share, leading to an 80% payout ratio—a strong figure in the BDC sector.

Additionally, Ares Capital not only offers a solid yield but has also established a track record of increasing its dividends, which is noteworthy among dividend-paying stocks.

Here’s a chart showcasing ARCC’s dividend payments, with the increase at the end of 2022 signifying a special dividend payout:

A Rare 9% Dividend That Grows

Source: Income Calendar

ARCC’s high and growing dividend makes it a perfect fit for tracking with Income Calendar. So, let’s put it to work.

Effortless Dividend Tracking with Income Calendar

Using Income Calendar, it’s possible to exclusively forecast when and how much dividends will be distributed over the next week, month, or year.

For example, if we invest $100,000 in ARCC, alongside two other high-yield funds—the Alerian MLP ETF (AMLP) with a 7.8% yield, and the AllianceBernstein Global High Income Fund (AWF) yielding 7.2%—here’s what we might expect:

The projected totals show dividend payments between $597.62 and $2,849.78, resulting in an annual total of $23,976.06 for an investment of $300,000. This estimation does not include potential dividend increases, which may result in an even higher payout.

Users receive detailed reports per stock, along with a month-by-month calendar displaying key dates related to earnings and dividend distributions.

For December, a traditionally strong month for dividends, here’s an overview of our expected payments:

This view provides insights into payment dates, ex-dividend dates, and upcoming earnings reports for your selected stocks, even accounting for market holidays.

Simplifying dividend tracking means less time spent on spreadsheets and more time enjoying life.

Additional features include real-time notifications when dividends are credited to your account, weekly summaries of expected payouts, and a yield-on-cost calculator to assess the true yield of your investments based on your purchase timelines.

Explore this advanced dividend planner and take the opportunity to trial it for yourself today.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.