Rising Above the Market Madness

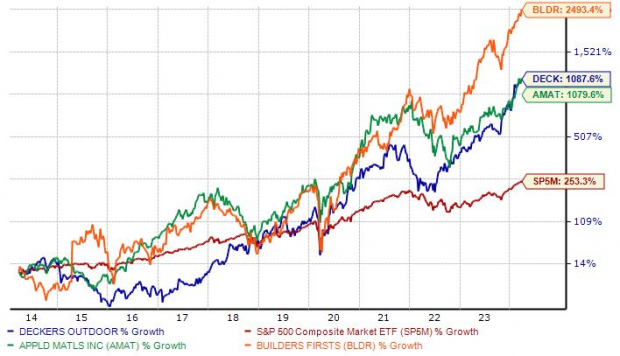

Investors are eternally on the prowl for equities that can deliver beyond market expectations. Over the past decade, a select few have not just exceeded but soared past the S&P 500, reaching an impressive 250% gain and an annualized return of 13.4%. Among these stellar performers are three outstanding companies: Deckers Outdoor DECK, Applied Materials AMAT, and Builders FirstSource BLDR.

A Peek at the Performers

Directing our gaze toward the upward trajectory of these companies, we observe a steady rise mirrored in the visuals below:

Image Source: Zacks Investment Research

Aside from their extraordinary performance, all three gems currently boast a favorable Zacks Rank, indicating a chorus of analysts raising their forecasts. Let’s dig deeper into each company’s story.

Shining Bright: Applied Materials

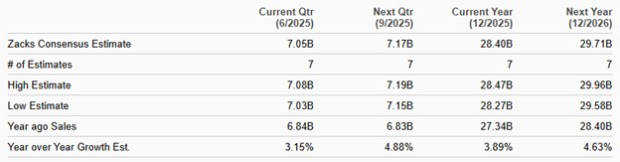

Applied Materials, the backbone of semiconductor manufacturing equipment, services, and software, has garnered a Zacks Rank #2 (Buy) as analysts ramp up their earnings projections.

Image Source: Zacks Investment Research

Not one to disappoint dividend enthusiasts, AMAT offers a 0.6% yield with a sustainable payout ratio, showcasing a robust dividend growth rate of 9% over the past five years.

Could CEO Gary Dickenson’s optimism be well-placed? In the latest earnings call, he highlighted, “Our leadership positions at key semiconductor inflections support continued outperformance…”

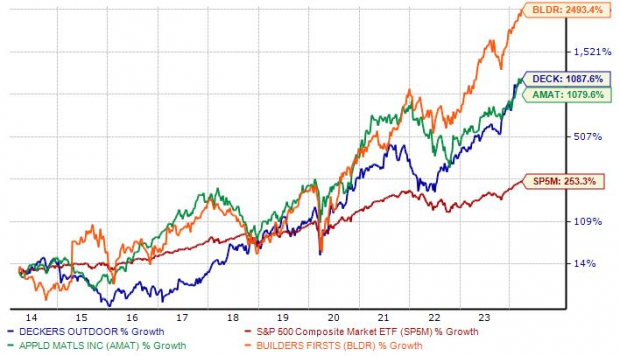

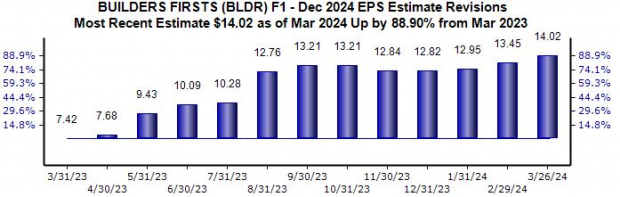

Builders FirstSource: Laying the Foundation for Success

Builders FirstSource, a supplier of building materials and construction services, has experienced a surge in earnings outlook, with the current fiscal year’s projections soaring 89% to $14.02 per share over the past year.

Image Source: Zacks Investment Research

Driven by operational efficiency, BLDR has seen margin expansion, with its gross margin hitting a record high of 35.2% in the trailing twelve months. The company’s robust cash flow of $1.9 billion in FY23 is a testament to its financial prowess.

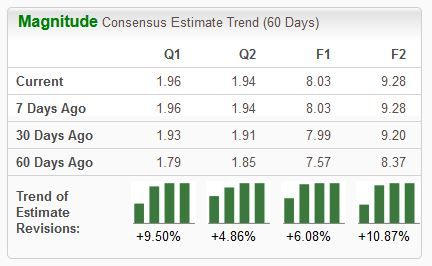

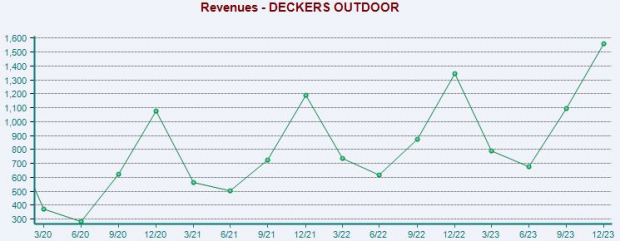

Deckers Outdoor: A Breath of Fresh Air

Deckers Outdoor, a sought-after Zacks Rank #1 (Strong Buy), spearheads the design and production of innovative footwear and accessories for the outdoor and lifestyle domains.

With promising growth prospects, particularly in its UGG and HOKA brands, Deckers Outdoor anticipates a 39% earnings surge in FY24 on the back of a 15% sales increase.

The stock’s ‘A’ Style Score for Growth speaks volumes about its forward momentum:

Image Source: Zacks Investment Research

Deckers Outdoor has consistently outperformed expectations, a trend marked by the upward-pointing green arrows in the visuals below. Notably, its recent earnings report showcased a 32% beat on EPS estimates and a sales figure surpassing expectations by nearly 9%.

The Finale

For stock enthusiasts seeking a bountiful harvest, these three stalwarts – Deckers Outdoor DECK, Applied Materials AMAT, and Builders FirstSource BLDR – have proven themselves as not just survivors but victors in the ever-evolving stock market. Additionally, with optimistic Zacks Ranks on their side, the forecast looks promising for these standout performers.