In the fast-paced world of technology investments, the NEOS Nasdaq 100 High Income ETF (QQQI) emerges as a shining beacon for investors seeking a blend of income and stability. The first quarter saw a surge of interest in the tech sector, and QQQI’s distinctive approach to Nasdaq exposure offers a potent mix for those navigating the turbulent waters of market volatility.

Monday witnessed a resurgence in tech stocks after a brief period of sluggish performance. The news of a potential iPhone license agreement between Apple and Google’s Gemini AI sparked a 5% surge in Alphabet’s stock, as reported by CNBC. Meanwhile, Nvidia’s GTC Conference, focused on artificial intelligence, ignited further gains for the company’s shares.

According to Jay Hatfield, the founder and CEO of Infracap, the markets are poised for a rebound as the earnings season looms on the horizon. Amidst this uncertainty, investors find themselves oscillating between tech stocks and other market segments, unsure of their next move.

Unlocking Potential: QQQI as a Nasdaq Income Enhancer

For investors looking to weather the storm of market unpredictability while maintaining exposure to the tech industry, the NEOS Nasdaq 100 High Income ETF (QQQI) emerges as a strategic choice. By investing in the Nasdaq-100 index, the fund aims to deliver robust monthly income with an added layer of tax efficiency.

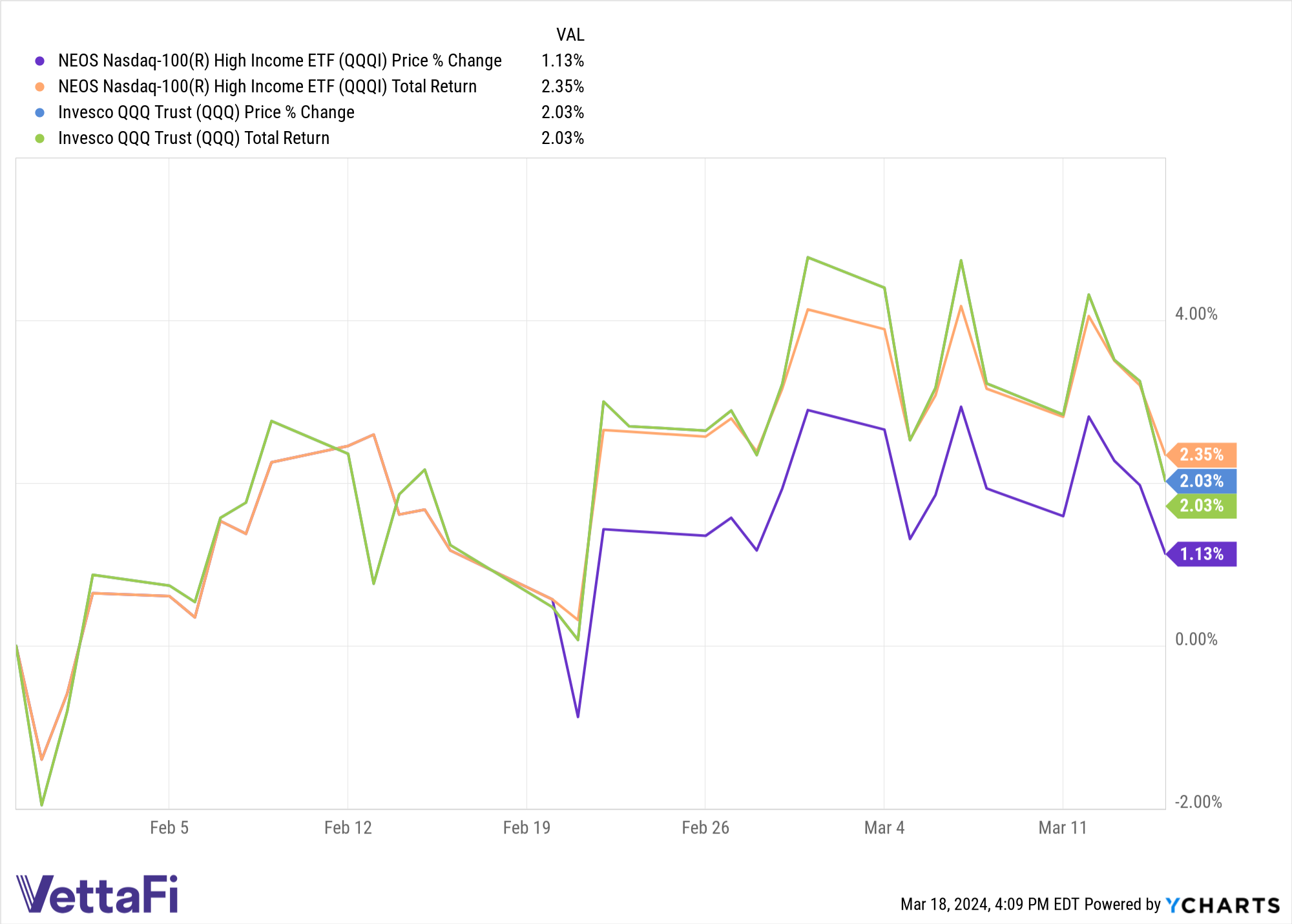

QQQI adopts an options strategy that leverages covered calls to generate premiums, accumulating over $30 million in net flows since its inception on January 30. These earned premiums act as a cushion, potentially safeguarding against market downturns.

The beauty of QQQI lies in its focus on tax efficiency, courtesy of the call options on the NDX that qualify as section 1256 contracts. This taxation mechanism, governed by IRS rules, ensures favorable treatment for investors. The year-end treatment of options as if sold at fair market value allows for a tax advantage, with any subsequent gains or losses regulated at a ratio of 60% long-term and 40% short-term.

NEOS prides itself on its ability to actively manage call options to seize gains during market upswings or mitigate losses in declining markets. Furthermore, the fund managers actively pursue tax-loss harvesting opportunities throughout the year, optimizing returns on both the call options and equity holdings.

The NEOS Nasdaq 100 High Income ETF (QQQI) boasts an expense ratio of 0.68%, making it an attractive option for income-focused investors.

For a deeper dive into news, insights, and analysis, explore the Tax-Efficient Income Channel.

The perspectives articulated in this piece reflect the author’s views and not necessarily those of Nasdaq, Inc.