Nvidia (NASDAQ: NVDA) – a titan whose shares have surged 1,800% in the past half-decade – owes its meteoric rise to a tight grip on the artificial intelligence (AI) chip realm. This supremacy has ushered in a golden era of earnings, with revenue and net income catapulting into the triple digits and notching historic highs in the latest financial quarter.

The burning question now lingering in the minds of investors worldwide is the longevity of this AI frenzy, which Nvidia has ridden to prosperity. The firm finds itself perched precariously on the precipice of relying substantially on the insatiable hunger for AI tools – be it chips, software, or platforms. A staggering 80% plus of Nvidia’s revenue originates from data center dealings in the most recent quarter. However, a singular statistic serves as a beacon of insight.

The AI Dialogue Shift

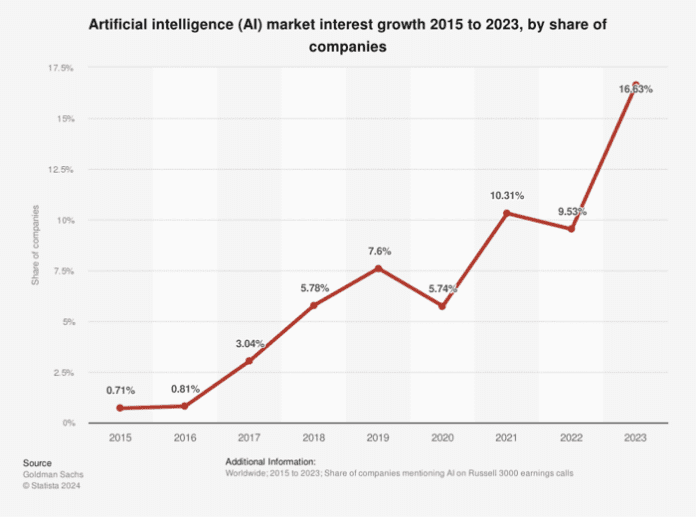

Not a decade ago, companies scarcely broached the topic of AI in their earnings dialogues – a crucial juncture to delineate significant ventures and long-range prospects. Fast forward to the present, and there’s been a seismic shift, as documented by Statista.

The image below vividly illustrates the transformation – in the Russell 3000 cohort, over 16% delved into AI during their earnings calls last year, up from the sub-10% mark the year prior. This astronomical surge marks a quantum leap from the feeble sub-1% figure registered in 2015.

Data source: Statista.

This upsurge hints at a positive trajectory – a near-consistent surge in AI discussions, yet the present scale of these conversations signifies a vast expanse for growth. The uptick in AI mentions portends that more corporations are likely initiating AI ventures, where Nvidia – the chip supremacy – stands to reap significant rewards.

This synchronicity indicates that Nvidia’s revenue expansion might still be in its incipient stage, offering a beacon of hope for further stock performance. For prospective investors, the message is clear – the time is ripe to dive into the shares of this AI juggernaut. Regardless of Nvidia’s future – whether it ascends further or undergoes a brief hiatus – the company’s trajectory alongside the burgeoning demand for AI commodities and amenities remains promising.

Is Investing $1,000 in Nvidia a Sound Move Right Now?

Prior to making a foray into Nvidia stocks, deliberate on this:

The Motley Fool Stock Advisor brain trust has pinpointed what they deem to be the 10 most promising stocks for investors to dunk their chips into, and Nvidia missed the cut. These chosen 10 equities harbor the potential to churn out monumental returns in the foreseeable future.

Stock Advisor extends investors a seamless roadmap to success, replete with portfolio construction counsel, periodic insights from analysts, and a bi-monthly duo of fresh stock recommendations. Since 2002, the Stock Advisor service has outstripped the S&P 500 yield by a triad*.

Discover the 10 stocks

*Stock Advisor returns as of April 4, 2024

Adria Cimino harbors no position in any of the above-mentioned stocks. The Motley Fool maneuvers holdings in and vouches for Nvidia. The Motley Fool stands by a disclosure policy.

The viewpoints and opinions articulated here represent the author’s stance and do not necessarily mirror those of Nasdaq, Inc.