Tech Giants Excel Amid AI Boom: Alphabet and Meta Brighten Prospects

Wall Street’s impressive rally from January 2023 to January 2025 is largely fueled by the flourishing technology sector, particularly driven by the incredible advancements in generative artificial intelligence (AI). As this AI narrative continues to evolve, underscored by the rapid growth of cloud computing and data centers, the market outlook remains positive.

According to a report by Bloomberg Intelligence, “The generative AI market is poised to explode, growing to $1.3 trillion over the next 10 years from a market size of just $40 billion in 2022.” With this potential growth, three major players, Alphabet Inc. GOOGL, Meta Platforms Inc. META, and Microsoft Corp. MSFT, stand out as promising candidates for investors.

Alphabet Inc. Shows Strong Growth

Alphabet is experiencing impressive growth in both cloud services and its search business. In the first quarter of 2025, GOOGL reported continued double-digit revenue growth from its search segment. Additionally, Alphabet has reached over 270 million paid subscriptions, driven by services like YouTube and Google One.

Google Cloud has solidified its status as the third-largest player in the competitive cloud services market, trailing only behind Amazon.com Inc.’s Amazon Web Services and Microsoft Azure. With the increasing demand for Large Language Models, GOOGL is making significant progress with its AI model, Gemini. Notably, Google Bard and the Search Generative Experience now utilize Gemini Pro, leading to improved user experiences.

In 2024, Vertex usage surged 20 times, demonstrating strong developer interest in innovations like Gemini Flash, Gemini 2.0, Imagen 3, and Veo. GOOGL has also introduced Gemma 3, consisting of lightweight, state-of-the-art models able to operate on a single GPU or Tensor Processing Unit (TPU). During the Cloud Next 2025 conference, Alphabet revealed Ironwood, its latest TPU, expected to launch later this year.

Furthermore, Google Cloud introduced its Cloud Wide Area Network, enabling enterprises to leverage its extensive global fiber infrastructure. Alphabet also premiered Willow, a new quantum chip, alongside Gemini 2.5, its most advanced reasoning model, with an optimized version, Gemini 2.5 Flash, designed for developers. The company holds a Zacks Rank #3 (Hold).

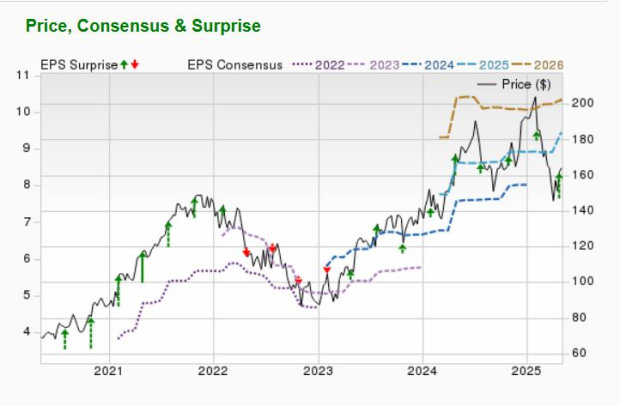

Earnings Estimates Favor GOOGL

For the first quarter of 2025, Alphabet reported earnings of $2.81 per share, exceeding the Zacks Consensus Estimate of $2.02. GOOGL’s quarterly revenues amounted to $76.49 billion, surpassing projections by 1.3%.

Looking ahead, the Zacks Consensus Estimate for 2025 anticipates revenues of $324.35 billion, reflecting a year-over-year improvement of 9.9%, with earnings per share projected at $9.43, indicating a 17.3% increase year-over-year. GOOGL carries a long-term (3-5 years) EPS growth rate of 15.6%, notably above the S&P 500’s long-term growth rate of 12.4%.

Valuation Insights for GOOGL Shares

Currently, Alphabet’s forward P/E ratio stands at 16.21, below the industry average of 18.88 and the S&P 500 average of 18.62. GOOGL boasts a return on equity of 34.54%, compared to 5.39% for the industry and 16.92% for the S&P 500 Index.

The short-term average price target among brokerage firms for GOOGL reflects a potential increase of 30.4% from its last closing price of $152.75, with the target range situated between $160 and $240. This suggests a maximum upside of 57.1%, posing no downside risks.

Image Source: Zacks Investment Research

Meta Platforms Inc. Capitalizes on User Engagement

Meta Platforms, holding a Zacks Rank #3, benefits from steady user growth across all regions, particularly in Asia Pacific. Enhanced engagement on platforms like Instagram, WhatsApp, Messenger, and Facebook drives growth.

The company’s AI-driven platform is improving ad delivery and increasing returns on ad spend for advertisers. Strong performances in sectors such as e-commerce, gaming, entertainment, and media further bolster Meta’s growth.

For the first quarter of 2025, Meta reported earnings of $6.43 per share, exceeding the Zacks Consensus Estimate by 23.2%. META’s revenues for the quarter reached $42.31 billion, up 2.6% from expectations, marking a 16.2% year-over-year increase.

Additionally, Meta is exploring innovative chat experiences within WhatsApp and Messenger, alongside visual creation tools for posts on Facebook and Instagram. The company is gradually integrating AI for video and multi-modal experiences to enhance user interaction.

On July 24, 2024, META launched the Llama 3 AI model, which, when powered by NVIDIA’s latest HDX H200 chip, shows a significant revenue potential—$7 generated for every $1 invested by an API provider over four years. This initiative aims to position Meta as a competitor to existing market leaders like OpenAI.

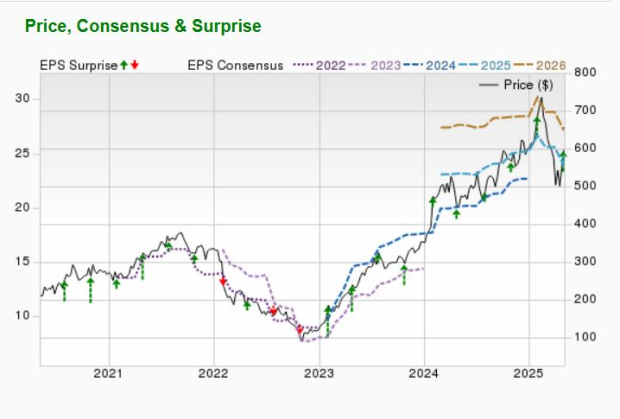

Positive Earnings Estimates for META

For the first quarter of 2025, Meta’s earnings reached $6.43 per share, surpassing the Zacks Consensus Estimate by 23.2%. Revenues of $42.31 billion exceeded expectations by 2.6%.

Looking forward, the Zacks Consensus Estimate for 2025 shows revenues of $185.8 billion, predicting a 13% year-over-year improvement, with earnings per share expected to be $25.52, a 7% annual rise. META’s long-term (3-5 years) EPS growth rate stands at 16.1%, exceeding the S&P 500’s rate of 12.4%.

Valuation of META Shares

Meta Platforms currently holds a forward P/E of 23.22, indicating a strong positioning within the market.

“`html

Meta and Microsoft Show Strong Financial Performance Amid Market Fluctuations

For the current financial year, Meta Platforms, Inc. (META) holds a forward price-to-earnings (P/E) ratio of 35.28X, which surpasses the industry average of 28.50X and the S&P 500’s 18.62X. The company boasts an impressive return on equity (ROE) of 38.69%, compared to just 0.38% for the industry and 16.92% for the S&P 500 Index.

Currently, brokerage firms have set a short-term average price target for Meta that suggests a potential increase of 16.3% from its last closing price of $592.49. The estimated target price ranges between $466 and $935, indicating a maximum upside of 57.8% alongside a possible downside of 21.3%.

Image Source: Zacks Investment Research

Microsoft Corp. Exceeds Earnings Expectations

Microsoft Corporation (MSFT) recently reported its third-quarter fiscal 2025 earnings, which exceeded expectations driven by a surge in its AI business and the adoption of its Copilot features, alongside robust growth in the Azure cloud infrastructure segment. Revenues from the Productivity and Business Processes sector rose due to strong uptake of Office 365 Commercial solutions, with average revenue per user (ARPU) growth led by E5 and M365 Copilot.

Additionally, Microsoft’s Intelligent Cloud revenues were significantly bolstered by the growth of Azure AI services and its Copilot business. The company’s focused strategy has improved results in non-AI services, aided by growth in enterprise customers and enhanced operational scale. Notably, Xbox content and services also saw revenue rises due to better-than-expected performance in both third-party and first-party offerings. Microsoft currently holds a Zacks Rank #2 (Buy).

Impressive Earnings Performance for MSFT

In the third quarter of fiscal 2025, Microsoft reported earnings of $3.46 per share, surpassing the Zacks Consensus Estimate by 8.1%. Revenues reached $70.06 billion, beating the consensus estimate by 2.5%.

For the full fiscal year 2025, the Zacks Consensus Estimate projects revenues of $278.6 billion, reflecting a year-over-year growth of 13.7%. Earnings per share are expected to be $13.30, an increase of 12.7% year over year. Microsoft is also ahead with a long-term (3-5 years) EPS growth rate of 14.8%, greater than the S&P 500’s long-term growth rate of 12.4%.

Microsoft Valuation Insights

Presently, Microsoft has a forward P/E of 32.74X for the current financial year, in contrast to 17.57X for the industry and 18.62X for the S&P 500. The company’s return on equity stands at 32.74%, surpassing the industry average of 17.57% and the S&P 500’s 16.92%.

The short-term average price target for Microsoft by brokerage firms indicates a potential increase of 15.8% from its last closing price of $438.73, with target prices ranging from $448 to $626. This forecast suggests a maximum upside of 42.7% and a stable outlook without downside risk.

Image Source: Zacks Investment Research

Semiconductor Industry Insights

With ongoing advancements in earnings growth and an expanding customer base, the semiconductor industry is well-positioned to meet the demanding needs of Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is anticipated to rise significantly from $452 billion in 2021 to $803 billion by 2028.

In summary, both Meta and Microsoft demonstrate solid financials in a fluctuating market, backed by strong growth in key sectors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`