Spotlight on Oversold Stocks in Financials: A Buying Opportunity?

The current market landscape reveals several financial sector stocks that have been classified as oversold. Investors may view these stocks as potential bargains due to their low valuations.

The Relative Strength Index (RSI) serves as a key momentum indicator. It assesses a stock’s performance by comparing its price increases to its decreases. An RSI below 30 generally signals that a stock is oversold, hinting at a possible rebound, according to Benzinga Pro.

Below is a summary of significant oversold stocks within the financials sector, with RSI values close to or below 30.

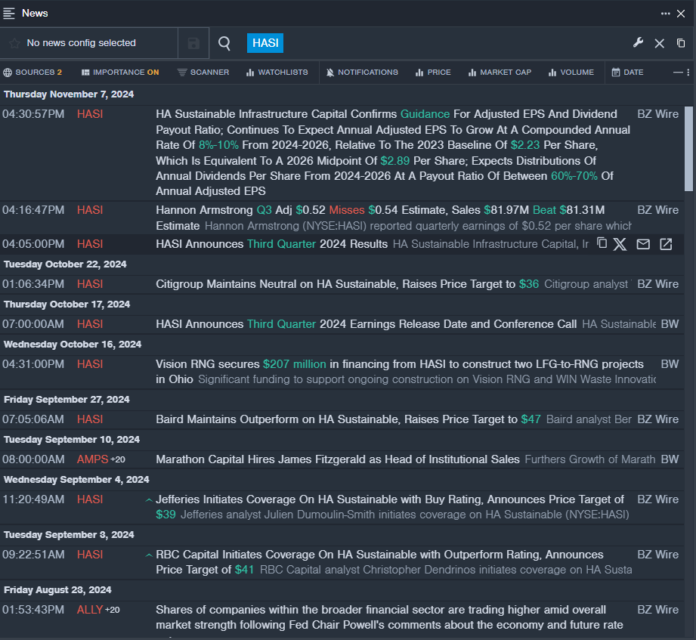

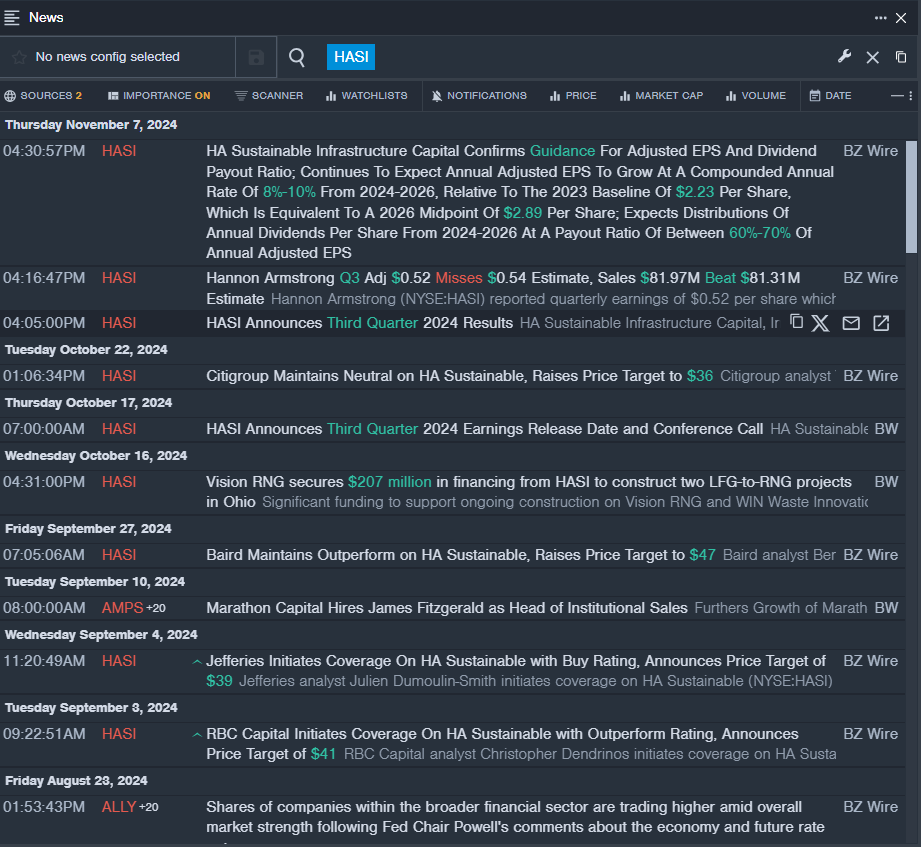

HA Sustainable Infrastructure Capital Inc HASI

- On Nov. 7, Hannon Armstrong released mixed third-quarter results. “Our Q3 and 2024 YTD results underscore the resiliency and consistency of our business,” stated Jeffrey A. Lipson, president and CEO of HASI. Despite these affirmations, the stock has seen a drop of approximately 22% over the last month, hitting a 52-week low of $21.77.

- RSI Value: 25.88

- HASI Price Action: Shares closed at $27.22 on Friday after a decline of 1.2%.

- Benzinga Pro’s newsfeed provided updates on HASI’s latest developments.

Paysafe Ltd PSFE

- On Nov. 13, Paysafe’s announced third-quarter adjusted earnings of 51 cents per share, which exceeded analyst expectations of 2 cents. Revenue grew to $427.10 million, an 8% increase year over year, surpassing the forecast of $423.096 million. CEO Bruce Lowthers remarked, “Revenue growth continues to be strong this year,” highlighting the company’s strategic focus. In recent days, the stock has declined about 29%, with a 52-week low of $10.05.

- RSI Value: 29.82

- PSFE Price Action: Shares fell 2.3% to close at $17.67 on Friday.

- Benzinga Pro’s charting tool assisted in tracking PSFE’s performance trends.

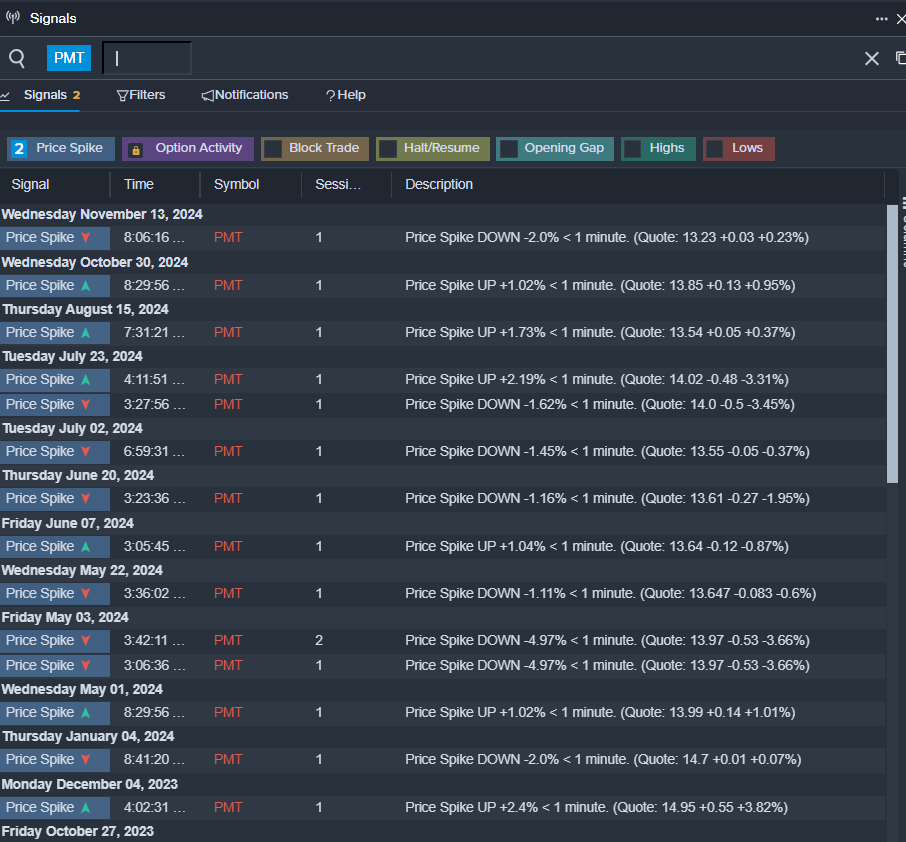

PennyMac Mortgage Investment Trust PMT

- On Oct. 22, PennyMac Mortgage reported varied quarterly results. Chairman and CEO David Spector noted, “PennyMac Financial reported outstanding results in the third quarter, with an annualized operating return on equity of 20 percent.” However, the stock has decreased by around 7% over the last month, reaching a 52-week low of $12.81.

- RSI Value: 28.91

- PMT Price Action: Shares closed at $13.06 on Friday.

- Benzinga Pro’s signals feature indicated possible upward movement for PMT shares.

Read More:

Market News and Data brought to you by Benzinga APIs