Investing in Energy: Opportunities in Renewable and Fossil Fuel Stocks

The demand for energy is set to increase significantly in the future. Influenced by technological advancements, population growth, and a rising middle class, this need continues to grow. While renewable resources are expected to provide much of this new energy capacity, fossil fuels will remain essential in supporting the global economy.

Investors have several options to benefit from the increasing energy demand. Brookfield Renewable (NYSE: BEP)(NYSE: BEPC), Kinder Morgan (NYSE: KMI), and Chevron (NYSE: CVX) are highlighted by contributors from Fool.com as leading investment choices. These energy stocks feature increasing dividends, providing investors with a method to capitalize on the growing energy market.

Strong Dividends with Brookfield Renewable

Reuben Gregg Brewer (Brookfield Renewable): Investors who value dividends will find Brookfield Renewable appealing. The company offers two types of shares: a limited partnership yielding 5.3% and a corporate share yielding 4.5%.

Both share classes represent the same underlying company, with the yield difference attributed to the popularity of each structure. But what do these shares represent?

Managed by Brookfield Asset Management, Brookfield Renewable boasts a diverse portfolio of renewable energy sources, including hydroelectric, solar, wind, and battery storage. This makes it a comprehensive option for exposure to various clean energy segments. The global spread of its assets also ensures geographical diversification.

Brookfield takes an active approach, purchasing undervalued assets, enhancing their worth through investment, and selling them when prices are favorable. Proceeds from these sales are reinvested into new opportunities.

This operational strategy distinguishes Brookfield Renewable from typical energy firms, positioning it more like a clean energy hedge fund. As demand for clean energy surges, Brookfield Renewable appears poised for substantial growth.

Dividend investors who are open to exploring beyond conventional options may find Brookfield Renewable worth investigating. Historically, it has consistently raised its dividend at an impressive annualized rate of about 6% over the past 20 years.

Kinder Morgan’s Expanding Natural Gas Business

Matt DiLallo (Kinder Morgan): The demand for natural gas in the United States is projected to grow significantly over the next decade. Analysts anticipate an increase of 20 billion cubic feet per day (Bcf/d) by 2030, up from last year’s level of 108 Bcf/d.

Factors contributing to this demand include rising exports (LNG and exports to Mexico) and growing needs in power generation and industries. Furthermore, artificial intelligence (AI) data centers could add considerable demand, with predictions estimating an increase of 3 Bcf/d to 6 Bcf/d by 2030, and even more potential gains.

Kinder Morgan is well-positioned to take advantage of this market opportunity. As a leader in natural gas infrastructure, it currently transports 40% of the country’s gas production and controls 15% of its storage capacity. The company is actively securing projects to boost this capacity.

For instance, Kinder Morgan and its partner recently approved a $3 billion project, South System Expansion 4, which will add 1.2 Bcf/d of capacity in the Southeast, projected to be operational by 2028. Additionally, the company is expanding its Gulf Coast Express pipeline by 570 million cubic feet per day for a total cost of $455 million, expected to go into service by mid-2026.

With numerous projects in development, Kinder Morgan is optimistic about sustaining its cash flows over the long term, allowing it to continue increasing its nearly 5% dividend yield, which has seen seven years of growth.

Given its strong position in the market and its commitment to returning value to shareholders, Kinder Morgan represents a solid investment opportunity in the energy sector.

Chevron: A Leader in Oil Dividends

Neha Chamaria (Chevron): Chevron’s history of dividend payments is among the best in the energy industry. Unlike many oil and gas companies, Chevron has raised its dividend for more than 35 consecutive years, including an 8% increase announced earlier this year.

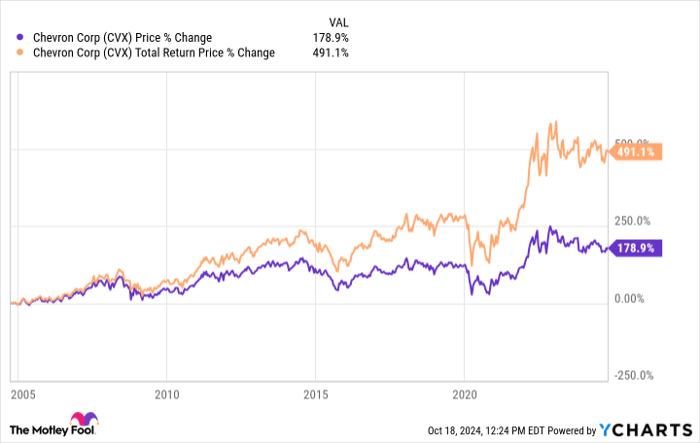

This impressive track record is bolstered by a faster compound annual growth rate in dividends compared to rivals like ExxonMobil over the past five years. Additionally, the compounding effect of reinvested dividends has significantly boosted shareholder returns.

CVX data by YCharts.

Chevron’s focus on increasing its free cash flows (FCF) suggests that shareholders can expect consistent dividend growth. Management anticipates an average annual FCF increase of over 10% by 2027, assuming a Brent crude oil price of $60 per barrel.

With its proven track record and commitment to returning value to investors, Chevron remains a strong choice for dividend-seeking investors in the energy sector.

Chevron’s Potential Growth Surge: The Impact of a Hess Acquisition

Chevron’s free cash flow (FCF) is poised for stronger growth following the Federal Trade Commission’s approval of its acquisition of Hess. Chevron anticipates that this deal will lead to quicker and sustained growth in both production and FCF, exceeding its current five-year projections.

This potential upswing in FCF also hints at larger dividend increases for Chevron’s shareholders. With a current yield of 4.3% and promising growth prospects, the company stands out as a strong choice for energy dividend investments right now.

Is $1,000 Investment in Brookfield Renewable Partners Wise Today?

Before considering an investment in Brookfield Renewable Partners, take note:

The analyst team at Motley Fool Stock Advisor recently revealed their selection of the 10 best stocks for current investors, and Brookfield Renewable Partners did not make the list. The stocks included in their top picks are expected to yield impressive returns in the upcoming years.

For context, think back to April 15, 2005, when Nvidia first appeared on this list. If you had invested $1,000 then, your investment would be worth an astonishing $845,679 today!*

Stock Advisor is designed to assist investors in building a successful portfolio by offering clear guidance, regular analyst updates, and two new stock recommendations each month. Since 2002, this service has achieved returns that more than quadruple those of the S&P 500.*

View the 10 recommended stocks »

*Stock Advisor returns as of October 14, 2024

Matt DiLallo holds positions in Brookfield Asset Management, Brookfield Renewable, Brookfield Renewable Partners, Chevron, and Kinder Morgan. Neha Chamaria and Reuben Gregg Brewer do not hold positions in any mentioned stocks. The Motley Fool has positions in and recommends Brookfield Asset Management, Brookfield Renewable, Chevron, and Kinder Morgan. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool follows a disclosure policy.

The opinions expressed here are those of the author and do not necessarily reflect Nasdaq, Inc.