Top Growth Stocks to Consider for Long-Term Investment

The economy and stock market are known for their fluctuations. Long-term investing allows for a broader perspective, helping investors focus on major trends that influence stock performance over time.

In the past decade, industries such as cloud computing, e-commerce, and digital advertising have shown significant growth. While these sectors still hold potential, emerging fields like artificial intelligence (AI) are shaping future opportunities.

The innovative companies driving these advancements have consistently rewarded their shareholders and possess the fundamentals needed for continued success. Here are three outstanding growth stocks to consider purchasing and holding for the long haul.

1. Nvidia

Known for its AI chips, Nvidia (NASDAQ: NVDA) has become a leader in the AI market since early 2023. With a strong foundation in graphics processing units (GPUs), Nvidia has virtually cornered the market for AI model training, as cloud computing companies have invested billions in its H100 chips to gain the necessary computational power for AI applications.

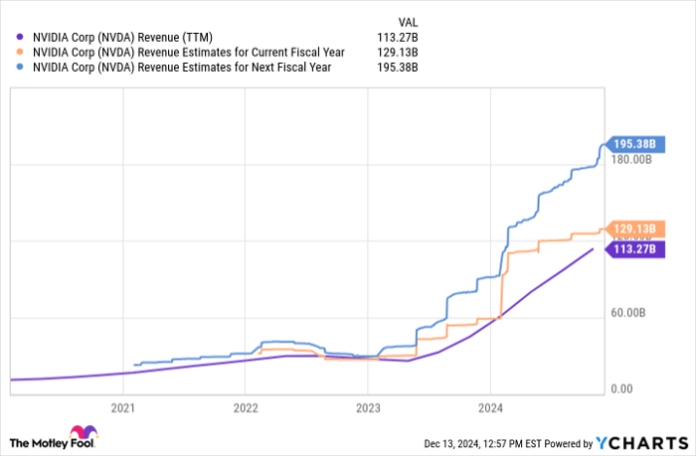

The rapid growth of AI technology continues to drive demand for Nvidia’s next-generation chips. Analysts predict the company will generate nearly $200 billion in revenue in the next fiscal year:

NVDA Revenue (TTM) data by YCharts

Expected earnings growth for Nvidia stands at around 20% annually over the next three to five years. With a forward price-to-earnings (P/E) ratio of 47, the valuation seems reasonable for such a key player in the emerging AI landscape. Investors may want to consider buying Nvidia now and adding to their positions as opportunities arise.

2. Alphabet

As one of the world’s most recognized brands, Google dominates internet searches to the point where regulators deemed it a monopoly earlier this year. This fact alone positions its parent company, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), as a stock worth considering. Alphabet’s portfolio extends beyond search; it includes YouTube, Google Cloud, and interests in autonomous driving, quantum computing, and smartphone software.

Alphabet is competing fiercely for leadership in AI. Its advantages include a well-established cloud business (Google Cloud), the AI model Gemini, and vast amounts of first-party data that are crucial for training AI systems. With $93 billion in cash and $55 billion in free cash flow over the past year, Alphabet is financially equipped to invest heavily in innovation:

GOOGL Free Cash Flow data by YCharts

Considering its existing operations and potential in AI, analysts predict Alphabet’s earnings will grow at an annual average of nearly 18% over the next three to five years. With a current P/E ratio of just 24, it represents an attractive investment opportunity.

3. Amazon

Amazon (NASDAQ: AMZN) has evolved from an online bookstore to a global e-commerce giant, controlling roughly 40% of all e-commerce in the United States. This remarkable growth story is accompanied by its ability to adapt, as Amazon consistently ventures into new markets.

Amazon’s Prime subscription service grants it access to over 200 million customers, creating additional avenues in video streaming, grocery, and healthcare sectors.

Additionally, the company operates the largest cloud computing platform, a primary source of its profits. As businesses look to deploy AI applications, Amazon’s cloud services become increasingly vital. Its versatility positions Amazon as a robust growth stock.

AMZN Revenue Estimates for Current Fiscal Year data by YCharts

Looking ahead, Amazon’s core businesses show promise, as e-commerce still represents less than one-fifth of total retail spending in the U.S. With recent ventures such as online vehicle sales, Amazon proves its intent to target diverse consumer markets.

Analysts expect Amazon’s earnings to increase by an average of 28% over the next three to five years. The stock, trading at a forward P/E of 44, remains a solid investment choice.

A New Opportunity Awaits

Have you ever felt like you missed out on buying successful stocks? You may want to pay attention now.

Occasionally, our team of experts issues a “Double Down” stock recommendation for companies they believe are poised for growth. If you worry you missed your chance to invest, the time to act may be now. The historical success rates are persuasive:

- Nvidia: If you invested $1,000 when we recommended it in 2009, you’d have $348,112!*

- Apple: If you invested $1,000 when we recommended it in 2008, you’d have $46,992!*

- Netflix: If you invested $1,000 when we recommended it in 2004, you’d have $495,539!*

Currently, we are excited to announce “Double Down” alerts for three exceptional companies, presenting a chance that may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.