“`html

Three Promising Stocks for Long-Term Investors

Finding a solid growth stock isn’t too hard, but selecting one to hold for a decade can be challenging. Some growth companies lack the proven potential to justify a long-term investment. Nevertheless, if you can accept the risks, there are noteworthy options available. Here are three stocks that could deliver impressive returns for those willing to hold them for at least ten years.

Iovance Biotherapeutics: A Risky Yet Rewarding Investment

Investing in pharmaceutical companies can be complex. Jumping in too soon might lead to disappointment if a promising drug fails. Conversely, waiting too long could mean missing significant gains. For those willing to take that chance, Iovance Biotherapeutics (NASDAQ: IOVA) presents an intriguing prospect, especially as its shares are still down over 80% from their peak in early 2021.

Such declines aren’t unusual for younger biopharma firms. Iovance’s stock initially rose sharply when its lead drug began to show promise in trials during 2019 and 2020. Investors may have gotten overly excited, as the first regulatory approval for its cancer treatment, Amtagvi, only arrived in February of this year. While the market reacted positively to this news, much of the early enthusiasm had faded, and subsequent gains have eroded.

This current dip, however, could be an opportunity for savvy investors.

Amtagvi may be FDA-approved only for specific solid tumors, but it has the potential to treat a wider array of cancers. It’s currently undergoing trials for 12 additional applications, with several advancing to promising late-stage phases.

Iovance is already achieving success with Amtagvi. In the last quarter, the company reported $58.6 million in revenue, up from an initial $31.1 million in Q2. Forecasts for the year suggest full-year revenue could reach about $160 million, with expectations for growth to between $450 million and $475 million in the next year. Analysts anticipate revenue surpassing $700 million by 2026, and GlobalData estimates that annual sales of Amtagvi could exceed $1 billion by 2030.

Potential investors should be aware of the inherent risks. The company is still incurring substantial losses despite the robust demand for its therapy. Early losses are not unusual in the biopharma sector, but it is uncertain when Iovance will transition to profitability; analysts project this might not occur until at least 2027. Investors should weigh these factors carefully when contemplating their investment size.

Thus, patience will be crucial as Iovance strives to capitalize on its opportunities.

Palo Alto Networks: A Leader in Cybersecurity

Cybersecurity is becoming increasingly important as digital threats rise. According to cybersecurity firm Check Point Software, weekly cyberattacks surged by a staggering 75% in the third quarter compared to the previous year, up from a 30% increase in Q2. This challenge isn’t going away soon, and Palo Alto Networks (NASDAQ: PANW) is well-positioned to tackle it.

Palo Alto assists organizations in safeguarding against cybercrimes and disruptions. Its services range from threat detection to malware defense, phishing protection, and secure remote access. With user-friendly solutions, it meets a wide variety of cybersecurity needs efficiently.

In the latest assessments by market research firm Gartner, Palo Alto once again earned recognition as a leader in the endpoint protection platform market and maintained its status for the eleventh consecutive year in the network firewall segment. This consistent recognition underscores the firm’s solid capabilities.

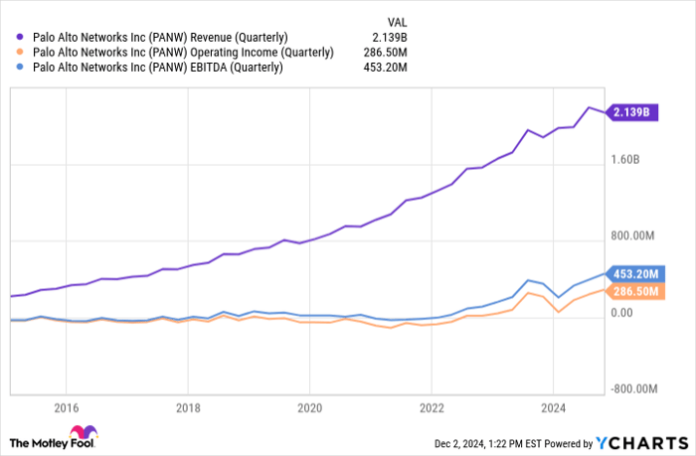

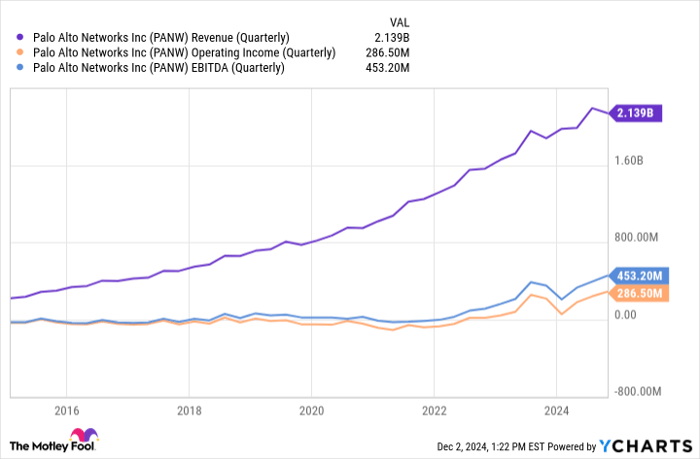

Palo Alto’s financial performance reflects its effectiveness. Its revenue has consistently grown in quarterly reports for over a decade, with operating income and EBITDA also showing steady increases.

Data by YCharts.

Remarkably, Palo Alto Networks’ profit margins are also on the rise. The scalability of its software means that whether it serves 100 users or 1,000, the production costs remain largely the same. Additionally, the subscription-based model contributes to stable, recurring income.

With the cybersecurity sector expanding, analysts predict Palo Alto will achieve 14% revenue growth in fiscal 2025, rising to nearly 16% the following year.

Wolfspeed: Innovating with Silicon Carbide

Lastly, consider adding Wolfspeed (NYSE: WOLF) to your investment portfolio for long-term growth potential.

Unless you’re an electrical engineer, the term “silicon carbide” might not resonate. However, this technology is likely to play a larger role in the future, positioning Wolfspeed for expansion.

Put simply, most electrically powered devices rely on silicon components. Historically, standard silicon has been sufficient for many applications. However, with advancements in technology, it now struggles to meet the power efficiency and voltage demands of advanced equipment, like electric vehicles and data center systems.

This is where Wolfspeed comes in. The company has perfected the technique of combining carbon with silicon to enhance its efficiency and ability to manage higher electrical loads.

While silicon carbide can be used in various applications, its current most significant role is in heavy machinery and industry. Wolfspeed’s technology is increasingly integrated into electric vehicles, improving powertrains and charging systems by reducing power loss by 80% compared to conventional systems. Its applications are also expanding to construction equipment, agricultural machinery, and locomotives.

As these industries continue to evolve, Wolfspeed’s advancements in silicon carbide might become even more valuable, presenting an opportunity for long-term investors.

“`

Wolfspeed’s Promising Future in Silicon Carbide Technology

Silicon Carbide’s Efficiency and Current Challenges

Wolfspeed specializes in silicon carbide, a material commonly found in chips and components for HVAC systems and data center power supplies. Its products can achieve energy efficiency levels of up to 99%, while being half the size of standard silicon offerings.

Mixed Financial Performance Creates Investor Frustration

Despite these advantages, some customers remain hesitant to fully embrace Wolfspeed’s solutions. The company saw a 24% revenue increase in fiscal 2023, which ended in June 2023. However, growth stagnated in fiscal 2024, continuing a trend of inconsistent revenue that has troubled investors for over a decade. Currently, Wolfspeed is facing substantial financial losses. Analysts do not anticipate a return to profitability until fiscal 2027, when a new generation of electric vehicles is expected to launch, alongside the resolution of hefty restructuring costs and significant capital expenditures. This ongoing financial turbulence has made the stock’s performance quite unpredictable for shareholders.

Potential Growth Amidst Continued Volatility

For those willing to embrace the current volatility, Wolfspeed may hold long-term promise. Analysts have projected a 44% increase in sales for fiscal 2026, which the company believes could lead to breakeven operating cash flow. Furthermore, Wolfspeed’s management is optimistic about achieving EBITDA profitability in the latter part of this year, setting the stage for a return to overall profitability by fiscal 2027.

Long-Term Outlook for Silicon Carbide Market

Looking ahead, Global Market Insights forecasts that the silicon carbide market is likely to expand at a compound annual growth rate exceeding 30% through 2032. Notably, most of this growth is expected to occur in the latter half of this period as silicon carbide technology becomes more widely adopted in the industry.

Investors Should Weigh Risks Versus Rewards

Investing in Wolfspeed involves accepting higher than average risks in the short term. Success will depend largely on how effectively the company navigates toward its long-term potential, but the market is likely to begin rewarding Wolfspeed for its progress in profitability as time goes on.

Consider Your Investment Options

Before making a decision about investing in Palo Alto Networks, review the following:

The Motley Fool Stock Advisor analyst team has recently identified what they consider to be the 10 best stocks to buy now, excluding Palo Alto Networks. Analysts believe these selections could yield substantial returns over subsequent years.

Take for instance when Nvidia was recommended on April 15, 2005. Investing $1,000 at that time would have grown to $872,947!*

Stock Advisor offers a straightforward strategy for success, featuring guidance on portfolio building, regular analytical updates, and two new stock picks each month. The service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024

James Brumley is not affiliated with any of the stocks mentioned. The Motley Fool holds positions in and recommends both Iovance Biotherapeutics and Wolfspeed, and it also recommends Gartner and Palo Alto Networks. The Motley Fool has its own disclosure policy.

The opinions expressed in this article are solely those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.