Energy and Financial Stocks Struggle as Market Sees Mixed Performance

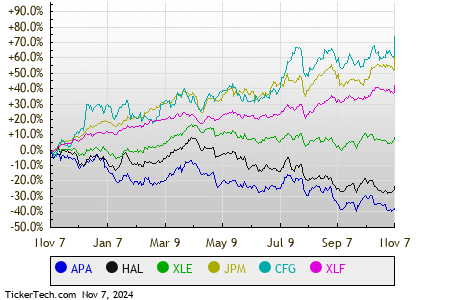

On Thursday afternoon, energy stocks lagged, showing a 0.9% decline. APA Corp (Symbol: APA) and Halliburton Company (Symbol: HAL) were notable underperformers, with losses of 9.1% and 3.8%, respectively. The Energy Select Sector SPDR ETF (Symbol: XLE), which tracks this sector, dropped 0.4% today but remains up 13.74% year-to-date. In comparison, APA Corp’s year-to-date performance reflects a 34.55% decline, while Halliburton is down 17.39%. Together, these two companies make up about 2.9% of XLE’s holdings.

Financial Sector Also Sees Declines

Next, the Financial sector posted a 0.6% loss. Among significant financial stocks, JPMorgan Chase & Co (Symbol: JPM) and Citizens Financial Group Inc (Symbol: CFG) experienced losses of 3.9% and 3.6%, respectively. The Financial Select Sector SPDR ETF (XLF), which tracks financial stocks, fell 1.3% in midday trading but shows a strong year-to-date gain of 31.39%. Year-to-date, JPMorgan Chase & Co is up 42.31%, and Citizens Financial Group Inc has increased by 45.56%. Collectively, these two constitute around 7.1% of XLF’s holdings.

A quick look at stock performance over the past twelve months provides further insights into these movements, represented in a chart below:

S&P 500 Sector Snapshot

This afternoon’s trading also revealed varying performances across the S&P 500 sectors, with four sectors appreciating while three faced declines. The detailed snapshot of performance is available in the table below:

| Sector | % Change |

|---|---|

| Technology & Communications | +1.0% |

| Services | +0.4% |

| Healthcare | +0.4% |

| Consumer Products | +0.2% |

| Utilities | -0.0% |

| Materials | 0.0% |

| Industrial | -0.1% |

| Financial | -0.6% |

| Energy | -0.9% |

![]() 25 Dividend Giants Widely Held By ETFs

25 Dividend Giants Widely Held By ETFs

Also see:

• Analyst Least Favorites

• ARAY Historical Stock Prices

• NSTB Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.