Why Now Could Be the Right Time to Invest in Celsius Stock

2024 has been a fantastic year for high-growth stocks, with the Nasdaq-100 Index gaining 23.4% year to date. Many stocks have surged over 100%. Yet, Celsius Holdings (NASDAQ: CELH) is an exception, down 70% from the highs earlier this year due to a significant sales slowdown.

The Rise of Celsius in the Energy Drink Market

Over the last decade, Celsius has changed the energy drink landscape by promoting sugar-free products. Their beverages, enhanced with vitamins, are positioned as healthier alternatives compared to traditional energy drinks. This strategy has helped the brand attract gym enthusiasts, women, and young consumers, while expanding overall market share. Celsius now competes with major players like Red Bull, as well as coffee, soda, and fruit juices.

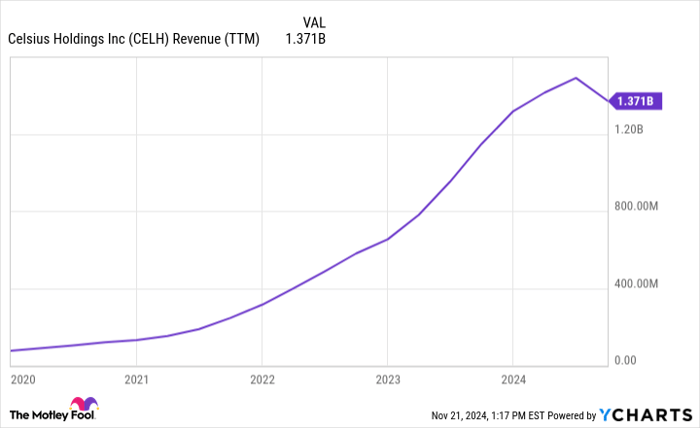

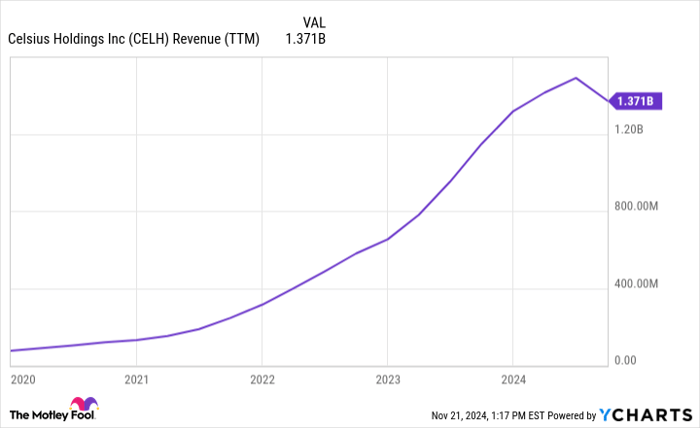

Celsius has enjoyed impressive growth, reporting $1.37 billion in revenue in the past 12 months, up from less than $100 million five years ago. Management claims it has captured approximately 11.8% of the U.S. energy drink market, pulling customers from established brands like Monster Beverage and Red Bull. Recently, the company has begun expanding internationally, entering markets in Canada, the U.K., Australia, and France, with a 37% year-over-year increase in international revenue last quarter, reaching $18.6 million.

Difficulties with Distribution

Despite these strong growth metrics, Celsius stock has dropped 70% from earlier highs. This decline is primarily due to recent revenue figures that have raised concerns about future performance.

The root of the issue lies in a distribution deal Celsius made with PepsiCo in 2022. This agreement allows Celsius to utilize Pepsi’s extensive distribution network in the U.S. and internationally. Initially, Pepsi ordered large quantities of Celsius to meet rising demand. However, in recent quarters, they found that they had over-ordered, leading to a normalization of inventory levels. This adjustment resulted in a 33% year-over-year drop in Celsius’ revenue in the third quarter.

While this revenue dip may seem alarming, consumer demand for Celsius remains strong. The company maintains its market share of over 10% in the energy drink segment, with year-to-date retail sales surpassing all of 2022’s total. Notably, orders to Costco rose 15% in the third quarter, and orders to Amazon increased by 21%. This data illustrates that the recent revenue decline is likely to stabilize, with market conditions expected to improve by 2025 when Pepsi normalizes its order quantities.

CELH Revenue (TTM) data by YCharts

Evaluating Celsius as an Investment

A 33% drop in revenue can be concerning, leading many investors to shy away from Celsius stock. However, for those who believe in its long-term potential, a price below $30 appears attractive.

In the past five years, Celsius has experienced remarkable revenue growth, increasing by 1,720%. While growth may slow in the coming years, there is still potential for steady expansion. Given its ability to gain market share, overall category growth, and pricing strategies, it’s plausible for Celsius to double its revenue to approximately $2.75 billion within five years. Using Monster Beverage as a benchmark, Celsius could attain 25% profit margins, leading to roughly $690 million in earnings by the same timeframe. This would result in a price-to-earnings (P/E) ratio below 10, based on its current market cap of $6.6 billion.

I anticipate the stock will command a higher P/E ratio in five years, making it an appealing buy-the-dip option as Celsius looks to return to double-digit revenue growth by 2025.

Should You Consider Investing in Celsius Now?

Before purchasing Celsius shares, keep the following in mind:

The Motley Fool Stock Advisor team recently highlighted their top 10 stock picks, and Celsius was not among them. The selected stocks have the potential to yield significant returns in the coming years.

For perspective, when Nvidia was featured on this list on April 15, 2005, a $1,000 investment would now be worth $869,885.*

Stock Advisor offers a straightforward guide for success, including portfolio-building advice, regular analyst updates, and two new stock recommendations each month. The Stock Advisor service has outperformed the S&P 500 by more than four times since 2002.*

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has investments in Amazon. The Motley Fool has positions in and recommends Amazon, Celsius, Costco Wholesale, and Monster Beverage. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.