The landscape of telecom stocks offers a tantalizing opportunity for shrewd investors seeking a balance between dividends and future growth. In an era where high interest rates are threatened, the allure of the stock market for robust yields beckons once more. American telecom companies are currently facing multifaceted pressures, creating an environment ripe for scrutiny and discovery.

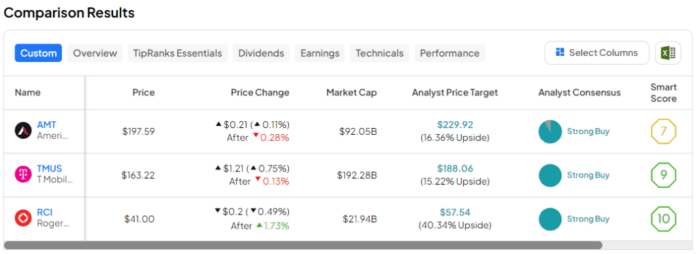

With the impending decline in rates and the concomitant alleviation of consumer pressures, companies that are propelling the 5G revolution forward are poised to ascend once more. Thus, with a focus on value investing, we delve into three highly rated telecom stocks using TipRanks’ Comparison Tool.

When it comes to standout performance in the telecom sector, T-Mobile emerges as a beacon of success. Over the past five years, T-Mobile has outstripped its legacy competitors by a staggering 135%, a rare feat in the industry. The secret to T-Mobile’s success lies in its superior networks, competitive pricing strategies, and innovative promotional tactics.

The relentless pursuit of expanding its 5G wireless coverage places T-Mobile squarely in the lead, with no imminent threat to its dominance visible on the horizon. The company’s strategic investments over decades have culminated in a formidable competitive moat, drawing the admiration and bullish sentiment of Wall Street analysts.

Moving forward, T-Mobile is strategically aligning itself to cater to the burgeoning market for the next wave of wireless wearable devices. By forging partnerships that harness the power of 5G and spatial computing, T-Mobile is poised not just as an enabler but as a significant beneficiary of the Metaverse’s ascent.

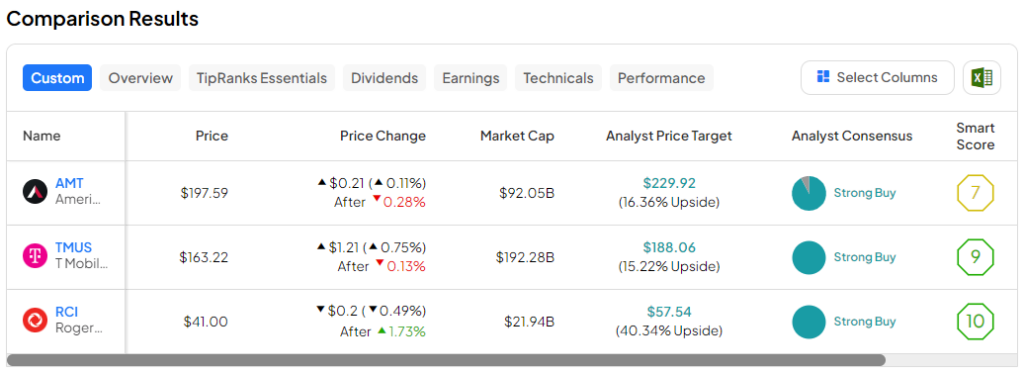

Unlocking the Potential of TMUS Stock

TMUS stock is a Strong Buy, with 17 analysts unanimously recommending a Buy in the past three months. An average price target of $186.73 suggests a promising upside potential of 14.4%.

Rogers Communications (NYSE:RCI)

Rogers Communications, a Canadian telecom entity, also garners a Strong Buy rating from analysts. While not as prominently recognized as its American counterparts, Rogers has struggled to keep pace in recent years.

Despite a respectable dividend yield (currently at 3.62%), Rogers’ shares have languished over both the short and long terms. The lackluster performance has left investors yearning for more, even with the optimistic sentiments echoed by most analysts.

However, the merger with Shaw Communications has injected a sense of optimism into the stock. This strategic move bolstered Rogers’ market position, especially in Western Canada, presenting a potential boon for investors despite regulatory concerns.

Analysts foresee synergies and operational efficiencies stemming from the merger as significant drivers of future growth. With the possibility of cost savings materializing sooner than anticipated, Rogers may be on the brink of a renaissance, positioning itself as a candidate for a value play.

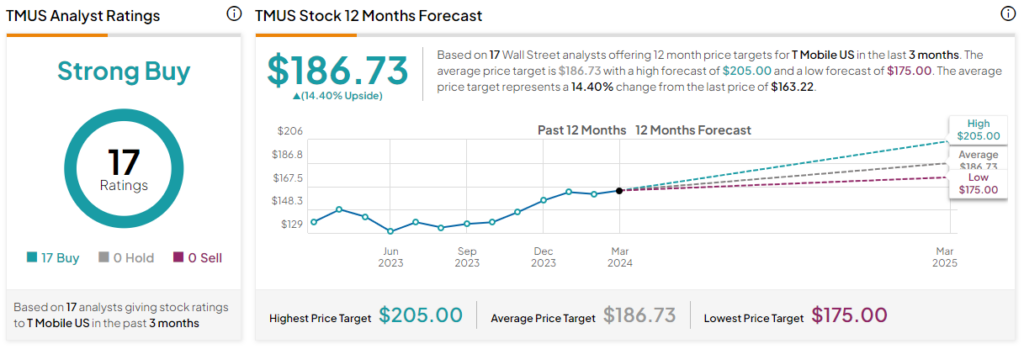

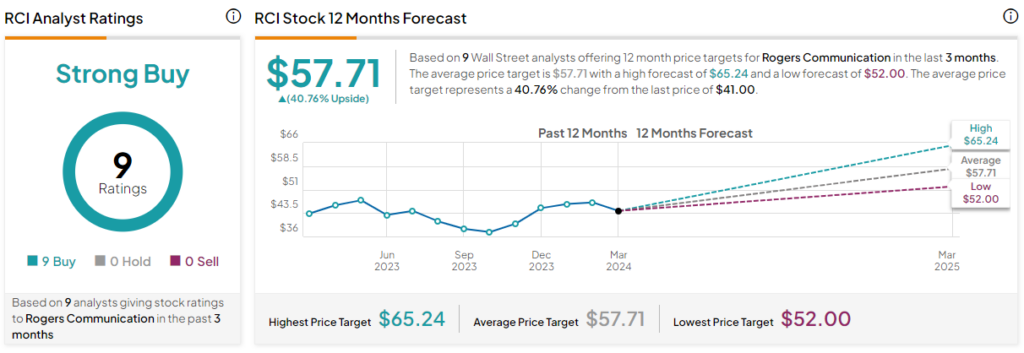

Reviewing the Potential of RCI Stock

RCI stock enjoys a Strong Buy rating, with nine analysts unanimously advising a Buy in the past three months. The average price target of $57.71 forecasts an impressive upside potential of 40.8%.

American Tower (NYSE:AMT)

American Tower, a real estate investment trust (REIT) specializing in leasing cell towers, has weathered substantial headwinds in recent years. Despite a significant share price decline, a resurgence in the company’s fortunes is on the horizon due to a confluence of favorable factors.

The revival in AMT shares can be attributed to positive catalysts such as optimism surrounding lower rates, beating revenue estimates in the last quarter, and optimistic guidance for the future. With shares rebounding more than 20% from their lows, American Tower is poised for a significant comeback.

In the upcoming year, American Tower is primed to capitalize on the data center boom, leveraging the potential of generative AI and edge computing in cloud services. As the company’s strategic acquisition of data center firm CoreSite pays dividends, a resurgence in growth beckons for this underappreciated cell tower REIT.

Exploring the Potential of AMT Stock

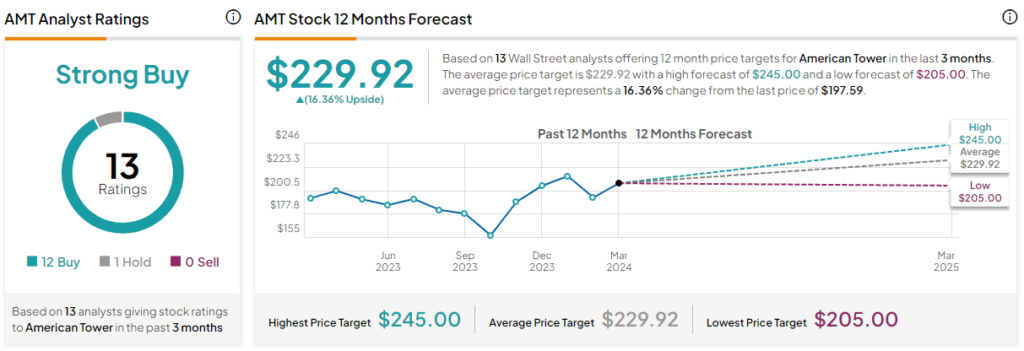

AMT stock boasts a Strong Buy rating, with 12 Buy recommendations and one Hold in the past three months. The average price target of $229.92 implies an attractive upside potential of 16.4%.

The Final Verdict

The telecom sector offers fertile ground for investors seeking a blend of value and growth prospects, with dividends as an added bonus. While all three stocks present compelling cases, Rogers Communications stands out with its projected gains and attractive valuation. As the cheapest option based on its P/E ratio, RCI stock carries the promise of significant returns in the year ahead.

Disclaimer: The opinions expressed herein are solely those of the author and do not reflect the views of Nasdaq, Inc.