HAVERTYS HVT Faces Challenges Amid Ongoing Housing Market Decline: Can 2025 Bring Improvement?

HAVERTYS, a home furnishings retailer with 127 showrooms across 17 Southern and Midwestern states, is navigating tough times in an enduring housing market recession. Established in 1885, the company offers products in the middle to upper-middle price ranges.

Leadership Change at HAVERTYS

On November 12, 2024, HAVERTYS announced a significant transition within its leadership. Long-time CEO and chairman of the board, Clarence H. Smith, will retire and shift to the role of executive chairman effective January 1, 2025.

Smith dedicated 50 years to the company, serving as CEO for 21 years. His successor, Steven G. Burdette, currently the president, will take over as CEO and join the board of directors.

Burdette will be the seventh CEO in HAVERTYS’ 139-year history.

Disappointing Q3 Earnings Report

On October 30, 2024, HAVERTYS released its third-quarter earnings, falling short of expectations by $0.19, or 39.6%. The reported earnings were $0.29, compared to a consensus estimate of $0.48.

Sales for the quarter dropped 20.2%, totaling $175.9 million, while comparable-store sales fell 20.5%.

The company reported weaker than expected sales, even during the Labor Day sale. However, it noted an increase in customer traffic as the quarter progressed.

Design consultants have played a larger role, accounting for 34.5% of written business this year, compared to 29% last year. Despite this, consumer hesitance regarding significant purchases has been a major concern. With decreased home sales and less homeowner movement, demand for new furniture has dwindled.

During this quarter, HAVERTYS opened one new store and plans to launch three more before the end of the year, expecting to conclude 2024 with 129 locations.

On a positive note, gross margins remained steady at 60.2%, only slightly down from 60.8% the previous year. No major damages were reported to its stores following the recent hurricanes in Florida and the Carolinas.

Analysts Lower Earnings Forecasts

The outlook for furniture retailers remains dim until the housing market recovers. In the past month, two earnings estimates were revised downward for 2024 and 2025.

The 2024 Zacks Consensus Estimate has decreased to $0.93 from $1.45 just 30 days ago, representing a significant drop of 71% from 2023 earnings of $3.25.

For 2025, the Zacks Consensus Estimate is now $1.87, down from $2.63 in the last month. Nonetheless, this represents an expected growth of 100.5% year-over-year.

Strong Financial Position Despite Market Strain

Amid challenging market conditions in the furniture sector, HAVERTYS boasts a solid balance sheet. As of September 30, 2024, the company held no debt, with credit available amounting to $80 million. Its cash reserves, including cash equivalents and restricted cash, totaled $127.4 million.

During this quarter, HAVERTYS distributed $15.3 million in cash dividends, continuing a tradition of paying dividends annually since 1935. The current dividend yield stands at 5.5%.

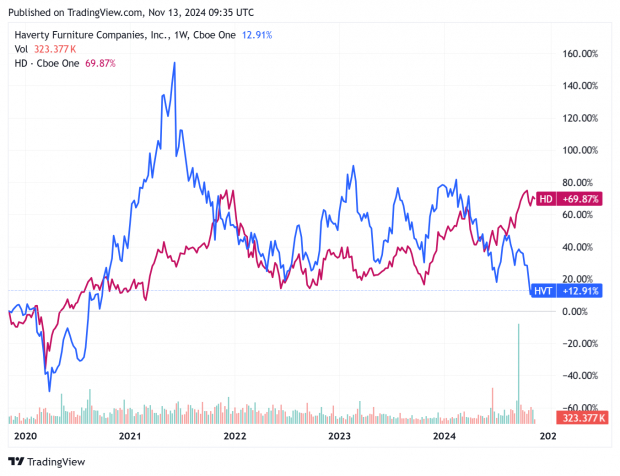

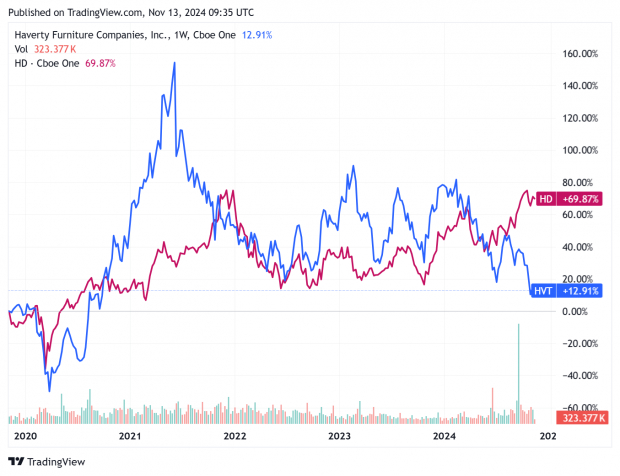

Stock Prices Hit Multi-Year Low

Given the overall negative sentiment towards the furniture market, it’s unsurprising that HAVERTYS shares are trading at multi-year lows. Historically, these stocks have moved in line with other housing-related companies like Home Depot.

Image Source: Zacks Investment Research

In light of declining earnings, shares are currently not trading at a bargain price; HAVERTYS has a forward price-to-earnings (P/E) ratio of 24.9. Investors looking for potential recovery opportunities in housing should consider monitoring HAVERTYS closely.

Discover Top Stocks for Quick Gains

Experts have recently selected 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys, predicting they have the best chances for early price increases.

Since 1988, the complete list has outperformed the market more than twice over, averaging an annual gain of +23.7%. Be sure to check these carefully chosen stocks for investment opportunities.

Want the latest investment recommendations? Download our report on 5 Stocks Set to Double to discover more free insights.

Haverty Furniture Companies, Inc. (HVT): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.