NIKE Faces Challenges: Analysts Downgrade Stock After Weak Earnings

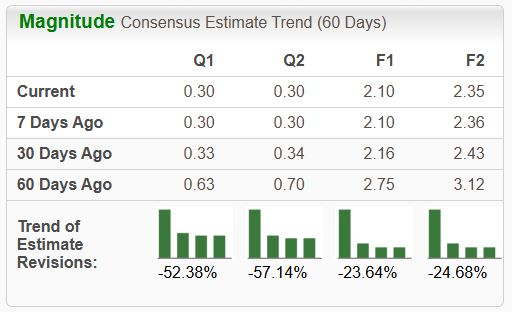

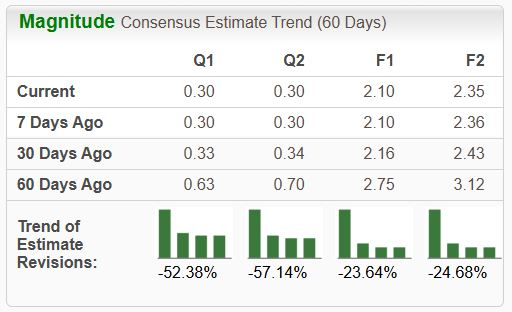

NIKE NKE, a leader in athletic footwear and apparel, operates in over 160 countries around the world. Recently, analysts have lowered their earnings forecasts for the company following disappointing quarterly results, resulting in a Zacks Rank of #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s delve into the factors impacting NIKE’s performance.

Challenges for NIKE

NIKE’s latest quarterly earnings report generated concern among investors, as both earnings per share (EPS) and sales showed significant declines. Specifically, EPS dropped by 25% compared to the previous year, while sales fell by 8%.

The stagnation in sales growth is striking, suggesting minimal progress over recent years. A quarterly sales chart highlights this trend.

Image Source: Zacks Investment Research

“We’re taking immediate action to reposition our business to restore long-term shareholder value. Our team is prepared, and I’m confident you will witness more moments of NIKE being NIKE again,” stated CEO Elliott Hill.

Currently, NIKE’s valuation appears high, with a forward 12-month earnings multiple of 32.7X, exceeding the five-year median of 30.4X. Additionally, the PEG ratio stands at 2.2X, slightly above its five-year median, reflecting elevated expectations for future growth.

Bottom Line

Analysts’ downward revisions of earnings estimates from lackluster quarterly results present a challenging outlook for NIKE’s stock in the short term. With a Zacks Rank of #5 (Strong Sell), experts have expressed a bearish perspective on the company’s earnings potential.

For investors interested in better-performing stocks, it could be wise to consider opportunities in stocks rated #1 (Strong Buy) or #2 (Buy) by Zacks. These stocks typically offer stronger earnings prospects and could lead to greater returns.

Zacks Identifies Top Semiconductor Stock

This opportunity is only 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, our newly identified semiconductor stock has substantial room for growth.

With robust earnings growth and a broadening customer base, this company is well-positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is expected to increase from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Free Stock Analysis Report for NIKE, Inc. (NKE)

Read this article on Zacks.com

The views expressed here belong to the author and do not necessarily reflect those of Nasdaq, Inc.