AI Revolution: Why Alphabet and Meta Platforms Are Stocks to Hold

Many trillion-dollar firms are diving into the booming artificial intelligence (AI) sector. Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Meta Platforms (NASDAQ: META) are prominent players in this landscape.

Though these tech giants made their mark well before AI became mainstream, their ventures into this field are set to enhance their long-term prospects. Here’s a closer look at what makes them strong investments.

1. Alphabet

Alphabet, the parent company of Google, initially faced a drop in share price amidst the rising popularity of AI. Some investors feared that ChatGPT would challenge Google directly. This viewpoint has merit, given that the AI chatbot offers many search functions similar to Google’s.

Nonetheless, the situation turned around. Google continues to dominate the search market, and Alphabet has always been deeply involved in AI development, making strategic advancements.

A new AI section now sits at the top of Google search results, which summarizes findings based on user queries. The company has also introduced Gemini, an AI assistant, and offers a range of AI tools via its Google Cloud platform.

This focus on AI is translating into impressive financial performance. In the most recent quarter, Alphabet reported revenue of $88.3 billion, marking a 15% increase from the previous year. Its net income surged by 33.6% to reach $26.3 billion.

Company leaders emphasized the transformative influence AI has on Google’s products and services. More than just technology, Alphabet’s competitive advantage lies in its brand recognition and innovation-driven culture.

The name “Google” is synonymous with online searches, making it unlikely for the company to lose its edge in this domain. Its extensive data collection continuously refines its algorithms, enhancing its value over time.

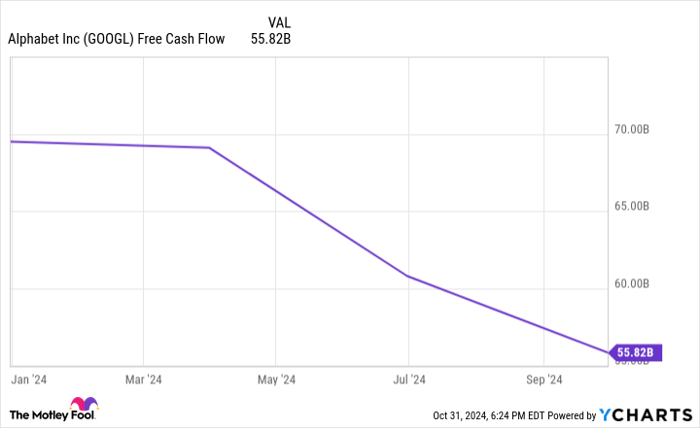

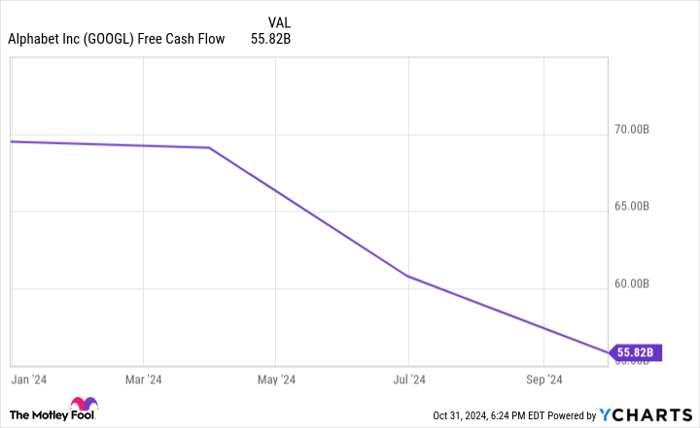

YouTube, another Alphabet asset, thrives in the streaming industry, which also holds significant growth potential. Despite a recent decline, Alphabet still maintains substantial free cash flow.

GOOGL Free Cash Flow data by YCharts

The company allocates enough resources for research and development, which has allowed it to quickly respond to competition from ChatGPT.

Recently, Alphabet has also started a dividend program. While it’s too soon to determine its viability as a strong income stock, reinvesting dividends could enhance long-term returns significantly.

2. Meta Platforms

Meta Platforms, known for Facebook, Instagram, and WhatsApp, is heavily investing in AI. The company anticipates significant growth in capital expenditures through 2025, primarily for AI-related infrastructure.

Though investors may be wary of rising spending, AI is beginning to show positive effects on company outcomes. Meta AI, its virtual assistant, stands out in the market, while AI algorithms on platforms like Facebook are boosting user engagement—a critical factor given the company’s reliance on advertising revenue.

Moreover, Meta is enhancing the way businesses create ads through generative AI, making this process faster and more efficient.

Meta Platforms is experiencing robust financial growth, with its third-quarter revenue rising 19% year-over-year to $40.6 billion. The net income for this period was $15.7 billion, a 35% increase from the previous year. Daily active users have also climbed 5% to 3.29 billion.

Investments in AI may temporarily pressure profits, but the long-term outlook remains strong. Few companies boast an ecosystem as expansive as Meta’s, allowing for diverse monetization strategies—from AI innovations to e-commerce and paid messaging on WhatsApp.

Benefiting from the network effect, Meta’s platforms become increasingly valuable as they attract more users and advertisers.

With an enormous user base, a robust competitive advantage, and multiple growth paths, Meta Platforms is well-positioned to provide market-beating returns for patient investors.

An Opportunity Not to Be Missed

Have you ever felt you’ve missed the chance to invest in top-performing stocks? This is your moment.

Our expert analysts occasionally release a “Double Down” stock recommendation for companies poised for significant growth. If you think you missed your window, now might be the best time to buy. Consider these figures:

- Amazon: A $1,000 investment made in 2010 would be worth $22,292 today!*

- Apple: A $1,000 investment made in 2008 would have grown to $42,169!*

- Netflix: A $1,000 investment made in 2004 would have skyrocketed to $407,758!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not present themselves again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Meta Platforms. The Motley Fool has positions in and recommends Alphabet and Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.