Predicting AI Spending Growth: Top Stocks to Watch for 2025

Investment in artificial intelligence (AI) infrastructure has remained strong over the past few years, and this trend is set to continue into 2025. According to market research firm IDC, total AI spending could reach an impressive $227 billion next year.

This upward trajectory is expected to persist through 2028, with total investment projected to exceed $749 billion by that time. Given this continued growth, let’s examine two AI stocks that may present solid buying opportunities as we enter 2025, characterized by their appealing valuations and potential for strong long-term growth.

1. Microsoft: A Key Player in AI Growth

Microsoft (NASDAQ: MSFT) has had a challenging year in 2024, with shares rising only 14%, compared to the 31% increase seen by the Nasdaq Composite. Nonetheless, potential investors should not overlook the company’s significant growth prospects driven by AI.

Microsoft is positioned well across various AI-focused markets, from cloud computing to personal technology. CEO Satya Nadella highlighted on the company’s October 2024 earnings call that its AI business is projected to achieve an annual revenue run rate of $10 billion in the upcoming quarter—a first in the company’s history.

The long-term outlook for this revenue run rate appears encouraging, as Microsoft increasingly relies on its cloud services bolstered by AI adoption. In the first quarter of fiscal 2025, the Intelligent Cloud revenue soared 20% year over year to $24.1 billion, propelled by a 23% increase in Azure cloud service revenues.

A notable contributor to Azure’s growth during this period was AI, accounting for 12 percentage points of that increase. Microsoft’s cloud business could see even more acceleration if it can meet the rising demand for its AI services.

Additionally, Microsoft’s share of the cloud infrastructure services market grew to 20% last quarter, slightly outpacing the overall growth of cloud infrastructure spending which is projected to reach $2 trillion globally by 2030, as indicated by Goldman Sachs. Should Microsoft maintain this market share, its cloud revenue could potentially rise to $400 billion, up from $105 billion in fiscal 2024.

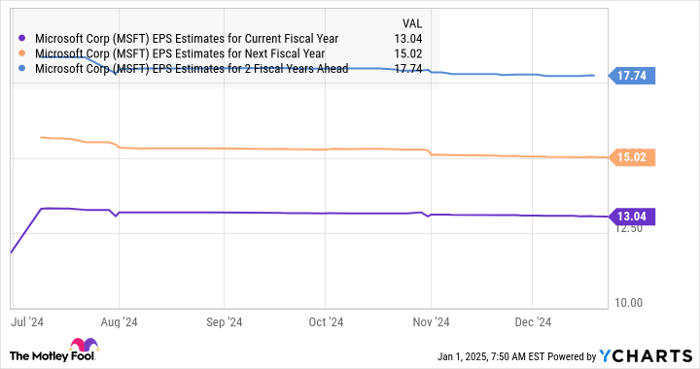

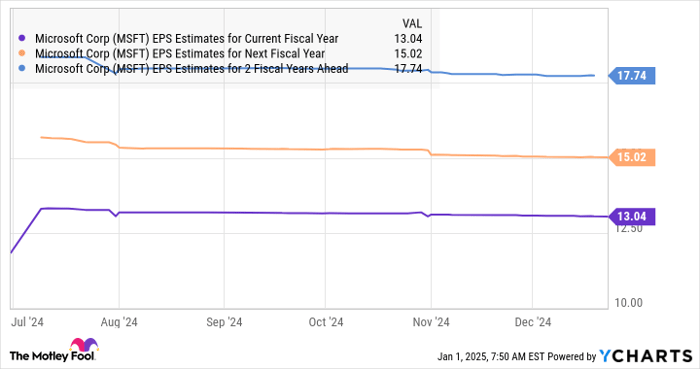

These compelling factors contribute to analyst projections of a 10% earnings increase in fiscal 2025, estimating earnings per share at $13.04.

MSFT EPS Estimates for Current Fiscal Year data by YCharts

Investors will find Microsoft stock accessible at a valuation of 35 times earnings, which is competitive in comparison to the Nasdaq-100 index’s earnings multiple of 33. Given the company’s growth potential, acquiring Microsoft shares at this valuation seems favorable.

2. Lam Research: Positioned for Recovery

Lam Research (NASDAQ: LRCX) has struggled in the past year, down 2%. The downturn mirrors the challenges faced in the memory market over the last couple of years, but brighter prospects are emerging for 2025.

Research firm TrendForce expects a 25% increase in capital spending for dynamic random-access memory (DRAM) in 2025, coupled with a 10% rise in NAND flash storage investments. With the rollout of AI servers and generative AI-capable devices, this increase in memory demand is not surprising.

Devices such as smartphones capable of on-device large language model (LLM) features are likely to require significantly more DRAM. Companies like Micron Technology are experiencing similar industry trends as a result.

Though Lam Research derives 35% of its revenue from sales to memory producers, improvements in the memory market can enhance its financial results. Following a challenging fiscal 2024, Lam reported a 20% year-over-year revenue increase to $4.17 billion for the first quarter of fiscal 2025, alongside a 25% rise in earnings to $0.86 per share.

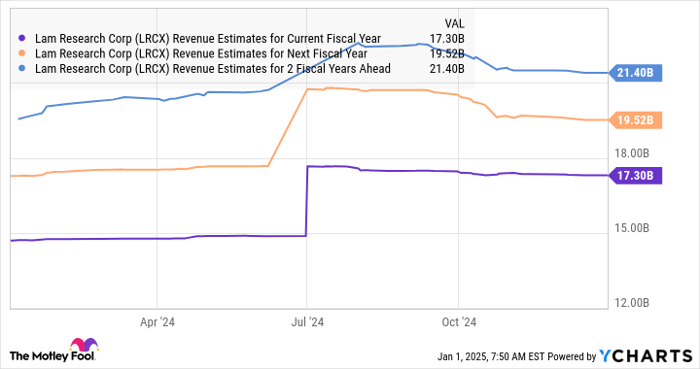

Analysts forecast continued growth for Lam in the current fiscal year and beyond. After a 14% revenue decline last year, a bounce back of double-digit growth is anticipated moving forward. Earnings are expected to increase by 17% in each of the next two fiscal years.

LRCX Revenue Estimates for Current Fiscal Year data by YCharts

Given this positive outlook, Lam Research presents a compelling AI stock option for 2025, currently trading at 24 times earnings, a discount compared to the Nasdaq-100 index’s 33 times. An improved growth trajectory could encourage a valuation adjustment, presenting possibilities for upside.

Lam’s 12-month median price target of $95 suggests a 32% increase in stock price, further incentivizing investors to consider it for their portfolios in the coming year.

Should You Invest $1,000 in Microsoft Now?

Before making any investment in Microsoft, it’s worth noting: the Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy presently—and Microsoft wasn’t included in that list. The stocks selected could yield substantial returns in the long run.

For perspective, consider when Nvidia was recommended on April 15, 2005… a $1,000 investment would now be worth $885,388!

Stock Advisor provides a comprehensive blueprint for investors, with guidance on building a portfolio and regular updates from analysts, as well as two new stock picks each month. This service has more than quadrupled the S&P 500 return since 2002*

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Goldman Sachs Group, Lam Research, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.