Wall Street Rallies After 2024 Election Results

Market Surge fueled by Election Results and Economic Optimism

Regardless of opinions about President-elect Donald Trump’s economic plans, it is undeniable that the 2024 U.S. presidential election has sparked enthusiasm among investors on Wall Street. Since hitting bear market lows in 2022, stocks have been recovering, helped along by declining inflation, increased spending in AI and data centers, and a more lenient Federal Reserve. However, the recent election added momentum, driven by expectations for business-friendly policies and reduced uncertainty.

Investor Enthusiasm on the Rise

Wall Street is buzzing with excitement, evident in the sharp rise of Bitcoin and related stocks like MicroStrategy (MSTR). Interestingly, Bitcoin’s market cap has surpassed that of silver. Meanwhile, Tesla (TSLA) experienced its largest five-day rally in four years, and the underperforming ARK Innovation ETF (ARKK) jumped 16% in just a week. Small-cap stocks are also recovering, reaching all-time highs after years of stagnation. Currently, the market is embracing risk, rewarding those bold enough to invest. Below are two speculative meme stocks worth considering:

BuzzFeed’s Comeback

BuzzFeed (BZFD) is a well-known media company that creates engaging content, often going viral. The platform mixes pop culture with current events, using humor that resonates with younger audiences. Additionally, BuzzFeed is involved in journalism, news coverage, and video production.

Vivek Ramaswamy Invests in BuzzFeed

Since its peak in 2021, BZFD has faced difficulties, diving from nearly $60 to below $1 at times. However, Vivek Ramaswamy, former Republican presidential candidate and potential cabinet member, has taken a significant step by acquiring a nearly 9% stake in the company. In a letter to the BZFD board, he expressed belief in BuzzFeed’s potential to regain value, but emphasized the need for a strategic overhaul.

If anyone can revitalize BZFD, it’s Ramaswamy. Traditional media, especially left-leaning outlets, have struggled with declining viewership, as illustrated by Comcast (CMCSA)‘s decision to sell MSNBC. Ramaswamy’s background and connections in modern media may help restore balance and improve the company’s outlook.

BZFD’s Stock Movement

After a period of low activity, BZFD shares appear to be breaking out from their recent stagnation.

Image Source: TradingView

GameStop’s Reign as a Meme Stock

GameStop (GME) leads the video game retail market, offering a wide selection of gaming consoles, accessories, and new and pre-owned game titles in digital and physical formats.

The Original Meme Stock

Although GameStop primarily sells video games, it has cemented its place as the king of meme stocks on Wall Street. GME has rewarded investors with dramatic short squeezes, most famously witnessing a 1600% gain in a single month in early 2021. While some investors doubt GME’s fundamentals, the surge in meme popularity has tangible benefits for the company.

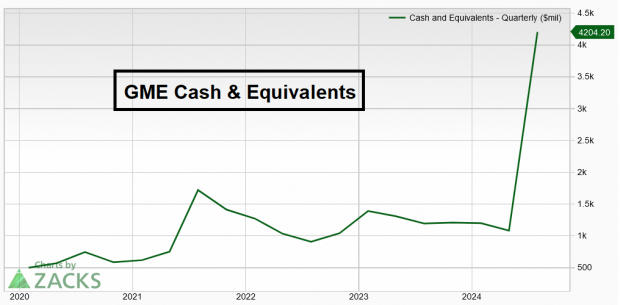

GameStop’s Strong Cash Position

Typically, when a stock becomes a meme and later crashes, it doesn’t benefit from the period of hype. However, GME’s management has wisely sold millions of shares during market peaks, accumulating a vast cash reserve.

Image Source: Zacks Investment Research

This substantial cash position allows GME to invest in its operations, explore new opportunities, or possibly distribute a special dividend.

Conclusion

The recent U.S. election has reinvigorated investor enthusiasm on Wall Street. With meme stocks gaining traction, GME and BZFD present interesting investment opportunities backed by potential growth catalysts.

7 Top Stocks to Watch for the Next 30 Days

Recently, experts have identified seven top stocks from a pool of 220 Zacks Rank #1 Strong Buys, considering them most likely to experience early price increases.

Since 1988, the full list of these stocks has consistently outperformed the market with an average annual gain of +23.7%. It’s worth keeping an eye on these handpicked selections.

For the latest recommendations from Zacks Investment Research, download our report on 5 Stocks Set to Double today.

Comcast Corporation (CMCSA): Free Stock Analysis Report

GameStop Corp. (GME): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

ARK Innovation ETF (ARKK): ETF Research Reports

BuzzFeed, Inc. (BZFD): Free Stock Analysis Report

For more information on this article, visit Zacks.com.

The views expressed in this article are those of the author and do not reflect the opinions of Nasdaq, Inc.