2024 Shows Promise: Stocks to Consider Before Year-End

As 2023 winds down, the stock market is enjoying a strong performance. The S&P 500 index has climbed about 28% since January, while the technology-heavy Nasdaq Composite index surged 31.5% in the same timeframe.

Companies like Nvidia, Palantir, and Microsoft have seen significant gains this year, driving major indexes to new heights. However, investors might also want to explore stocks that remain below their previous valuation peaks. Here’s why two contributors from Motley Fool believe that purchasing these undervalued stocks could be a wise move before the year’s end.

Carnival’s Comeback: A Market Leader Rebounding

Jennifer Saibil: Shares of Carnival (NYSE: CCL) have increased by 44% this year, following a year in which they more than doubled. Despite this recovery, the stock still trades at 63% less than its all-time highs.

Carnival’s business operations show significant improvement, with sales rebounding and demand reaching new heights. For the fiscal third quarter of 2024, which ended on August 31, the company reported revenue growth from $6.9 billion to $7.9 billion, year-over-year. By the end of September, nearly half of Carnival’s inventory for 2025 was already booked, marking the strongest booking position ever for 2026.

However, profitability hasn’t fully recovered to previous reliable levels. The adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) rose by 25% from last year to $2.8 billion for the third quarter, while operating income improved by $554 million to reach $2.2 billion. Net income was $1.7 billion for the quarter, but the company hasn’t achieved consistent positive net income yet.

The major concern for investors lies in Carnival’s substantial debt of $29 billion as of the third quarter, a remnant of the pandemic when cruises were paused. Although management is actively working to reduce this liability, the high debt levels still pose significant challenges. Recently, news of interest rate cuts brought some optimism, suggesting a faster payoff of this debt.

Future demand may face a slowdown, potentially leading to fluctuating performance until the market stabilizes. Nevertheless, the current demand continues to outperform expectations amid inflation and high interest rates—traditionally tough conditions for luxury product vendors. As economic conditions improve, Carnival is well-positioned to maintain strong demand with minimal disruption.

It’s important for investors to keep expectations realistic; steady growth is uncommon. The critical point is analyzing Carnival’s long-term health and management strategy. With a long-standing reputation as an industry leader, Carnival seems poised to regain its status as a market-beating stock.

Intel: A Chip Stock with Room for Recovery

Keith Noonan: While the stock market has rallied, 2024 has not been kind to Intel (NASDAQ: INTC). Its stock price has plummeted by 58% this year and is down 72% from its peak.

Intel is facing challenges on multiple fronts. The company’s chip-design segment is losing market share to competitors like Advanced Micro Devices and Arm Holdings in both the PC and server markets. Additionally, Nvidia’s stronghold on AI training graphics processing units (GPUs) has left Intel lagging in the artificial intelligence sector.

Intel’s attempts to increase its manufacturing capabilities have been expensive without the returns needed to compete with industry leader Taiwan Semiconductor Manufacturing. Its ongoing efforts to enhance production and yield quality are costly and have yet to yield significant results.

Recently, the resignation of CEO Pat Gelsinger added to the uncertainty surrounding Intel’s future, prompting investors to speculate on whether the company might sell its fabrication business or continue with its current structure.

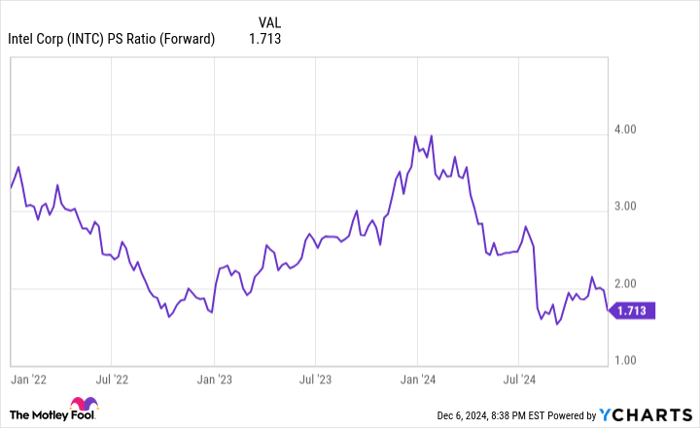

The fallout from these issues has pushed Intel’s forward price-to-sales ratio (P/S) to around 1.7, significantly lower than historical levels. Even though profit challenges have driven the forward earnings ratio to roughly 53, many investors see potential for significant value to emerge.

Predicting Intel’s strategic moves is not central to the investment thesis. Rather, the focus is on the strength of Intel’s strategic resources. Given the growing importance of advanced chip design and fabrication, Intel retains substantial leverage in critical areas that could benefit shareholders moving forward.

A Second Chance at Lucrative Investments

Have you ever felt you missed out on buying successful stocks? If so, you’re in luck.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant gains. If you’re hesitant about having missed your opportunity, now is a crucial time to act before it’s too late. The statistics illustrate the potential:

- Nvidia: Invest $1,000 in 2009, and it would have grown to $369,349!*

- Apple: Invest $1,000 in 2008, and it would have become $45,990!*

- Netflix: Invest $1,000 in 2004, and it would be worth $504,097!*

At this moment, we are issuing “Double Down” alerts for three outstanding companies that may not offer another opportunity like this soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

Jennifer Saibil and Keith Noonan have no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Microsoft, Nvidia, Palantir Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Carnival Corp. and offers options including long January 2026 $395 calls on Microsoft and short February 2025 $27 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein belong to the author and do not reflect those of Nasdaq, Inc.