AI Investment Opportunities: Three Key Players to Watch

As we approach 2024, artificial intelligence (AI) is becoming more prominent. Recent advancements in generative AI are being adopted widely, propelling AI-related stocks to peak levels. One of the most significant beneficiaries of this trend has been the semiconductor industry, where AI chips are essential for training large language models and conducting AI inference.

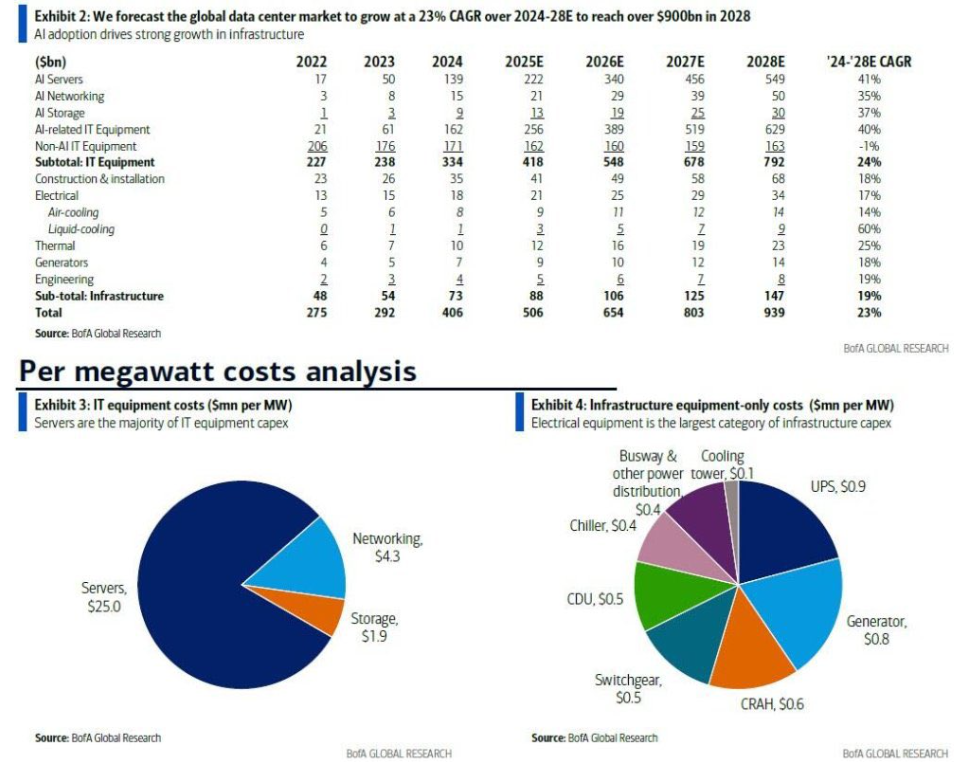

Looking ahead, spending on AI infrastructure is expected to increase, with Microsoft announcing a substantial investment of $80 billion for AI data centers this year. Such initiatives from other tech giants like Alphabet, Amazon, and Meta Platforms reflect a broader trend of heightened financial commitment to AI infrastructure.

Where should you invest $1,000 today? Our team of analysts has identified the 10 best stocks to consider. Check out the recommendations »

Next, let’s explore three AI chip manufacturers poised to benefit from this wave of investment.

1. Nvidia

Nvidia (NASDAQ: NVDA) has emerged as a leader in AI infrastructure, contributing to its rise as one of the world’s largest companies by market capitalization. Originally, Nvidia specialized in graphic processing units (GPUs) for graphics rendering in video games. To expand its market, it developed CUDA, a free software program that enables developers to use its chips for various applications. Over time, CUDA became the industry standard for GPU programming.

More recently, Nvidia has released several developer tools tailored for AI, solidifying its dominant position with about 90% market share in GPUs. Major tech companies require significant computing power for new AI models, driving demand for Nvidia’s GPUs. Microsoft, Nvidia’s largest customer, plans to boost its AI data center investment, suggesting stronger growth for Nvidia in 2025.

Currently, Nvidia is trading at a forward price-to-earnings (P/E) ratio of just over 31 based on next year’s estimates, alongside a price/earnings-to-growth ratio (PEG) of 0.98. A PEG under 1 indicates the stock may be undervalued compared to its growth potential.

Image source: Getty Images.

2. Advanced Micro Devices

Advanced Micro Devices (NASDAQ: AMD) holds a secondary position in the GPU market with about a 10% share. Despite this, AMD benefits from the booming investment in AI data centers. In the last quarter, its data center revenue soared 122% year over year to $3.5 billion, primarily fueled by sales of its Instinct GPUs and EPYC central processing units (CPUs).

AMD has revised its data center GPU revenue projections for 2024 significantly, now expecting to exceed $5 billion instead of the initial $2 billion forecast. Major clients such as Microsoft, Meta Platforms, and Oracle are integrating its MI300X GPUs. Notably, AMD specializes in AI inference applications rather than the broader training functions that competitors offer.

With its pending acquisition of ZT Systems, AMD aims to expand into a comprehensive data center solutions provider, as ZT designs and manufactures server infrastructure.

Trading at a forward P/E of approximately 17, AMD represents a viable investment option.

3. Broadcom

In contrast to Nvidia and AMD, Broadcom (NASDAQ: AVGO) focuses on designing custom AI chips tailored for specific tasks. Known as ASICs (application-specific integrated circuits), these chips offer enhanced performance and lower energy use compared to standard GPUs; however, they lack the flexibility that GPUs provide and require a longer development time for individual clients.

Broadcom’s custom chips gained traction recently, starting with its collaboration with Alphabet to develop tensor processing units (TPUs). Alphabet credits these chips, along with GPUs, with helping lower costs and reduce processing times. Following this success, Broadcom has attracted additional large clients, including Meta Platforms, ByteDance (the owner of TikTok), OpenAI, and Apple.

Last quarter, Broadcom mentioned its three largest data center customers could potentially deploy up to 1 million AI chips each by 2027, representing an estimated $60 billion to $90 billion opportunity that includes networking equipment. Broadcom also manufactures specialized networking chips that facilitate efficient communication among AI chips.

While the stock currently trades at 36 times the fiscal 2025 earnings estimates, which is higher than Nvidia and AMD, the potential for custom AI chips presents a substantial future opportunity for Broadcom.

Catch a Second Chance on Promising Stocks

Have you ever felt you missed your opportunity with top stocks? If so, our analysts have a timely recommendation.

Occasionally, our expert team issues a “Double Down” stock alert for companies they foresee on the verge of significant growth. If you’re concerned about missing investment opportunities, now is the ideal moment to consider buying before prices rise. The numbers clearly outline the past performance:

- Nvidia: If you invested $1,000 when we endorsed it in 2009, you’d have $352,417!

- Apple: If you invested $1,000 after our 2008 recommendation, you’d have $44,855!

- Netflix: A $1,000 investment after our 2004 alert would now be worth $451,759!

Currently, we’re issuing “Double Down” alerts for three incredible companies, and opportunities like this may not appear again soon.

Explore the 3 “Double Down” stocks now »

*Stock Advisor returns as of January 6, 2025

Randi Zuckerberg, a former director of market development at Facebook and sister to Meta CEO Mark Zuckerberg, is a member of The Motley Fool’s board. Suzanne Frey, an executive with Alphabet, also serves on the board. John Mackey, former Whole Foods CEO, is another board member. Geoffrey Seiler owns stock in Alphabet. The Motley Fool recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Oracle, and has positions in these companies. The Motley Fool endorses Broadcom and recommends options including long calls on Microsoft. The Motley Fool operates under a disclosure policy.

The views expressed here belong to the author and do not necessarily represent the views of Nasdaq, Inc.