Current Market Dip Presents Opportunities for AI-Driven Investments

After over two years of remarkable growth, the current bull market is taking a much-needed pause. The Nasdaq Composite has now entered correction territory, defined as a drop of 10% or more from its recent peak. While it may be concerning to see the value of investment portfolios decline, discerning investors will recognize the opportunity that this downturn presents. The future of the market remains uncertain, but those with a long-term perspective—aiming to hold investments for five to ten years—can find quality companies available at lower prices.

One of the dominant factors influencing the market today is the rapid adoption of artificial intelligence (AI). According to PricewaterhouseCoopers (PwC), AI could potentially add as much as $15.7 trillion to the global economy by 2030, revealing significant growth prospects.

Looking for investment opportunities? Our analyst team has revealed what they believe are the 10 best stocks to buy right now. Learn More »

Given the scale of the AI opportunity, investors may wish to view the ongoing market decline as an ideal time to acquire shares in leading AI companies at discounted rates.

Image source: Getty Images.

Investing in Alphabet

In the realm of internet search, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) stands alone. Google transformed the search landscape with its advanced algorithms and currently commands approximately 90% of the global search market, according to StatCounter. This dominance enables the company to excel in digital advertising, controlling an estimated 26% of the market in 2024.

Moreover, Google Cloud is a key player in the cloud infrastructure market as the third-largest provider, holding an 11% share according to Canalys.

Alphabet has integrated AI solutions for its search functionalities, enhancing the effectiveness of its digital advertising. Recently, the firm has assembled a collection of popular AI models for use by its cloud customers. Additionally, Alphabet’s proprietary Gemini has emerged as one of the leading chatbots, competing effectively against ChatGPT.

The current valuation makes Alphabet an attractive option for long-term investors. The stock is trading at just 20 times earnings, below its five-year average of 26. While there are valid concerns about the economy, a potential recession, and ongoing antitrust issues, the stock provides a compelling value for long-term holders.

Investing in Meta Platforms

Meta Platforms (NASDAQ: META) is unmatched in the social media space. Beyond its flagship Facebook, the company also owns Instagram, WhatsApp, Messenger, and Threads, collectively attracting around 3.35 billion users each month. This extensive user base underpins its success in digital advertising, holding 21% of the market, second only to Google.

Meta’s incursion into AI has proven smart, using its vast database to develop the Large Language Model, Meta AI (LLaMA), which ranks among the most utilized LLMs globally. While these offerings are freely available for academic research, the company monetizes them through agreements with hyperscalers and cloud service providers. Meta is also introducing premium subscriptions for its AI assistant, anticipating future demand for advanced AI solutions.

Despite the economic uncertainties facing Meta, the long-term outlook appears promising. The stock currently trades at 25 times earnings, presenting an appealing investment opportunity in a market leader.

Investing in The Trade Desk

The Trade Desk (NASDAQ: TTD) may not be a household name, yet it is a frontrunner in the programmatic advertising sector. Offering a self-service platform, the company enables advertisers to purchase ad space and manage their campaign success efficiently.

The Trade Desk is known for its innovation, notably with the development of Unified ID 2.0, which standardizes encrypted consumer data usage for precise targeting while ensuring data security. The company also launched OpenPath, providing direct publisher access to premium ad inventory. Upcoming this year is Ventura, a connected TV operating system aimed at delivering detailed data insights.

Most recently, the company unveiled its AI-powered Kokai platform, designed to optimize digital marketing capabilities. Kokai can process 13 million ad impressions per second, assisting advertisers in targeting their audiences effectively.

Though The Trade Desk faced challenges earlier this year, missing its first guidance in over eight years, this dip is noted as atypical. The stock has since dropped more than 50% from its recent high. Presently, it trades at 33 times forward earnings, marking its most favorable valuation in nearly five years, presenting an opportunity for value-seeking investors.

Reevaluating Your Investment in Alphabet

Before investing in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks available today…and Alphabet did not make the list. Such investments have the potential to yield substantial returns over the years.

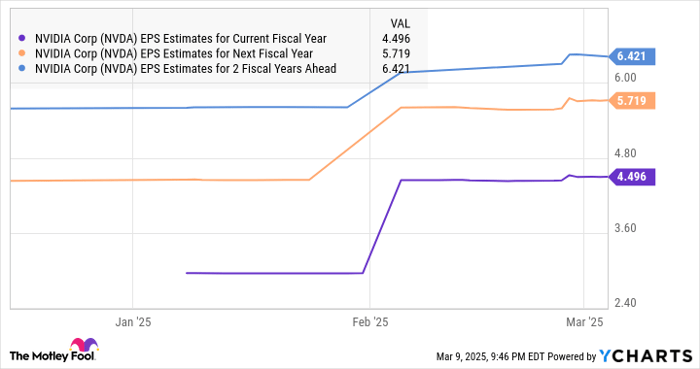

For instance, when Nvidia was included on this list on April 15, 2005, a $1,000 investment then would now be valued at $655,630!*

Stock Advisor provides a straightforward investment strategy, complete with portfolio-building guidance, timely updates, and two new stock selections each month. Since 2002, the Stock Advisor has produced returns over four times that of the S&P 500.* Don’t miss the latest top 10 list, available to Stock Advisor members.

See the 10 stocks »

*Stock Advisor returns as of March 10, 2025

Randi Zuckerberg, former director of market development at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is part of The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, also serves on the board. Danny Vena holds stock positions in Alphabet, Meta Platforms, and The Trade Desk. The Motley Fool recommends and has positions in these companies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.