Investing in AI: Top Stocks to Buy This Month

In 2024, the stock market has been heavily influenced by artificial intelligence (AI), which is emerging as a transformative technology. However, it’s important to note that AI is still in its early stages, with significant growth prospects expected in 2025 and beyond.

Here are three AI stocks you should consider buying this month.

1. Nvidia (NASDAQ: NVDA)

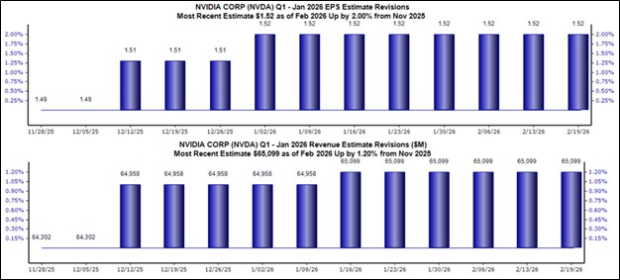

Nvidia has emerged as a leader in the AI sector, with its revenue experiencing remarkable growth over the past two years. For the fiscal year 2024, which ended in January of last year, Nvidia’s revenue soared by 125%. Analysts predict that in fiscal year 2025, revenue could more than double again.

The company’s graphics processing units (GPUs) are essential for AI development, as they provide the necessary processing power for training large language models (LLMs) and performing AI inference. Nvidia enjoys a dominant 90% market share in the GPU market, significantly outperforming competitor Advanced Micro Devices. This edge is primarily due to its advanced software platform, CUDA, which simplifies programming for AI tasks.

Investment in AI infrastructure is rapidly increasing, fueled by the growing computational needs of LLMs. Notably, Nvidia’s largest client, Microsoft (NASDAQ: MSFT), has announced a staggering $80 billion commitment to AI data centers this year. Typically, around half of this spending is allocated to servers equipped with GPUs. Last fiscal year, Microsoft invested $44.5 billion in capital expenditures.

With other major customers also ramping up their AI infrastructure spending, Nvidia still has much room for growth. Despite its impressive stock performance, Nvidia currently trades at a forward price-to-earnings (P/E) ratio of approximately 31.5 based on 2025 estimates, with a price/earnings-to-growth (PEG) ratio of 0.98. Notably, a PEG under 1 is often viewed as undervalued.

Image source: Getty Images.

2. Microsoft (NASDAQ: MSFT)

Microsoft is making significant investments in AI infrastructure this year, and it’s evident why. The company’s Azure cloud computing platform has seen impressive growth, with a 33% revenue increase last quarter, while utilization of Azure’s OpenAI services has doubled over the past six months. Customers are increasingly leveraging Azure to develop their own AI applications, leading to heightened demand for data and analytics services.

Azure’s growth potential is sometimes limited by capacity constraints, but the company expects revenue to accelerate in the latter half of its fiscal year as new capacity becomes available. To meet surging demand, Microsoft is heavily investing in building data centers globally.

Beyond cloud services, Microsoft aims to enhance its AI software offerings with its AI assistant copilots for the Microsoft 365 suite. For a monthly fee of $30 per enterprise user, these copilots streamline tasks like email management and presentation creation using natural language input. This feature is anticipated to be a significant growth driver for Microsoft.

Currently trading at a P/E of 32.5 for the current fiscal year estimates, Microsoft’s stock appears to be reasonably priced.

3. Salesforce (NYSE: CRM)

Salesforce is positioning itself as a frontrunner in agentic AI, which experts believe is the next evolution beyond generative AI. While generative AI allows users to create content through prompts, agentic AI goes further by executing tasks such as booking flights and making reservations by itself.

As a long-time leader in customer relationship management (CRM) software, Salesforce launched its agentic AI platform, Agentforce, last October, followed by an upgraded version in December. Users can customize a variety of ready-to-use agents through no-code and low-code tools, and there will also be options to create entirely new agents. These agents can serve diverse functions across sales, marketing, HR, and customer support.

Salesforce has reported rapid adoption of Agentforce, closing deals with over 1,000 teams in a short period. The company aims to deploy 1 billion Agentforce AI agents by the end of its fiscal year 2026 (ending January 2026). As a consumption-based product priced at $2 per conversation, Agentforce represents a significant opportunity for Salesforce.

The stock currently trades at a reasonable 29 times fiscal 2026 earnings and a PEG of 0.8.

Explore New Investment Opportunities

Worried you missed out on investing in top-performing stocks? You may find a second chance now.

Occasionally, our expert analysts recommend a “Double Down” stock—companies that they believe are on the verge of significant growth. If you’re concerned that you’ve missed your opportunity to invest, now could be the optimal time to buy before prices rise. Here’s a look at some past successes:

- Nvidia: Investing $1,000 in 2009 is now worth $352,417!*

- Apple: A $1,000 investment made in 2008 has grown to $44,855!*

- Netflix: An investment of $1,000 in 2004 is now valued at $451,759!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this may be a unique opportunity.

Discover the 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, Nvidia, and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.