Why Amazon Remains a Strong Investment Heading into 2025

Amazon (NASDAQ: AMZN) stock has seen impressive growth in 2024, rising 48% year-to-date. Despite its substantial $2.37 trillion market cap, which could suggest limited future returns, Amazon holds significant advantages in e-commerce. The stock appears undervalued based on its increasing cash flow, making it an interesting prospect for investors.

Below are three compelling reasons why buying Amazon stock could be a smart decision as we move into 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

1. Amazon’s Massive Customer Base

Amazon boasts one of the broadest competitive edges in the retail sector. With over 200 million Prime members, it offers a seamless shopping experience with a vast selection of products. The company continues to enhance customer loyalty through initiatives like same-day delivery and an upcoming pharmacy delivery service.

CEO Andy Jassy highlighted this on the Q3 earnings call: “At a time when consumers are being careful about how much they spend, we’re continuing to lower prices and ship even more quickly, and we can see this resonating with customers as our unit growth continues to be strong and outpace even our revenue growth.”

With $262 billion in trailing-12-month sales from both online and physical stores, there are still significant growth opportunities. Global e-commerce sales are projected to reach around $6 trillion, while the whole retail market is estimated at $30 trillion, according to Statista.

2. Advancements in Artificial Intelligence

Amazon is also strengthening its e-commerce dominance with new AI shopping features. The introduction of its AI shopping assistant, Rufus, in September aims to help customers find products more efficiently, potentially boosting sales. This AI initiative leverages Amazon’s leadership in cloud computing.

Amazon Web Services (AWS) remains the top player in the $300 billion cloud services industry, with a year-over-year revenue increase of 19% in Q3 on a currency-neutral basis. The shift of organizations to cloud-based data systems, in search of AI solutions, is one key driver of this growth.

In the last quarter, AWS generated $10 billion in operating income, contributing significantly to Amazon’s overall profit. As the cloud market continues expanding at double-digit rates, the rising demand for AI services in AWS presents a strong reason to consider investing in Amazon.

3. Amazon’s Cash Flow is Being Undervalued

Over the past several decades, Amazon stock has generated remarkable wealth for its shareholders. An investment of $10,000 in 2004 would now be worth almost $1 million. Amazon’s robust operating cash flow is a major factor driving these returns, yet the stock currently trades at a reasonable cash flow multiple that suggests there could be more highs ahead.

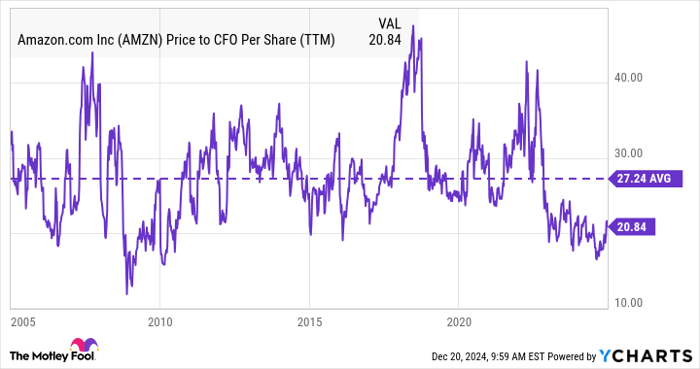

Back in 2004, the stock had a price-to-cash flow (P/CFO) ratio of about 30. Over the last two decades, the average was 27; however, at the present share price of $219, it trades at a multiple of 21.

Data by YCharts.

Compared to retail rivals like Walmart and Costco Wholesale, Amazon appears undervalued. Walmart’s current P/CFO is 19, while Costco’s is a lofty 42. Given Amazon’s historical growth in earnings and cash flow, it deserves a higher valuation than both competitors. Moreover, Amazon’s strategy of cost management in its retail segment is enhancing its profitability. Operating cash flow soared 57% year over year to reach a record $112 billion over the trailing-12-month period.

While investments in growth could lead to fluctuating cash flow results year by year, Amazon’s long-term growth trajectory supports its investment potential.

Should You Invest $1,000 in Amazon Now?

Consider these points before investing in Amazon:

The Motley Fool Stock Advisor analyst team has identified what they consider the 10 best stocks right now, and Amazon is not one of them. The selected stocks may offer substantial returns in the upcoming years.

Reflect on when Nvidia was recommended on April 15, 2005… if you invested $1,000 back then, you’d now have $855,971!*

Stock Advisor offers investors a straightforward strategy for success, complete with portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has produced returns that have more than quadrupled that of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, which is owned by Amazon, is on The Motley Fool’s board. John Ballard holds no position in the stocks mentioned. The Motley Fool recommends positions in Amazon, Costco Wholesale, and Walmart. For more information, refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.