Evaluating Shopify: A Compelling Stock Opportunity Amid Market Growth

Looking for a stock that can help you take advantage of the market’s resurgence? Consider investing in Shopify (NYSE: SHOP). It’s a prime time to consider this investment.

Understanding Shopify’s Role

In case you’re not familiar, Shopify assists businesses of all sizes in establishing and managing their e-commerce platforms. It provides a variety of services including online shopping carts, payment processing, and marketing support. This technology is offered on a subscription basis and also charges for each transaction made.

To grasp Shopify’s significance, consider its core principle: it serves as an alternative to Amazon, providing merchants who wish to avoid dependency on the largest online retailer an opportunity to sell online without competitive pressures.

Amazon once enjoyed a favorable reputation among sellers for its vast reach. Over time, it became overcrowded and started competing directly with many of its own merchants. This shift has driven many businesses to explore alternatives, with Shopify becoming a favored choice due to lower costs and the ability to build direct customer relationships. While exact figures are not disclosed, estimates suggest that 2 million to 4 million merchants use Shopify’s services.

Despite the uncertainty surrounding the exact number of active sellers, Shopify reveals key financials. In its most recent quarter, the platform facilitated sales worth $69.7 billion, generating approximately $2.2 billion in revenue—a significant increase from previous years. This sets the stage for why investors should consider acquiring stock in the company now.

1. Steady Growth Trends

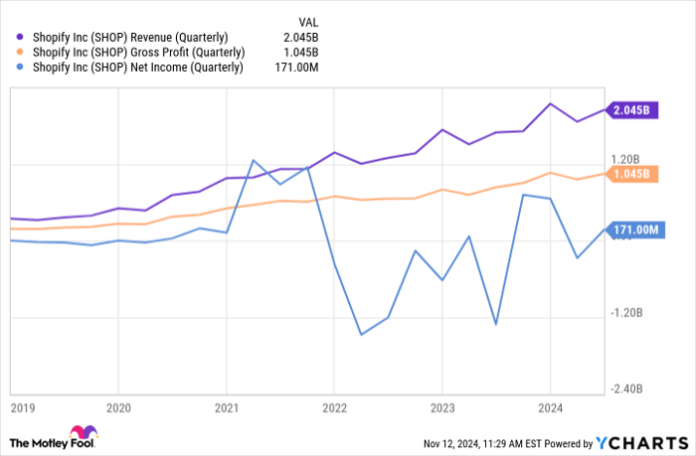

As previously mentioned, Shopify’s revenue last quarter saw a 26% year-over-year increase, significantly boosting its operating income. Free cash flow also rose impressively, from $276 million in the prior year’s third quarter to $421 million in the most recent quarter. This growth persists despite a challenging economy.

SHOP Revenue (Quarterly) data by YCharts

This performance stands out as Shopify has now recorded six consecutive quarters of revenue growth exceeding 25%, excluding the impact of its recently divested logistics division.

2. Meeting Merchant Demands

What makes Shopify’s current success noteworthy is its ability to provide services that align with the needs of merchants today. As the e-commerce landscape has evolved, sellers increasingly prefer to create direct connections with their audience rather than relying on large platforms like Amazon or eBay.

With the evolution of web marketing and social media, most brands now possess tools to attract their customers directly. The primary requirement for these merchants is a platform that can convert web traffic into sales—something Shopify excels at.

3. Significant Growth Potential

Even considering the current state of the online marketplace, there remains substantial growth potential ahead. Data from the U.S. Census Bureau indicates that only about 16% of U.S. retail sales occur online, leaving a vast majority still conducted in physical stores. Globally, the trends are similar.

Market research predicts that the global e-commerce software market will grow over 12% annually through 2032, positioning Shopify to capture a significant share of this growth, particularly with its renewed focus on international expansion.

Exercise Caution with Your Investment

This week, Shopify’s stock surged following the release of its third-quarter results and optimistic future outlook. The company projects revenues to continue climbing at a mid-to-high twenties percentage rate, which would push gross profits up significantly as well.

However, the substantial rise in share price may prompt profit-taking among investors. It may be wise to wait for a better entry point as the stock finds its balance post-rally.

Nevertheless, it is crucial not to hesitate too long. Shopify has previously demonstrated a capacity for sharp rebounds after similar stock movements since its recovery began in mid-2022.

A Fresh Chance at a Valuable Investment

Do you ever feel you’ve missed an opportunity to invest in successful stocks? If so, consider this your chance.

Experts occasionally issue a “Double Down” stock recommendation for companies poised for significant growth. With the numbers advocating for timely investments, now may be one of those moments:

- Amazon: A $1,000 investment made in 2010 would now be worth $23,818!*

- Apple: Investing $1,000 in 2008 has grown to $43,221!*

- Netflix: A $1,000 stake in 2004 would be worth $451,527!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and opportunities like this may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Shopify. The Motley Fool recommends eBay. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.