Walmart: A Solid Investment Amid AI and Health Trends

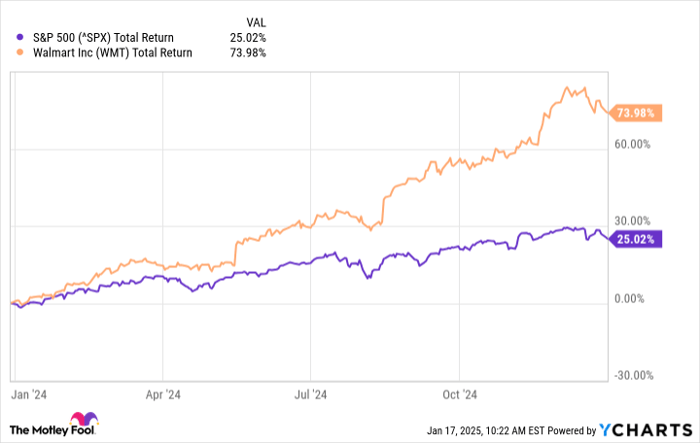

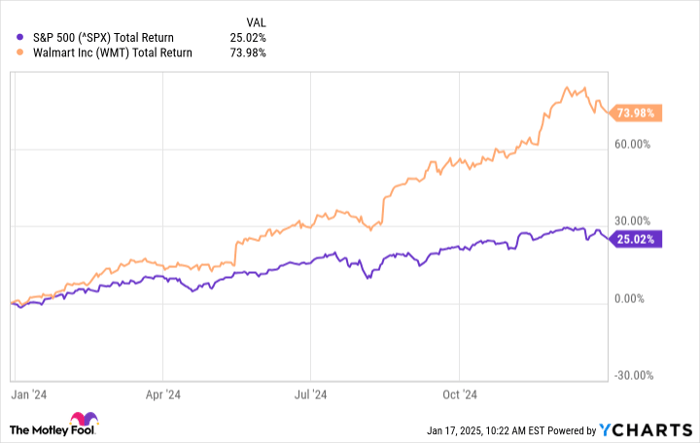

While Wall Street’s attention shifts to artificial intelligence and weight-loss drug stocks, Walmart (NYSE: WMT) has proven itself as a strong growth stock in 2024, outperforming the S&P 500 and many popular growth stocks.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Data by YCharts.

The retail sector is on the rise as inflation cools, setting the stage for a promising 2025 for Walmart, the world’s largest retailer. Here are three compelling reasons to consider adding it to your portfolio this year.

1. Increased Consumer Spending

With inflation stabilizing and interest rates dropping, consumer spending is likely to rebound. Walmart stands to gain significantly from this trend due to its position as the leading U.S. retailer in sales. The company operates over 4,600 stores nationwide, with nearly $674 billion in trailing 12-month sales.

Walmart is particularly well-suited to benefit from discretionary spending as it caters to a mass market, especially those affected by higher prices. As inflation eases, consumers may feel encouraged to shop more freely again. In cases where inflation remains elevated, shoppers will still gravitate toward discount retailers like Walmart.

The Federal Reserve started lowering interest rates in September 2024, and with three cuts made that year, the potential for stimulating consumer expenditures exists. While future cuts remain uncertain, any additional reductions could favor Walmart’s continued growth.

2. Growth in E-Commerce

Walmart ranks as the second-largest player in U.S. e-commerce. Yet, its 6% market share pales in comparison to Amazon‘s (NASDAQ: AMZN) 38%. Nevertheless, Walmart’s e-commerce operations surged, marking a 22% increase in U.S. online sales in the company’s third-quarter 2025, contributing to an overall 5.5% sales rise.

Walmart’s extensive store network serves as a key advantage, allowing it to utilize locations as delivery hubs, outperforming Amazon in this regard. Amazon is currently restructuring its logistics, shifting from a national to a regional model aimed at quicker delivery. Walmart’s existing network serves it well, while in-store pickup offers convenience to customers.

The e-commerce sector continues to evolve, providing Walmart opportunities to offer a wider range of items, including more costly products that attract wealthier shoppers who might not frequent physical stores. This diversification promises to increase sales contributions from online channels, regardless of future inflation trends.

3. A Reliable Dividend

Walmart maintains a growing dividend, currently yielding 0.9%. Although this figure is lower than the historical average of 1.5%, dividend stocks are generally more stable during economic uncertainties. Even if Walmart’s stock price fluctuates, the company remains committed to dividend payouts—having maintained its dividends during the pandemic when many peer firms did not.

Smart investors should consider Walmart not merely for its potential short-term gains in 2025 but for its long-term stability as a retail leader. This stock has the potential to outpace the S&P 500 again, underscoring its strength in value.

Is Now the Time to Invest in Walmart?

Before making a decision, take this into account:

The Motley Fool Stock Advisor analyst team has identified their top 10 best stocks to buy now, and Walmart is not included. The selected stocks could yield significant returns in the upcoming years.

For instance, consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $843,960!*

Stock Advisor offers an insightful roadmap for investors, including easy-to-follow strategies for building a portfolio, regular analyst updates, and two new stock recommendations each month. The service has quadrupled returns compared to the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, sits on The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Amazon and Walmart. The Motley Fool’s complete disclosure policy is available.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.