“`html

Investing in AI: ETFs Offer Diverse Options for Every Investor

Investing in artificial intelligence (AI) can pose a notable challenge for some investors.

Many potential shareholders may shy away from individual stocks due to risk. Others, while more willing to take on risk, might hesitate to invest in Nvidia after its significant price surge or be concerned about buying into Super Micro Computer, which recently postponed its SEC filing.

Fortunately, one viable option for cautious investors is exchange-traded funds (ETFs). These funds invest in a collection of stocks that meet specific criteria and are managed by professionals. In the realm of AI investing, three specific ETFs cater to a variety of risk appetites and offer the potential for strong returns. Three contributors from Fool.com share their insights on these options.

Why settle for one or two semiconductor stocks when this ETF provides access to over two dozen?

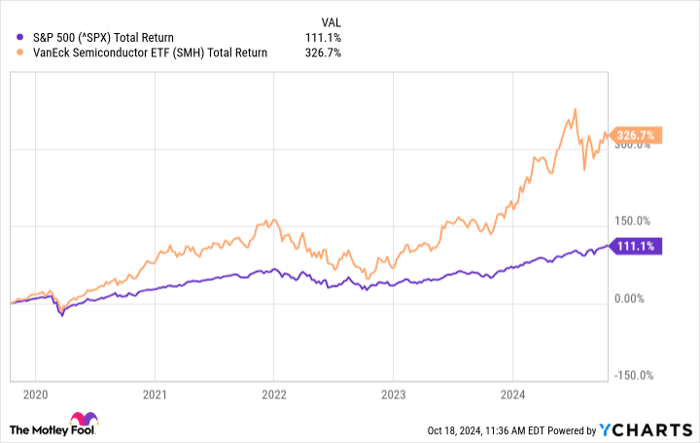

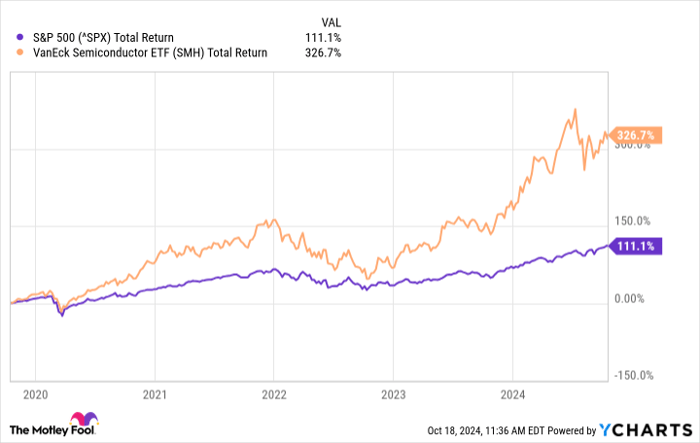

Jake Lerch (VanEck Semiconductor ETF): My recommendation for a stable investment in AI is the VanEck Semiconductor ETF (NASDAQ: SMH).

This fund is particularly attractive due to its focus on the booming semiconductor sector. Its top holdings feature well-known companies like Nvidia, Advanced Micro Devices, Taiwan Semiconductor Manufacturing, Broadcom, among others. Additionally, it includes smaller players in the semiconductor field, such as Teradyne and Synopsys, which focus on semiconductor testing.

Data by YCharts.

Moreover, with significant holdings in a diverse array of competitors, investors benefit regardless of which firm excels in AI chip development. If Nvidia faces setbacks, for instance, investors retain exposure to competitors like AMD or Intel.

The fund’s main strength lies in its connection to the AI revolution. AI technologies are transforming our daily lives, akin to how smartphones and PCs changed previous generations. The demand for faster semiconductors is surging, leading to skyrocketing sales and profits across the semiconductor industry.

This ETF is an excellent option for those eager to invest in AI while avoiding reliance on one or two stocks.

Discover the “AI ETF” that’s hiding in plain sight

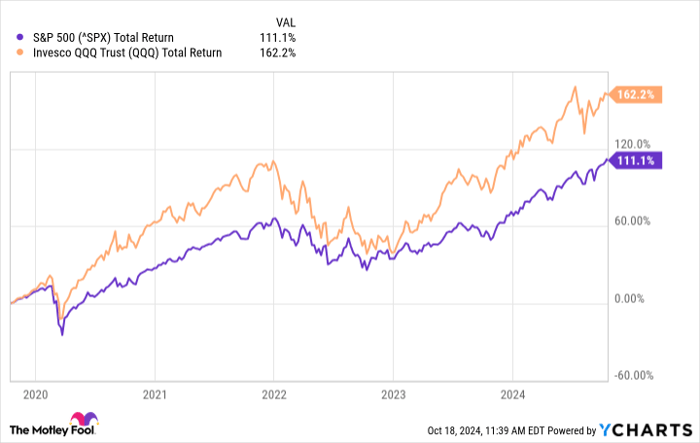

Will Healy (Invesco QQQ Trust): Instead of choosing individual companies, an alternative is to invest in leading tech stocks. While this might limit the gains of selecting the next Nvidia, it also helps cushion against surprises in the market.

The Invesco QQQ Trust (NASDAQ: QQQ) offers an efficient way to adopt this strategy. This ETF invests in the top 100 non-financial companies on the Nasdaq Composite index. However, not all holdings carry the same weight, and some are outside the tech sector; notably, retail giant Costco Wholesale is among the top ten holdings.

Data by YCharts.

Despite this, opting for these leading Nasdaq stocks simplifies management, resulting in an ETF expense ratio of just 0.2%, which is well below Morningstar‘s average expense ratio of 0.36% for similar funds.

Furthermore, many of the top holdings comprise prominent AI stocks. The largest position is Apple at an 8.7% allocation, followed closely by Nvidia at 8.3%, and Microsoft at 7.8%. Collectively, the top ten stocks account for about 50% of the fund.

Investors also gain exposure to smaller companies utilizing AI, such as The Trade Desk and the currently struggling Supermicro, which might yield significant returns if they regain momentum.

This ETF has achieved nearly 35% return over the past year, outpacing the S&P 500. The compelling reason to hold this fund lies in its long-term potential; with around 155% returns over five years, it offers a safer pathway to invest in AI compared to individual, volatile stocks.

Want AI benefits along with security? Don’t overlook the classic S&P 500.

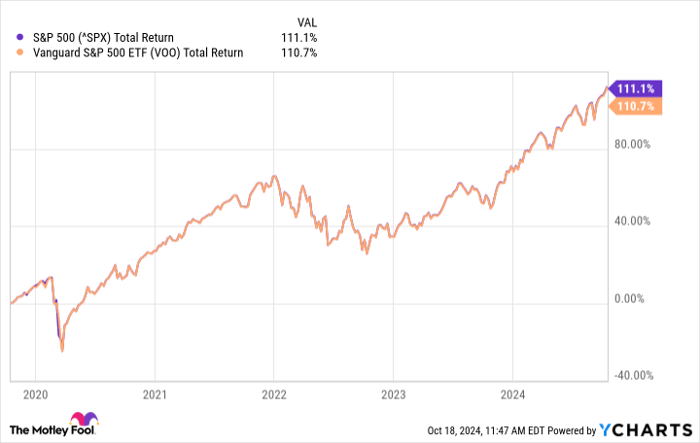

Justin Pope (Vanguard S&P 500 ETF): Investing in the S&P 500 could be an unconventional yet effective strategy for gaining exposure to AI. Many major tech firms, referred to as the “Magnificent Seven,” are seizing AI opportunities.

Leading the charge is Nvidia, the foremost AI chip manufacturer. Microsoft, Amazon, and Alphabet dominate public cloud services, which are essential for AI software deployment. Tesla is innovating AI for autonomous driving and robotics, while Apple integrates AI into its devices, and Meta Platforms incorporates AI into its social media environments.

Data by YCharts.

The Magnificent Seven together constitute over 31% of the S&P 500 index, thanks to their substantial market capitalizations, totaling trillions of dollars. If emerging AI firms thrive, they too will ultimately find themselves included in this esteemed list.

“`

Investing in AI: The S&P 500 and Semiconductor ETFs

The Palantir Technologies has recently been added to the prestigious S&P 500 index. This index has strict criteria for inclusion, making it a good indicator that a company is performing well. For investors in the evolving AI industry, it offers a way to reduce uncertainty while selecting promising companies.

For those considering AI investments, the S&P 500 is likely your safest option. This index includes 500 of the largest U.S. companies, which helps to diversify your investments beyond just AI and tech stocks. Its resilience is notable; the S&P 500 has been steadily climbing for decades and currently stands at an all-time high. However, it’s important to remember that even this reliable index can experience downturns and fluctuations.

You can’t invest directly in the S&P 500, but you can purchase shares of the Vanguard S&P 500 ETF (NYSEMKT: VOO). This ETF closely tracks the index and has a minimal expense ratio of 0.03%. While the S&P 500 isn’t exclusively focused on AI, it provides investors with a blend of exposure to the sector and overall market stability that is hard to match.

Should You Consider Investing $1,000 in the VanEck Semiconductor ETF?

Before making a decision to buy into the VanEck ETF Trust – VanEck Semiconductor ETF, it’s worth noting the following:

The Motley Fool Stock Advisor analyst team recently released their list of the 10 best stocks to buy right now. Unfortunately for the VanEck ETF, it did not make this list. Instead, the chosen stocks have high potential for substantial returns in the years ahead.

Take, for example, Nvidia’s placement on this influential list back on April 15, 2005. A $1,000 investment at that time would have grown to a staggering $845,679*!

By following Stock Advisor, investors gain access to a structured plan for success, which includes portfolio guidance, updates from analysts, and two new stock recommendations each month. Since its inception in 2002, the Stock Advisor program has generated returns that have more than quadrupled those of the S&P 500.*

See the 10 stocks »

The data indicates returns as of October 14, 2024.

John Mackey, the former CEO of Whole Foods Market, is on The Motley Fool’s board, as is Suzanne Frey, an executive at Alphabet. Randi Zuckerberg, former director at Facebook, is also a board member. Several affiliated individuals hold shares in various companies mentioned, including Nvidia and Palantir Technologies.

The views expressed in this article are those of the author and do not reflect the opinions of Nasdaq, Inc.