Investing Smart in 2025: Opportunities in ETFs to Consider Now

As 2025 begins, market conditions are shifting due to 2024’s weak performance and unexpectedly high interest rates. There are promising investment options available, and you don’t have to buy individual stocks to benefit. Here are three ETFs that I recommend adding to your portfolio this January.

The Small-Cap Valuation Gap is Expanding

At the start of 2024, small-cap stocks were trading at their lowest price-to-book (P/B) valuation compared to large-cap stocks in a quarter-century. Following a strong year for the S&P 500 index—driven especially by large tech companies—this gap has grown. For context, the average S&P 500 component has a P/B multiple of 5, while the average Russell 2000 (INDEXRUSSELL:RUT) small-cap stock stands at only 2.1.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Several factors suggest that small caps could narrow this gap in 2025 and beyond. Reduced interest rates typically favor small caps because they often rely more heavily on debt. Additionally, a potential change in administration under the incoming Trump government may lead to deregulation, which could aid small-cap growth. I’m taking advantage of this opportunity by investing in the low-cost Vanguard Russell 2000 ETF (NASDAQ: VTWO).

Real Estate Could Shine Brightly

In a recent article, I made bold predictions for 2025, indicating that real estate may emerge as the top-performing sector within the S&P 500. This outlook hinges on my belief that the Federal Reserve will implement rate cuts faster than the prevailing expert consensus.

Lower interest rates have several benefits for real estate investment trusts (REITs). First, borrowing costs drop, creating a favorable environment for growth. Moreover, because yield-focused assets like REITs typically yield higher returns when interest rates rise and lower ones when they fall, falling rates ultimately result in rising REIT prices. I already hold the Vanguard Real Estate ETF (NYSEMKT: VNQ) and plan to make additional purchases in 2025.

Dividend Stocks Offer Value

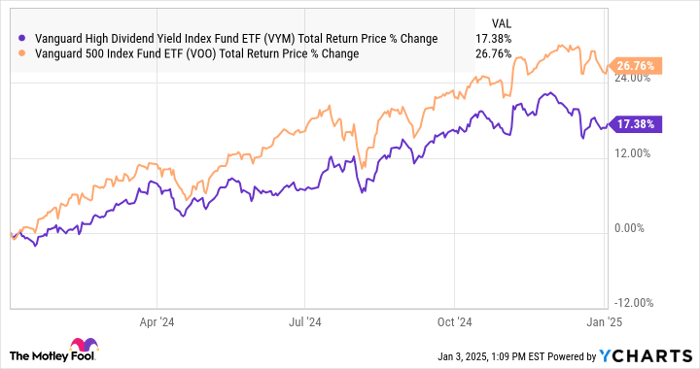

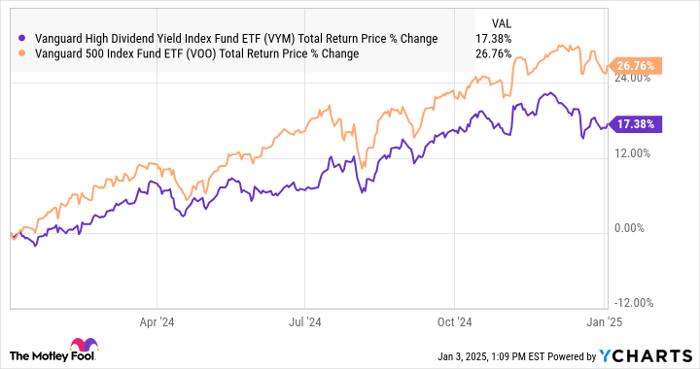

Contrary to the belief that all stocks are overly priced right now, dividend stocks present a different picture. Over the past year, the Vanguard High Dividend Yield ETF (NYSEMKT: VYM) has lagged the S&P 500 by nearly 10 percentage points, providing a potential buying opportunity while interest rates remain high.

VYM Total Return Price data by YCharts

This ETF boasts an impressively low expense ratio of 0.06% and tracks a weighted index of large-cap stocks with expected above-average dividend yields. Key holdings include Broadcom (NASDAQ: AVGO), JPMorgan Chase (NYSE: JPM), and ExxonMobil (NYSE: XOM), with no single stock exceeding 4% of the fund’s assets.

A Shared Investment Insight

It’s evident that my choice of all three ETFs is grounded in the belief that interest rates will decline more swiftly than anticipated in 2025. While I view this as a beneficial trigger, my investment rationale extends beyond this expectation.

Fundamentally, I am targeting these three Vanguard ETFs for the long-term, anticipating solid performance regardless of this year’s developments. The Russell 2000 ETF has generated 10.3% annualized total returns since its launch in 2010, the real estate ETF has yielded 7.5% long-term returns despite recent challenges, and the high-dividend ETF has returned 9.8% over the past decade. With promising entry points, I plan to hold onto all three for the long haul.

Is Vanguard Russell 2000 ETF Worth Your $1,000 Now?

Before considering an investment in the Vanguard Russell 2000 ETF, reflect on this:

The Motley Fool Stock Advisor analyst team has recently named their selection of the 10 best stocks for today… and Vanguard Russell 2000 ETF did not make the list. The chosen stocks might offer significant returns in the coming years.

For instance, consider when Nvidia was recommended on April 15, 2005… if you had invested $1,000 then, you’d have $885,388 today!!*

Stock Advisor equips investors with actionable strategies, including portfolio-building guidance, regular updates, and two new stock recommendations each month. This service has outperformed the S&P 500 by more than four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

JPMorgan Chase is an advertising partner of Motley Fool Money. Matt Frankel has positions in Vanguard Real Estate ETF and Vanguard Russell 2000 ETF. The Motley Fool has positions in and recommends JPMorgan Chase, Vanguard Real Estate ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.