Top Growth ETFs to Consider for Your Investment Portfolio

If you’re eager to invest in growth stocks but don’t want the hassle of tracking multiple companies, you’re in good company. Several exchange-traded funds (ETFs) specializing in growth are available to make your investment simpler.

This article highlights three notable growth ETFs to consider if you have around $2,000 to invest. Each option has its unique advantages, making it feasible to own all three without any strategic pitfalls.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Vanguard Information Technology ETF

Technology stocks have been leaders in the market for almost thirty years, and that trend shows no signs of slowing down. Innovations from tech companies, including personal computers and artificial intelligence, continue to shape our world. The performance of the technology sector is likely to remain strong for the foreseeable future.

The Invesco QQQ Trust has traditionally been a go-to fund for tech investors, as it tracks top firms including Nvidia, Microsoft, and Apple. However, there’s always a chance that the next big tech stars could emerge via different exchanges, such as the New York Stock Exchange.

The Vanguard Information Technology ETF (NYSEMKT: VGT) addresses this concern. It includes a broader range of technology stocks, not limited to those listed on the Nasdaq. While it features familiar names like Nvidia, Microsoft, and Apple, it also adds representation from other companies, such as Salesforce and Accenture.

While concentrating on Nasdaq stocks may yield good returns, having a diverse perspective on technology can be beneficial. It’s always safer to diversify than to rely solely on one segment of the market.

iShares S&P 500 Growth ETF

If you like the idea of growth investing but prefer a more streamlined approach than the SPDR S&P 500 ETF Trust, consider the iShares S&P 500 Growth ETF (NYSEMKT: IVW).

This ETF exclusively includes S&P 500 stocks categorized as growth. Currently, there are slightly over 200 of these stocks, including major players like Nvidia, Apple, and Meta Platforms, as well as Alphabet and Amazon.

While it shares similarities with Invesco QQQ Trust, the iShares fund is built on the S&P 500 Growth Index, which is designed to maintain a more balanced approach to the larger companies. As a result, even though Nvidia remains the largest holding, others like Apple, Meta, and Microsoft are similarly weighted, promoting reduced volatility.

This unique balance can be beneficial for long-term investors. A less volatile investment can help you stay committed during market downturns.

iShares Russell Mid-Cap Growth ETF

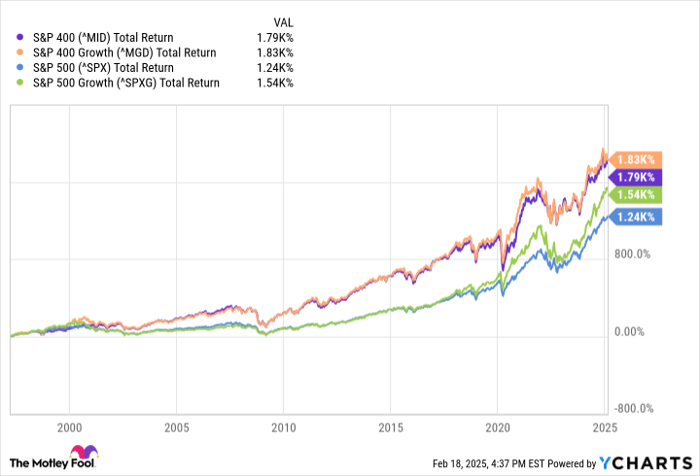

As an investor, it’s wise to look beyond large-cap stocks and diversify with mid-cap growth exposure as well. Mid-cap stocks have shown strong performance over time, often bettering the S&P 500.

This phenomenon can be attributed to the growth stage of mid-sized companies. They are established enough to have viable products or services but have yet to unlock their full market potential.

^MID data by YCharts

Companies like SoundHound AI, IonQ, Nuscale Power, and AST SpaceMobile are excellent examples of mid-cap growth firms witnessing recent momentum as their potential unfolds. The challenge lies in weathering their inherent volatility.

If you prefer a less risky route, think about investing in the iShares Russell Mid-Cap Growth ETF (NYSEMKT: IWP), which diversifies within mid-cap growth stocks and reduces the risks associated with individual stock picks. Alternatively, the iShares S&P Mid-Cap 400 Growth ETF (NYSEMKT: IJK) is another viable option.

Moreover, you could consider broader mid-cap funds like the Vanguard S&P Mid-Cap 400 ETF (NYSEMKT: IVOO) or the iShares Core S&P Mid-Cap ETF (NYSEMKT: IJH), which also include mid-cap value stocks that historically perform well over time.

Seize This Unique Investment Opportunity

Ever feel like you missed out on the chance to invest in top-performing stocks? Now’s a good moment to pay attention.

Occasionally, our analysts spot opportunities they believe are on the verge of a breakout. If you feel you’ve missed your chance before, now could be the time to invest before it’s too late. The figures are compelling:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d have $348,579!*

- Apple: If you had invested $1,000 when we doubled down in 2008, you’d have $46,554!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, you’d have $540,990!*

We currently have “Double Down” alerts for three impressive companies, and the window for this opportunity may not remain open long.

Learn more »

*Stock Advisor returns as of February 21, 2025

Randi Zuckerberg, a former director at Facebook, is a board member of The Motley Fool. John Mackey, ex-CEO of Whole Foods Market, is also a board member. Suzanne Frey, an executive at Alphabet, holds a board position as well. James Brumley has investments in Alphabet. The Motley Fool owns and endorses Accenture Plc, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Salesforce, and ServiceNow, among others. The Motley Fool suggests NuScale Power and provides options advice regarding Microsoft. The Motley Fool’s disclosure policy can be reviewed for further details.

The views expressed here are solely those of the author and do not reflect the views of Nasdaq, Inc.