“`html

Upcoming Earnings: Three Large-Cap Stocks to Watch

As Nvidia NVDA awaits its results, other big tech companies part of the Magnificent Seven have already reported their third-quarter earnings. This week’s lineup features several large-cap stocks from diverse sectors that are generating interest.

Here are three significant stocks investors may consider buying as their quarterly results approach on Wednesday, November 6.

MercadoLibre – MELI

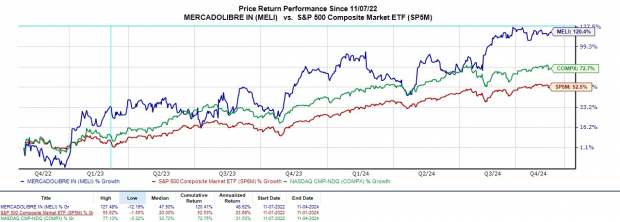

Kicking off with the retail sector, MercadoLibre MELI, the e-commerce leader in South America, is poised for impressive growth in Q3.

With a Zacks Rank #2 (Buy), MercadoLibre’s Q3 sales are expected to reach $5.25 billion, marking a 40% increase from $3.76 billion in the same quarter last year. Moreover, Q3 earnings are projected to jump 57% to $11.27 per share, up from $7.16 a share a year prior.

This strong growth trajectory keeps investors excited, with predictions of high double-digit growth in revenue and earnings for fiscal years 2024 and 2025. Currently, MELI has gained over 30% this year, solidifying its position as a top stock performer.

Image Source: Zacks Investment Research

Toyota Motor – TM

Toyota Motor’s TM stock stands out in the automotive industry and holds a Zacks Rank #1 (Strong Buy). Trading below 1X sales, analysts expect its revenue to grow slightly by 1% in Q3, reaching $79.78 billion.

Despite this growth, the company’s Q3 EPS is anticipated to decline to $4.39 from $6.54 a year ago. Nevertheless, TM trades at an attractive 7.9X forward earnings multiple and has beaten the Zacks EPS Consensus for the past seven quarters, with an impressive average earnings surprise of 77.93% over its last four reports.

Image Source: Zacks Investment Research

Qualcomm – QCOM

From the tech sector, Qualcomm QCOM is also on the radar, holding a Zacks Rank #2 (Buy).

The semiconductor giant is integrating generative AI across all product lines and is expected to report fiscal fourth-quarter results with projected sales of $9.9 billion, up 14%. Moreover, Q4 EPS is expected to grow by 27% to $2.56. QCOM offers a reasonable 15.1X forward earnings multiple compared to the broader market.

Image Source: Zacks Investment Research

Conclusion

MercadoLibre, Toyota Motor, and Qualcomm are three large-cap stocks that could see significant gains if they meet or surpass earnings expectations, while also providing positive guidance. These stocks are likely to remain viable long-term investments, becoming even more appealing if any post-earnings selloff occurs.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, five Zacks experts have chosen their favorites expected to skyrocket by 100% or more in the coming months. Among these, Director of Research Sheraz Mian selects one as having the most promising upside.

This company focuses on millennial and Gen Z consumers, generating nearly $1 billion in revenue last quarter alone. A recent dip in stock price presents an ideal entry point. While not all of Zacks’ top picks are winners, this stock could significantly outpace previous selections like Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Want updates on the latest recommendations from Zacks Investment Research? You can download 5 Stocks Set to Double for free.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Toyota Motor Corporation (TM): Free Stock Analysis Report

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`