The Magnificent Seven: Turning Points for Investors in Major Tech Stocks

The “Magnificent Seven” stocks have had impressive performances over the past few years. This group includes some of the largest companies globally, which have driven market growth and are expected to keep leading. The group consists of:

- Nvidia

- Apple

- Microsoft

- Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

- Amazon (NASDAQ: AMZN)

- Meta Platforms (NASDAQ: META)

- Tesla

Among these seven, three stocks stand out as strong investment opportunities right now: Amazon, Alphabet, and Meta Platforms. Investors should closely consider this trio.

Alphabet and Meta Platforms: The Best Value Investments

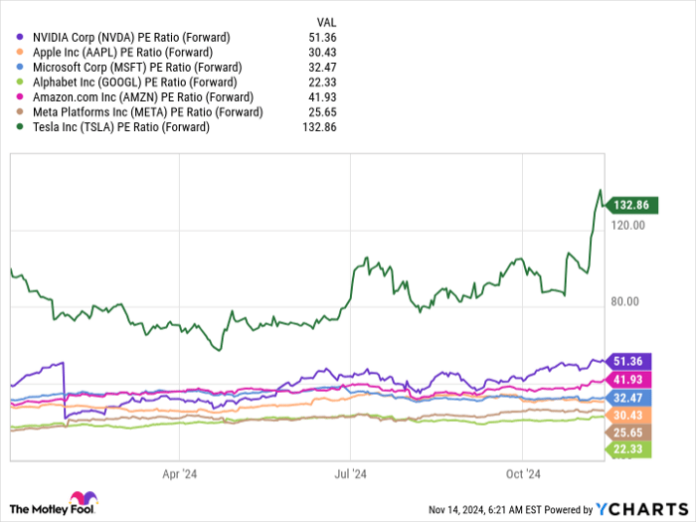

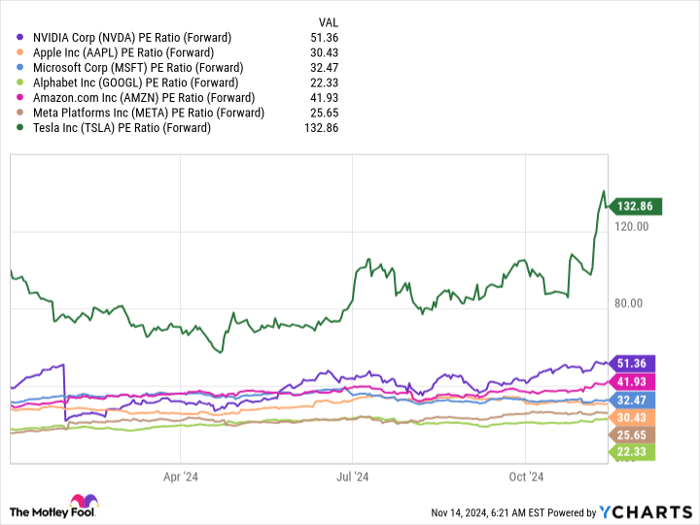

To evaluate these stocks, one must consider both growth potential and current valuations. Nvidia is the fastest-growing, driven by the surge in artificial intelligence (AI), but it also carries a hefty price tag.

In contrast, Alphabet and Meta are the least expensive in terms of forward price-to-earnings (P/E) ratios. Although one might assume that lower valuations indicate slower growth, that is not the case for these companies.

NVDA PE Ratio (Forward) data by YCharts

Both Alphabet and Meta display solid revenue growth, ranking in the middle of the group. Notably, their earnings-per-share (EPS) growth is among the highest. When a company trades at a lower price yet grows revenue and earnings faster than similar firms, it signals a worthwhile investment opportunity.

Historically, both firms have traded at discounts due to their reliance on advertising revenue, which can be unstable during economic downturns. In the third quarter, 75% of Alphabet and 98% of Meta’s revenues came from advertising. Despite the current strong economy, investors are cautious, knowing that a recession could impact these companies.

Nonetheless, I argue that this should not deter investment in these stocks. The broader market, represented by the S&P 500, is trading at 24.6 times forward earnings, while Alphabet sits at 22.3 and Meta at 25.7. This indicates that both are appealing investments.

Currently, Alphabet’s revenue and EPS show impressive growths of 15% and 37% respectively. Meta exhibits even stronger performance, with revenue growth of 19% and a 37% increase in earnings.

Both companies are investing in AI, though these initiatives are still growing but represent a small part of their overall business. In my assessment, Meta and Alphabet are strong buy candidates, alongside Amazon.

Amazon’s Profit Growth: A Strong Takeoff

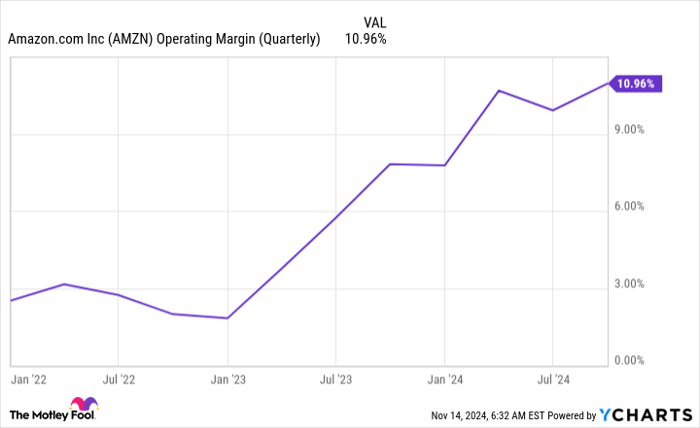

While Amazon isn’t as inexpensive as Alphabet and Meta, trading at 41.9 times forward earnings, there are valid reasons for this higher valuation.

Amazon is steadily improving its operating margins for three primary reasons. First, CEO Andy Jassy has focused on streamlining operations by eliminating unprofitable business segments. Second, the company’s higher-margin businesses, such as advertising and third-party seller services, have seen significant growth compared to its traditional online retail.

AMZN Operating Margin (Quarterly) data by YCharts

Last, Amazon Web Services (AWS), responsible for 17% of sales but contributing 60% of operating profits, is benefiting from rising demand in AI applications. This growth is projected to continue, fueling Amazon’s profitability.

In Q3, Amazon’s net sales rose by 11%, while its EPS soared by 52%, demonstrating that its profits are on track to outpace revenue increases. This trend supports the justification for Amazon’s current stock price, making it a top buy among these stocks.

Your Opportunity Awaits

Have you ever felt like you missed out on investing in successful stocks? Now could be your chance.

Sometimes, our team of expert analysts recommends a “Double Down” stock—a company they believe is about to soar in value. If you think you’ve missed your opportunity, now is the time to consider investing. The data highlights these potential growth stories:

- Amazon: If you had invested $1,000 when our analysts recommended in 2010, it would now be worth $22,819!*

- Apple: A $1,000 investment from our 2008 recommendation would be worth $42,611!*

- Netflix: An investment of $1,000 made when we recommended in 2004 would have grown to $444,355!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and such an opportunity may not come around soon again!

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board. Randi Zuckerberg, former market development director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also on The Motley Fool’s board. Keithen Drury holds positions in Alphabet, Amazon, Meta Platforms, and Tesla. The Motley Fool recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla, and has disclosed positions in those stocks. They advise options trading for Microsoft as well.

The views and opinions expressed herein reflect those of the author and may not represent those of Nasdaq, Inc.