The Medical Services sector is undergoing a notable transformation, driven by technological advancements and a stronger emphasis on patient-centered care. The rise of remote healthcare has accelerated the growth of digital health options, leading to significant increases in telemedicine and AI-based services. Hospitals and healthcare providers are utilizing these tools to enhance operations, improve diagnostic accuracy, and provide better treatments. Meanwhile, value-based care models, which prioritize patient outcomes rather than the number of services provided, are becoming more prevalent, encouraging healthcare providers to adopt preventive measures and tailored treatment approaches.

According to a recent Grand View Research report, the global healthcare analytics market was valued at $43.1 billion in 2023. This market is projected to grow at a CAGR of 21.1% between 2024 and 2030. Key players—payers, healthcare professionals, and patients—will all gain new insights and services from advanced healthcare data and analytics. Stocks such as Doximity (DOCS), BrightSpring Health Services, Inc. (BTSG), and Embecta Corp. (EMBC) are anticipated to flourish alongside this rapidly evolving landscape.

Furthermore, as the world continues to face challenges like aging populations and an increase in chronic diseases, the demand for skilled nursing professionals has surged. By 2025, this trend is expected to persist, significantly impacting the service industry within healthcare. However, the post-pandemic world has unveiled a global shortage of healthcare workers, particularly affecting manual labor positions. A report from Mercer projects a shortfall of over 100,000 healthcare workers in the United States by 2028, with nursing assistants facing the steepest expected deficit of more than 73,000. Such shortages contribute to rising labor costs and healthcare expenses.

Understanding the Industry Landscape

The Zacks Medical Services industry includes various third-party service providers and caregivers associated with primary healthcare companies to achieve economies of scale. Key players include pharmacy benefit managers, contract research organizations, wireless MedTech companies, third-party testing labs, surgical facilities, and healthcare workforce solutions providers. Over time, this industry has shifted from volume-based to value-based care. The resurgence in medical tourism is also fueling growth. This shift necessitates the recruitment of specialized external service providers, reinforcing the industry’s crucial role in modern healthcare management.

Three Trends Influencing the Medical Services Industry

Digital Transformation: The U.S. medical device market is increasingly embracing digital platforms. A 2024 report by Statista forecasts a 9.2% CAGR for the digital health market from 2024 to 2028. The rising availability of unstructured health data and demand for personalized services highlight the critical role of big data in healthcare. A Roots Analysis report estimates that the global big data in healthcare market will expand from $78 billion in 2024 to $540 billion by 2035, with a CAGR of 19.20%. Companies employing artificial intelligence have seen treatment costs decrease by 50% and patient outcomes improve significantly.

Evolving Nursing Care: By 2025, nursing roles will further develop due to advances in technology and changes in healthcare models. Telehealth and remote monitoring have allowed nurses to reach patients in underserved areas. There is a growing demand for specialized nurses, such as nurse practitioners and critical care specialists. As noted by the Bureau of Labor Statistics, employment for nurse anesthetists, nurse midwives, and nurse practitioners is expected to grow by 40% from 2023 to 2033, significantly outpacing other professions.

Workforce Shortages: Even after the COVID-19 health emergency was declared over, many healthcare workers continue to leave the field due to the stress of recent years. The aging population (approximately 10,000 individuals aged 59-77 join Medicare plans daily) intensifies the need for qualified personnel. According to a report by the WHO, a shortfall of 15 million healthcare workers worldwide is expected by 2030, leading to increased healthcare costs. A report from HR for Health mentions a 15.6% rise in labor expenses per adjusted discharge at hospitals compared to pre-pandemic levels.

Industry Outlook and Performance Comparison

The Zacks Medical Services industry is a part of the larger Zacks Medical sector and holds a Zacks Industry Rank of #140, placing it in the bottom 44% of over 250 Zacks industries. This ranking indicates less favorable near-term prospects for the group. Historical data shows that the top half of Zacks-ranked industries tends to outperform the bottom half by more than two to one.

Next, we will highlight specific stocks poised for market outperformance based on encouraging earnings projections. But before that, it’s essential to evaluate the industry’s performance and current valuation.

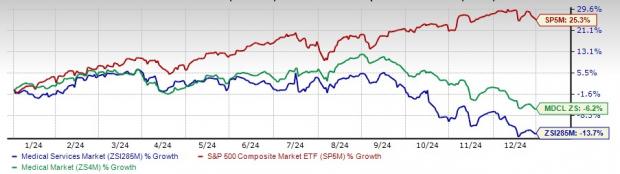

Comparative Performance: Medical Services vs. Sector and S&P 500

Over the past year, the Medical Services Industry has underperformed relative to its sector and the S&P 500. Stocks within this industry have collectively lost 13.7% during this period, contrasting with a 6.2% decline in the Medical sector and a notable 25.3% gain in the S&P 500 composite.

One-Year Price Performance

“`html

Medical Services Industry: Current Valuation and Top Stocks to Consider

Assessing Industry Valuation

Currently, the medical services industry is trading at a forward 12-month price-to-earnings (P/E) ratio of 14.79X. This is significantly lower than the S&P 500’s P/E of 25.08X and the sector’s 25.47X. Looking at historical data, this industry has experienced a high of 21.09X, a low of 11.83X, and a median of 15.54X over the past five years, as illustrated in the charts below.

Forward Price-to-Earnings Ratio (F12M)

Historical Price-to-Earnings Trends

Top Three Stocks for Investment

Here are three promising stocks from the Medical Services sector that have shown favorable earnings estimate revisions and currently hold a Zacks Rank #1 (Strong Buy).

Doximity: This digital platform connects U.S. medical professionals, featuring a network with over 80% of U.S. physicians. Doximity offers tools to help medical staff collaborate, stay informed on medical developments, and manage their roles effectively. The company’s expected earnings growth rate for fiscal 2026 stands at 9.9%, while the revenue forecast shows a 10.1% increase compared to fiscal 2025.

Price and Consensus: DOCS

BrightSpring Health Services: This company specializes in home- and community-based pharmacy and health solutions for individuals requiring specialized or ongoing care. With services offered in all 50 states, BrightSpring serves over 400,000 customers daily. For fiscal 2025, its projected earnings growth rate is an impressive 58.1%, with revenue expected to rise by 10.9% from 2024. It also holds a Zacks Rank #1.

Price and Consensus: BTSG

Embecta Corp.: A medical device company focused on solutions for diabetes care, Embecta produces pen needles, syringes, and safety injection devices, as well as digital tools for diabetes management. The fiscal 2026 earnings growth rate is forecasted at 9.2%. Additionally, revenue projections indicate a slight increase of 1.9% over fiscal 2025. Like the others, Embecta currently boasts a Zacks Rank #1.

Price and Consensus: EMBC

Special Report: Zacks Top 10 Stocks for 2024

Don’t miss your chance to explore Zacks’ latest selections for 2025, handpicked by the Director of Research, Sheraz Mian. This portfolio has shown remarkable success since its inception in 2012, achieving a total return of +2,112.6%, far exceeding the S&P 500’s +475.6%. Sheraz analyzed 4,400 stocks to identify the top 10 to invest in for this coming year. Be among the first to see these promising stocks.

Want further insights from Zacks Investment Research? Download your copy of “5 Stocks Set to Double” today.

Doximity, Inc. (DOCS): Free Stock Analysis Report

Embecta Corp. (EMBC): Free Stock Analysis Report

BrightSpring Health Services, Inc. (BTSG): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`