Nvidia’s Q3 Earnings: Why Investors Are Eager for Wednesday’s Report

This week is an exciting time for tech investors as one of the year’s most awaited earnings reports is just around the corner. Nvidia (NASDAQ: NVDA) is set to release its Q3 results on Wednesday, Nov. 20.

Challenges and Opportunities Ahead

Nvidia, a leading player in the artificial intelligence (AI) sector, has much to discuss. Key questions remain regarding its relationship with a crucial supplier and the progress of its latest Blackwell chip release.

As we await the announcement, multiple factors suggest that Nvidia’s stock is a strong buy right now. While there is always a possibility of disappointing news, Nvidia seems well-positioned for long-term success. Here are three compelling reasons to consider buying Nvidia stock today.

1. Promising Prospects for Blackwell

All indicators point to a successful launch of Nvidia’s Blackwell chips. Earlier this year, fabrication issues caused some concern, but it appears the company managed the situation quickly, with only minor delays. Deliveries of Blackwell to customers are expected shortly.

The Blackwell chips represent a significant upgrade from the already powerful Hopper chips, which continue to sell well. For instance, Elon Musk and his xAI team purchased 100,000 Hopper chips a few months back, now looking to buy an additional 50,000.

Nvidia’s demand for both its current and upcoming products is exceptionally high. Reports indicate that Nvidia has already sold out of Blackwell chips for at least the next 12 months. CEO Jensen Huang described this demand as “insane,” prompting the company to collaborate with Foxconn to introduce a dedicated Blackwell fabrication facility in Mexico.

2. Big Tech Continues to Invest

Recent earnings reports from Nvidia’s largest customers show that spending remains robust. Tech giants like Microsoft, Meta, and Alphabet are investing billions to develop data centers capable of supporting AI applications. Capital expenditure (capex) in these companies has soared over the past year, benefiting Nvidia greatly. This trend is expected to persist.

Meta plans to increase its capex significantly by 2025, with CEO Mark Zuckerberg noting the potential for substantial returns from AI advancements and indicating the need for further growth in spending. Meanwhile, Alphabet reported spending $13 billion last quarter on data centers and anticipates a similar amount in Q4, which would bring its annual capex to over $50 billion.

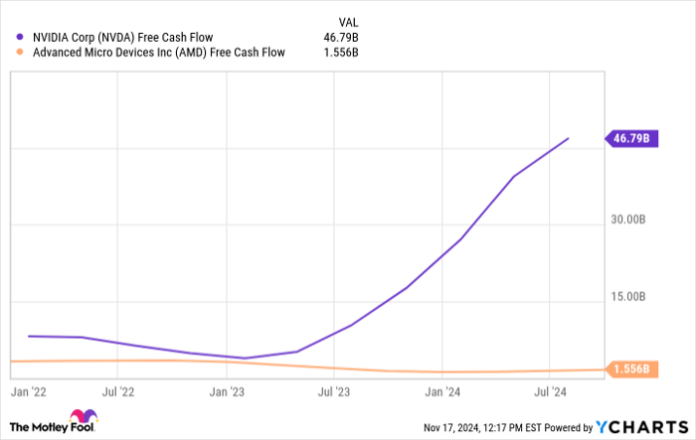

3. Nvidia’s Strong Free Cash Flow

Free cash flow (FCF) is a vital indicator of financial performance, and Nvidia demonstrates impressive results in this area. Comparing Nvidia’s FCF growth to that of its competitor, AMD, shows a distinct advantage.

Nvidia Free Cash Flow data by YCharts.

Nvidia’s FCF provides it with the means to respond to market needs and maintain its industry leadership. Unlike AMD and other competitors, Nvidia is in a position to allocate resources effectively for research, development, and talent acquisition.

Furthermore, Nvidia’s FCF allows for share repurchases. In the first half of this year, the company bought back $15.1 billion in stock, and last quarter, it announced a $50 billion share repurchase program.

On Wednesday, we will gain insights into how much of the $50 billion has been utilized. Clearly, Nvidia is dedicated to enhancing shareholder value.

Your Opportunity to Invest

Have you ever felt that you missed out on investing in successful stocks? This might be your chance.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies positioned for growth. If you fear you’ve missed your opportunity to invest, now is the time to act before it’s too late. Consider these statistics:

- Amazon: Investing $1,000 when we doubled down in 2010 would have grown to $22,819!*

- Apple: A $1,000 investment at our doubled-down recommendation in 2008 would now be worth $42,611!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, it would now be worth $444,355!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and this may be a unique opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and the sister of Meta Platforms CEO Mark Zuckerberg, is also on the board of The Motley Fool. Johnny Rice holds no positions in the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, and Nvidia. The Motley Fool maintains a disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.