2024 Stock Market Surprises: Sweetgreen, Reddit, and IonQ Rise Sharply

Sweetgreen (NYSE: SG) is a salad restaurant chain that went public in 2021. By early 2024, shares had plummeted nearly 80% from their initial public offering price, leading many investors to abandon the stock. However, 2024 marked a turnaround, with the stock more than tripling by November.

While Sweetgreen closed out the year with some losses, its performance was notable. Similarly, Reddit (NYSE: RDDT) and IonQ (NYSE: IONQ) also had impressive performances, each experiencing over 300% growth in 2024.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

In this article, we explore what fueled the success of these three stocks in 2024 and predict which company may perform best in 2025.

Sweetgreen’s 184% Surge

Initially, Sweetgreen attracted significant interest as a high-growth business. Yet, its losses raised red flags for investors. Toward the end of 2023, management introduced the Infinite Kitchen model to alleviate these concerns, a strategy that garnered investor approval in 2024.

The Infinite Kitchen focuses on automation. By utilizing technology, most salad preparation can be done by robots—a significant development in the industry.

In the first three quarters of 2024, labor and related costs accounted for 28% of the company’s revenue, its highest operating expense. Reducing this expense through automation could lead to improved profits.

Currently, Sweetgreen is at the early stages of implementing its Infinite Kitchen vision. At the beginning of the third quarter, only two of its 225 locations featured automation. By the third quarter’s end, that number grew to ten. As this technology scales in 2025, investors are optimistic that profits will increase, driving the stock price higher.

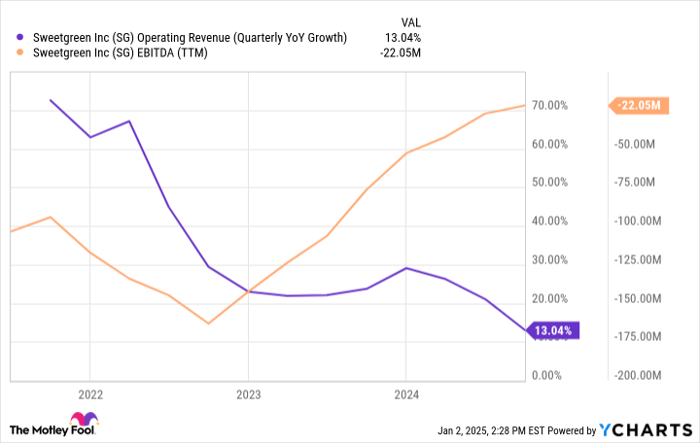

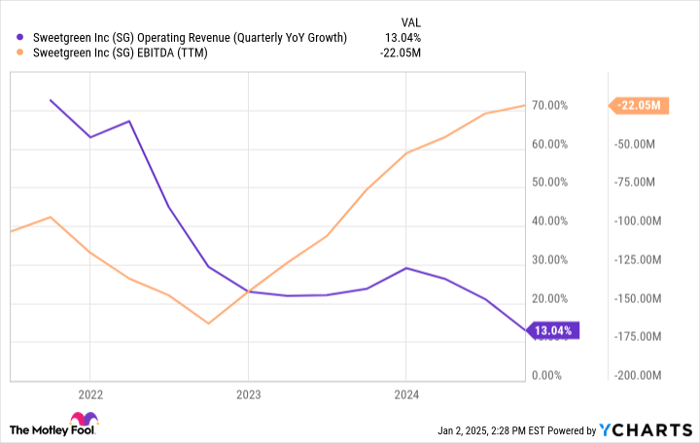

While revenue growth has slowed as the company prioritizes profits—opening new restaurants at a more measured pace—its earnings before interest, taxes, depreciation, and amortization (EBITDA) are on the rise.

SG operating revenue (quarterly YoY growth); data by YCharts; TTM = trailing 12 months.

Reddit’s 224% Growth

Reddit’s stock increased by 224%, a significant feat for a company that launched its initial public offering (IPO) only in March. Its financial performance is impressive and noteworthy.

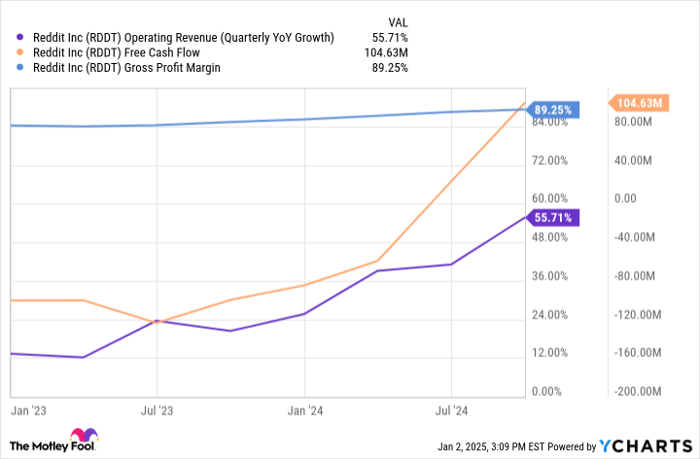

Over the last two years, Reddit’s revenue growth accelerated, a rarity in the investment landscape. In the third quarter, revenue surged by 68% year over year to reach $348 million. The increase stemmed from a growing user base and rising advertising demand.

Additionally, Reddit’s gross margin improved, surpassing 90% in the third quarter. This higher revenue, coupled with enhanced gross margins, has significantly boosted the company’s free cash flow.

RDDT operating revenue (quarterly YoY growth) data by YCharts. Chart doesn’t reflect third-quarter results.

A crucial factor behind Reddit’s growth has been its international expansion. The company leverages artificial intelligence (AI) to translate content into various languages, which has fostered adoption in new markets.

Though still developing, Reddit’s international user base consists of only 49 million users, indicating substantial room for future growth.

IonQ’s 237% Increase

IonQ stock saw a remarkable rise of over 400% in the last quarter of the year, resulting in a tripling of its value in 2024, alongside other quantum computing companies. While some skepticism exists regarding the quantum computing space, IonQ also achieved significant milestones.

Investors often find it challenging to evaluate companies in the quantum computing sector due to the technical nature of the technology. IonQ utilizes a trapped ion approach, which is one of several methods in the field.

To validate its approach, IonQ has secured third-party support, a positive indicator for investors. Its hardware is available across all major cloud computing platforms, distinguishing it from competitors. Furthermore, it has gained credibility through contracts with governmental organizations, such as a $55 million deal with the Air Force Research Lab aimed at deploying quantum computers on a larger scale.

Which Stock to Watch in 2025

Experts project that the quantum computing industry could be worth hundreds of billions of dollars in the future. If IonQ indeed leads this revolution, it may have significant long-term growth potential.

Reddit is expanding rapidly and still has many untapped users in international markets. Currently, the platform has about 100 million active users, but this number could grow substantially over time.

While both IonQ and Reddit show promise for 2025, Sweetgreen appears best positioned for growth due to its favorable valuation. Trading at five times sales, Sweetgreen may not seem inexpensive for a restaurant stock with slowed growth. Nonetheless, its focus on profitability could lead to improved unit economics if the Infinite Kitchen model proves effective. Management is likely to revisit new openings, which would further enhance future growth.

Previously, Sweetgreen has expressed ambitions of expanding to 1,000 locations from its current fewer than 250. Reducing operating expenses through automation is critical for achieving this goal. Consequently, Sweetgreen is my top pick for 2025 among the stocks discussed.

Opportunity Awaits with “Double Down” Stocks

Have you ever felt you missed out on investing in booming stocks? Now is your chance to consider strong investment opportunities.

Occasionally, our team of analysts identifies “Double Down” stock recommendations for companies expected to see significant gains. If you’re concerned about having missed out before, this might be the right moment to invest as opportunities combine with promising financials:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $374,613!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,088!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $475,143!

Currently, we’re issuing “Double Down” alerts for three outstanding companies. You may not want to miss out again.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool recommends Sweetgreen. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.