“`html

Top Vanguard ETFs to Consider for Your Investment Portfolio

Exchange-traded funds (ETFs) simplify investing by grouping individual companies under one ticker symbol. This provides instant diversification. Some ETFs follow stock market indexes, while others are themed or strategy-based.

One of the largest investment companies globally, Vanguard stands out for its structure. Investors own the funds, not the company itself, making it a reliable choice for ETFs meant for long-term holding.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. See the 10 stocks »

Below are three Vanguard ETFs that cater to various investor types. Each could serve as a solid foundation for a long-term portfolio. You can purchase all three for less than $1,500 or select the ones that align with your investing preferences.

1. The Vanguard ETF Owned by Warren Buffett

Investment legend Warren Buffett, known for his stock-picking prowess, holds only one Vanguard ETF: the Vanguard S&P 500 ETF (NYSEMKT: VOO).

This ETF tracks the S&P 500, which represents 500 major U.S. companies and is a key indicator of the market. It provides diversified exposure across multiple industries, including the notable “Magnificent Seven” tech stocks.

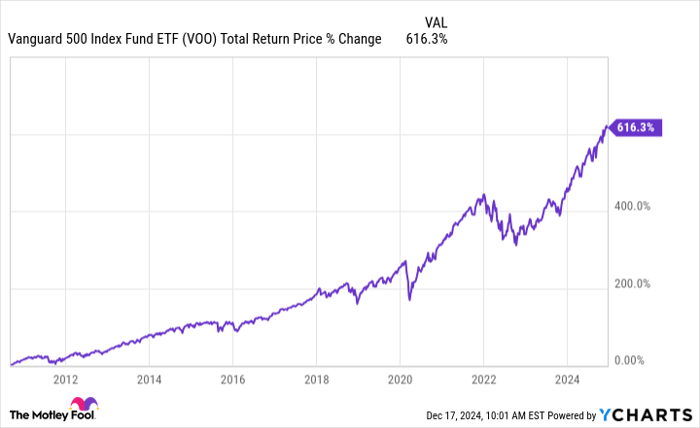

VOO total return price; data by YCharts.

The S&P 500 has proven to generate wealth effectively. Since the 1950s, an investment of $100 has grown to over $36,000, excluding dividends. While fluctuating yearly, its average annualized total return has been around 8% for the last 50 years.

Investors cannot buy the S&P 500 directly; hence, the Vanguard S&P 500 ETF serves as a suitable alternative.

2. An Excellent ETF for Growth Investors

Those seeking higher investment returns, despite potential volatility, may find the Vanguard Growth ETF (NYSEMKT: VUG) appealing. This ETF tracks the CRSP US Large Cap Growth Index, comprising 181 large-cap growth stocks.

It allocates approximately 52% of its funds to the “Magnificent Seven,” with the remainder spread across 174 other stocks, providing inherent diversification.

VUG total return price; data by YCharts.

Historically, holding this fund has proven beneficial. Sectors like artificial intelligence, cloud computing, semiconductors, and e-commerce are anticipated to enhance performance in large technology, favoring this ETF and its holders. Its expense ratio of 0.04% is low compared to many other growth-focused ETFs.

If you are comfortable with its significant concentration in major tech companies, the Vanguard Growth ETF could be a strong choice.

3. This ETF Provides Passive Income

Investors focused on earning passive income might consider the Vanguard High Dividend Yield ETF (NYSEMKT: VYM). It tracks the FTSE High Dividend Yield Index.

This ETF invests in 537 stocks, predominantly featuring established blue-chip companies with reliable dividend payouts over high-flying tech stocks, aside from Broadcom, which is its largest holding.

Notable names include Home Depot, Procter & Gamble, Johnson & Johnson, and Chevron. The ETF boasts a 2.6% dividend yield, and its constituent companies have an average earnings growth of 10%. These dividends are expected to grow over time, generating a robust stream of passive income.

With an expense ratio of only 0.06%, the Vanguard High Dividend Yield ETF offers a cost-effective solution for investors looking to manage a diverse portfolio of over 500 dividend stocks.

VYM total return price; data by YCharts.

Although this ETF has limited exposure to the tech sector (under 10%), it has provided steady dividends, making it a solid choice for investors prioritizing income over rapid growth.

Seize This Second Chance for Potential Gains

Have you ever felt like you missed out on investing in successful companies? Now is your chance to reconsider.

Occasionally, our analyst team issues a “Double Down” stock recommendation for companies poised for significant growth. If you’re apprehensive about having passed on earlier investment opportunities, now may be the ideal moment to invest. Consider these historical returns:

- Nvidia: An investment of $1,000 back in 2009 would now be worth $334,266!*

- Apple: An investment of $1,000 in 2008 would have grown to $46,976!*

- Netflix: A $1,000 investment in 2004 would have surged to $479,727!*

Currently, we are identifying “Double Down” stocks for three promising companies, and this may be one of the last chances to jump on board.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Justin Pope holds positions in Chevron and Johnson & Johnson. The Motley Fool has interests in and recommends Chevron, Home Depot, Vanguard Index Funds-Vanguard Growth ETF, Vanguard S&P 500 ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool also recommends Broadcom and Johnson & Johnson. For more information, please refer to their disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.

“`