Retail Sector Thrives Amid Economic Challenges: A Look at Top Stocks

The retail industry is showing resilience in the face of inflation and rising prices. Sales have been on the rise in recent months, and November continued the upward trend, driven by a strong start to the holiday season. Online sales, in particular, are playing a significant role in boosting overall retail performance.

During the five-day window from Thanksgiving to Cyber Monday, online sales surged, positively impacting total sales figures. Investors might find it worthwhile to consider retail stocks that have a strong online presence.

We have highlighted four promising stocks: Amazon.com, Inc. AMZN, Shopify Inc. SHOP, Maplebear Inc. CART, and Carvana Co. CVNA. These companies have experienced positive earnings revisions in the last 60 days and have earned a Zacks Rank of #1 (Strong Buy) or #2 (Buy), making them potential candidates for solid returns.

Surging Online Sales During the Holiday Shopping Rush

Retail sales in November increased by 0.7% month-over-month, totaling $724.6 billion, following a 0.5% gain in October, according to the Commerce Department. This increase outpaced economists’ forecasts of a 0.5% rise. Compared to last year, retail sales grew by 3.8% in November. Online sales saw a boost of 1.8%, driven largely by the strong consumer activity on Thanksgiving, Black Friday, and Cyber Monday.

On Black Friday, U.S. retail sales rose 3.4%, with online sales climbing by 14.6% to reach $10.8 billion. Cyber Monday alone saw consumers spend $13.3 billion online. Although Cyber Monday fell on December 1 this year, resulting in a slight 1.32% drop in online retail sales from October to November, the robust sales on Cyber Monday are expected to propel online sales in December.

The E-Commerce Surge Continues

According to the Census Bureau, sales from non-store retailers jumped by 9.8% in November compared to the previous year. Data from the National Retail Federation (NRF) indicates that online retail sales outpaced other categories, with month-over-month growth of 1.3% and a year-over-year increase of 21.5%.

The preference for online shopping has surged since the pandemic, leading to a significant shift in consumer behavior. Although the U.S. was initially slow to adopt online shopping, the convenience has drawn more consumers to digital platforms.

A report from Forbes Advisor predicts that by 2024, online sales will constitute 20.1% of total global retail purchases, with e-commerce sales expected to rise by 8.8% that year.

Top 4 Retail Stocks with Strong Online Platforms

Amazon.com, Inc.

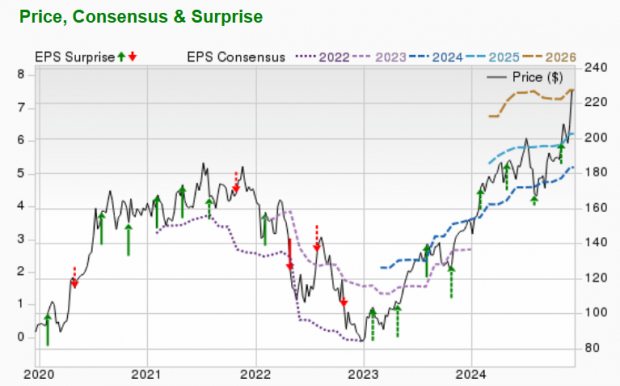

Amazon.com, Inc. stands out as one of the largest e-commerce platforms, operating extensively in North America and globally. The strength of AMZN’s online retail business is underscored by its Prime membership program and a vast distribution network. Additionally, Amazon’s acquisition of Whole Foods Market has significantly bolstered its presence in the physical grocery sector. The company holds a leading position in the cloud computing space through Amazon Web Services.

Amazon.com anticipates an earnings growth rate of 19.9% for the upcoming year, with the Zacks Consensus Estimate for current-year earnings improving by 9.3% in the last two months. AMZN currently holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

Shopify Inc.

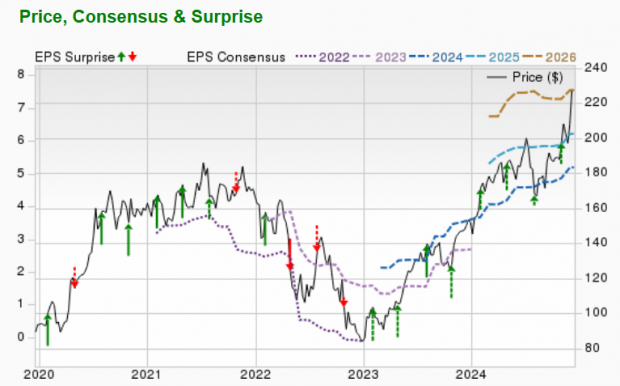

Shopify Inc. offers a cloud-based platform that enables small and medium-sized businesses to manage their sales across diverse channels, such as websites, mobile apps, physical stores, social media, and marketplaces.

Shopify’s expected earnings growth rate for next year is 18.4%, with the Zacks Consensus Estimate for this year’s earnings climbing by 11.6% over the past two months. SHOP holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

Maplebear Inc.

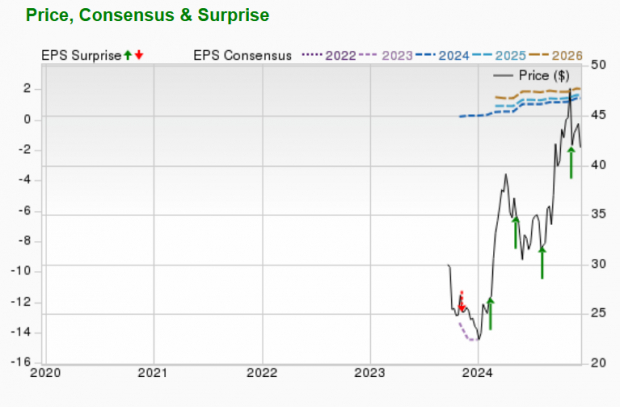

Maplebear Inc. is focused on grocery technology and works extensively across North America. The company’s Instacart platform provides a variety of technology-driven services to enhance retailers’ e-commerce operations, enabling them to fulfill orders and optimize in-store experiences.

Maplebear’s expected earnings growth rate for next year is projected at 15%, with the Zacks Consensus Estimate for this year’s earnings rising by 21.3% recently. CART is currently rated as a Zacks Rank #2.

Image Source: Zacks Investment Research

Carvana Co.

Carvana Co. operates as an online platform for buying and selling used cars. Its end-to-end business model covers all aspects of used-car retailing, including sales, financing, logistics, and inspections, effectively reshaping the traditional used-car market.

Carvana’s expected earnings growth rate for the coming year exceeds 100%, and the current-year earnings estimate has risen by more than 100% in the past two months. CVNA maintains a Zacks Rank of #1.

Image Source: Zacks Investment Research

Zacks Identifies Top 10 Stocks for 2025

Are you ready to discover our ten top stock picks for 2025?

Historically, these selections have performed exceptionally well.

Since 2012, when our Director of Research, Sheraz Mian, began overseeing the portfolio, the Zacks Top 10 Stocks have surged by +2,112.6%, easily outperforming the S&P 500’s +475.6%. Sheraz is currently evaluating 4,400 companies to pinpoint the best ten stocks to hold for 2025. Be sure to check them out when they are published on January 2.

Want the latest from Zacks Investment Research? Download our free report featuring 5 Stocks Set to Double.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Carvana Co. (CVNA): Free Stock Analysis Report

Maplebear Inc. (CART): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.