Retail Sector Rises as Consumers Rebound in October

The retail sector is recovering, thanks to the Federal Reserve’s recent rate cuts which are giving consumers more confidence to spend. In October, retail sales climbed, albeit at a slower rate, surpassing economists’ expectations. This increase in sales, right before the crucial holiday shopping season, is a good sign for retailers. Predictions for holiday sales propose a significant increase this year, despite various challenges ahead.

With this encouraging outlook, investing in retail stocks such as Amazon.com, Inc. AMZN, Abercrombie & Fitch ANF, Target Corporation TGT, and Carvana Co. CVNA seems smart as the holiday season approaches. Improvements in earnings estimates for these companies over the past two months support their potential. Each of these stocks holds a Zacks Rank of #1 (Strong Buy) or #2 (Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

October Retail Sales See Gains

In October, retail sales rose by 0.4% compared to September, exceeding the analysts’ forecast of a 0.3% increase, according to the Commerce Department’s report on Friday. September’s sales growth was revised upward to 0.8%, up from the initially reported 0.4%.

Sales went up across multiple sectors, with auto dealers reporting a rise of 1.6% and electronics and appliance stores seeing an increase of 2.3%. Additionally, food services and drinking places—an essential service category—saw sales increase by 0.7% in October after rising 1.2% the previous month. Experts view dining out as a key measure of financial well-being for households.

Online sales rose by 0.3% last month. As consumers become more willing to spend, overall retail sales are gaining momentum. Consumer spending recorded a 0.5% increase in September and a remarkable 3.7% year-over-year growth at that time. Easing inflation has further enabled consumers to spend more.

Holiday Season Boost Expected for Retail Stocks

The Federal Reserve recently cut interest rates by 50 basis points in September and another 25 basis points in early October as a move to stimulate the economy amid declining inflation. This reduction in borrowing costs is empowering consumers to spend more.

For several months, the retail sector faced challenges as the Federal Reserve hiked interest rates by a total of 525 basis points to tackle skyrocketing inflation. The recent rate cuts, combined with a rise in retail sales just before the holiday season, suggest a brighter future for the sector.

According to Forrester, holiday sales are expected to grow by 3.7% year-over-year, reaching $1 trillion in 2024. While this growth forecast is slightly less than the annual increases seen in recent years, it remains significantly higher than figures recorded prior to the COVID-19 pandemic.

In the online retail sector, sales are predicted to spike by 10.1% to $257 billion this year, marking a faster growth rate than observed in the previous two years. Online sales are projected to constitute 26% of total retail sales in 2024.

Top 5 Retail Stocks with Growth Prospects

Amazon.com, Inc.

Amazon.com, Inc. is a leading e-commerce giant, with extensive operations throughout North America and around the world. Its online retail activities are bolstered by the Prime program and a vast distribution network. The acquisition of Whole Foods Market gave Amazon a significant presence in the physical grocery sector. Furthermore, Amazon Web Services positions the company as a powerhouse in cloud computing.

Amazon forecasts an impressive earnings growth rate of 78.3% this year. Additionally, the Zacks Consensus Estimate for current-year earnings has risen by 8.8% over the last two months. Currently, AMZN holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

Abercrombie & Fitch

Abercrombie & Fitch is a specialty retailer offering high-quality casual apparel for men, women, and children through its approximately 850 stores worldwide, including North America, Europe, Asia, and the Middle East. Their product lineup includes a range of clothing items, along with personal care products and accessories, under well-known brands such as Abercrombie & Fitch, Abercrombie Kids, and Hollister.

The company projects a strong earnings growth rate of 64.2% for the current year, with the Zacks Consensus Estimate for current-year earnings up by 0.5% in the last 60 days. Currently, ANF carries a Zacks Rank of #1.

Image Source: Zacks Investment Research

Target Corporation

Target Corporation has transitioned from a purely brick-and-mortar retailer to a mixed model that caters to both in-store and online shoppers. Investments in technology have enhanced its website and mobile platforms and modernized the supply chain, helping Target to compete effectively in the retail landscape against fully online retailers.

Target’s expected earnings growth rate is 6.8% this year, with the Zacks Consensus Estimate for current-year earnings having risen by 0.2% over the past two months. The stock holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

Carvana Co.

Carvana Co. is a premier e-commerce platform specializing in the buying and selling of used cars. Their end-to-end online model covers everything from sales to financing and logistics, fundamentally transforming the traditional used-car selling experience.

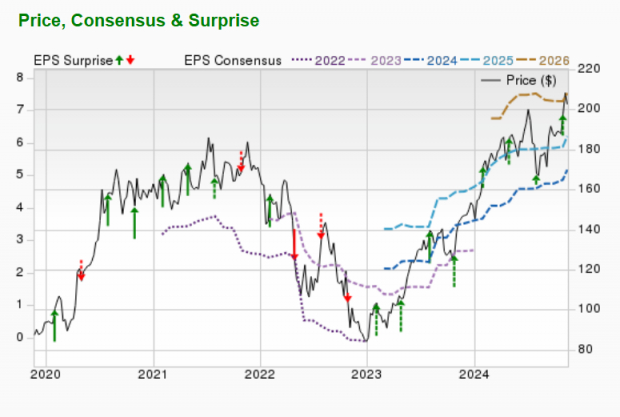

Carvana projects an earnings growth rate of 38.7% for the current year, and the Zacks Consensus Estimate for current-year earnings indicates an increase of more than 100% over the past two months. CVNA has a Zacks Rank of #1.

Image Source: Zacks Investment Research

Access Zacks’ Buys and Sells for Just $1

Yes, you read that right.

In a unique opportunity, we have provided 30-day access to our full range of stock picks for only $1. No hidden fees involved.

Many have seized this chance, while others hesitated, thinking it was too good to be true. We genuinely aim for you to explore our portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and many more that achieved remarkable gains in 2023.

Interested in the latest recommendations from Zacks Investment Research? Download the report 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.